FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

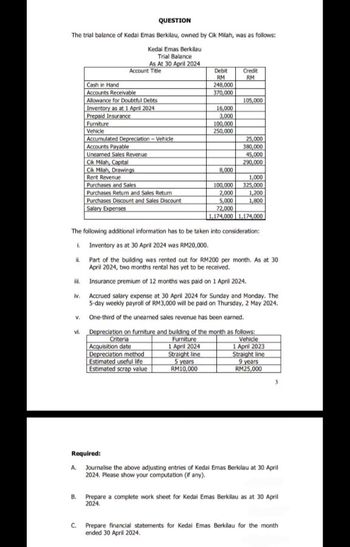

Transcribed Image Text:QUESTION

The trial balance of Kedai Emas Berkilau, owned by Cik Milah, was as follows:

Kedai Emas Berkilau

Trial Balance

As At 30 April 2024

Account Title

Debit

Credit

RM

RM

Cash in Hand

248,000

Accounts Receivable

370,000

Allowance for Doubtful Debts

105,000

Inventory as at 1 April 2024

16,000

Prepaid Insurance

3,000

Furniture

100,000

Vehicle

250,000

Accumulated Depreciation-Vehicle

25,000

Accounts Payable

380,000

Unearned Sales Revenue

45,000

Cik Milah, Capital

290,000

Cik Milah, Drawings

8,000

Rent Revenue

1,000

Purchases and Sales

100,000

325,000

Purchases Return and Sales Return

2,000

1,200

Purchases Discount and Sales Discount

5,000

1,800

Salary Expenses

72,000

1,174,000 1,174,000

The following additional information has to be taken into consideration:

i. Inventory as at 30 April 2024 was RM20,000.

. Part of the building was rented out for RM200 per month. As at 30

April 2024, two months rental has yet to be received.

ii. Insurance premium of 12 months was paid on 1 April 2024.

iv. Accrued salary expense at 30 April 2024 for Sunday and Monday. The

5-day weekly payroll of RM3,000 will be paid on Thursday, 2 May 2024.

One-third of the unearned sales revenue has been earned.

Depreciation on furniture and building of the month as follows:

V.

vi.

Acquisition date

Criteria

Depreciation method

Estimated useful life

Estimated scrap value

Furniture

1 April 2024

Straight line

5 years

RM10,000

Vehicle

1 April 2023

Straight line

9 years

RM25,000

Required:

A. Journalise the above adjusting entries of Kedai Emas Berkilau at 30 April

2024. Please show your computation (if any).

B. Prepare a complete work sheet for Kedai Emas Berkilau as at 30 April

2024.

C.

Prepare financial statements for Kedai Emas Berkilau for the month

ended 30 April 2024.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Subject/Course: Financial Accounting.arrow_forwardanswer 8 and 9arrow_forwardDetermining Asset Cost When Paying with Cash and Notes Payable Ked Inc. purchases equipment, which has a cash price of $2,690. Terms are arranged for a $800 cash down payment plus payment of the remaining $1,890, plus 15% compound interest per annum, through three equal payments. The purchase occurs on January 1, and the three payments occur on each December 31 thereafter. Required • Round answer to the nearest whole dollar. • Do not use negative signs with your answers. a. Compute the amount of each annual payment. $ b. What does Ked record for the cost of equipment? $ c. What total amount of interest was paid? $ 2,690 X Xarrow_forward

- Please do not give solution in image format thankuarrow_forwardDon't answer in imagearrow_forwardRequired information Exercise 9-21 Complete the accounting cycle using long-term liability transactions (LO9-2, 9-8) [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of Freedom Fireworks includes the following account balances: Debit $ 11,700 35,000 152,500 72,300 125,000 Accounts Credit Cash Accounts Receivable Inventory Land Buildings $ 2,300 10, 100 23, 200 205,000 155,900 Allowance for Uncollectible Accounts Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Totals $396,500 $396,500 During January 2021, the following transactions occur: Borrow $105, 000 from Captive Credit Corporation. The installment note bears interest at 6% annually and matures in 5 years. Payments Receive $31, 500 from customers on accounts receivable. January $2,030 are required at the end of ead onth for 6e months. January 4 January Pay cash on accounts payable, $16,000. 10 January Pay cash for salaries, $29,400. 15 January…arrow_forward

- STATEMENT OF FINANCIAL POSITION AS AT DECEMBER 31 All answers round to two decimal places except (c) & (e), eg 54.544 input as 54.54, 54.545 input as 54.55 2019 2018 2017 2$ $ $ 2019 2018 times Plant and equipment (net) 500,000 466,000 440,000 a)Current ratio 5.11 times times times Intangible Assets 580,000 480,000 412,000 b) Acid Test Ratio times times Short Term Investments 56,000 140,000 97,200 b)lnventory Turnover Prepaid Insurance (less than 12 months) 4,000 4,000 3,800 c)Average days to sell inventory 100 Days Days (Round to days, no decimal place required) Inventory 126,000 119,000 79,000 d)Accounts Receivable turnover times times (Assume all the sale are credit sales) Accounts receivables (net) 54,000 48,000 60,000 e) Average Collection Period Days Days (Round to days, no decimal place required) % Cash 220,000 144,000 122,000 f)Profit Margin 1,540,000 1,401,000 1,214,000 g)Return on Assets times times h)Asset Turnover % Accounts Payable 80,000 100,000 100,000 i) Return on…arrow_forwardWhat is the income before the income statement? Cheyenne Corp's unadjusted trial balance at December 1, 2022, is presented below. Cash $20,100 Accounts Receivable 38,600 Notes Receivable 11,000 Interest Receivable 0 Inventory 34,700 Prepaid Insurance 3,600 Land 20,900 Buildings 141,000 Equipment 59,000 Patent 9,900 Allowance for Doubtful Accounts $500 Accumulated Depreciation-Buildings 47,000 Accumulated Depreciation-Equipment 23,600 Accounts Payable 25,300 Salaries and Wages Payable 0 Notes Payable (due April 30, 2023) 10,500 Income Taxes Payable 0 Interest Payable 0 Notes Payable (due in 2028) 32,100 Common Stock 49,000 Retained Earnings 92,700 Dividends 12,000 Sales Revenue 919,000 Interest Revenue 0 Gain on Disposal of Plant Assets 0 Bad Debt Expense 0 Cost of Goods Sold 674,000 Depreciation Expense 0 Income Tax Expense 0 Insurance Expense 0 Interest Expense 0 Other Operating Expenses 65,900 Amortization Expense 0 Salaries and Wages Expense…arrow_forwardTrial Balance as at 30 September 2021 Dr Cr $ $ Equity 2,300,000 Sales 4,281,923 Purchases 1,893,612 Carriage Outwards 43,000 Drawings 15,000 Rent & Rates 96,000 Stationery 25,962 Advertising 100,000 Salaries & Wages 325,711 Returns 5,296 3,481 Bad Debts 33,250 Rent Receivables 100,000 Provision for Depreciation -Building 390,000 -Motor Vehicle 160,000 -Equipment 450,000 Carriage Inwards 56,009 Bank 25,000 Inventory, 1 October 2017 120,000 Equipment – at cost 1,500,000 Building – at cost 2,600,000 Motor Vehicle – at cost 800,000 Land 1,500,000 Commission Receivable 6,200 Discounts 12,693 32,158 Trade receivables 298,730 Trade payables 226,501 Cash 50,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education