FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Answer get with calculation and explanation please Don't Use AI tools I need Correct Answer only

Transcribed Image Text:Question

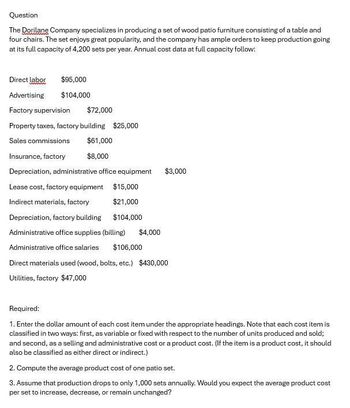

The Dorilane Company specializes in producing a set of wood patio furniture consisting of a table and

four chairs. The set enjoys great popularity, and the company has ample orders to keep production going

at its full capacity of 4,200 sets per year. Annual cost data at full capacity follow:

Direct labor

$95,000

www

Advertising

$104,000

$72,000

Factory supervision

Property taxes, factory building $25,000

Sales commissions

Insurance, factory

$61,000

$8,000

Depreciation, administrative office equipment $3,000

Lease cost, factory equipment $15,000

Indirect materials, factory

$21,000

Depreciation, factory building

$104,000

Administrative office supplies (billing)

$4,000

Administrative office salaries

$106,000

Direct materials used (wood, bolts, etc.) $430,000

Utilities, factory $47,000

Required:

1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is

classified in two ways: first, as variable or fixed with respect to the number of units produced and sold;

and second, as a selling and administrative cost or a product cost. (If the item is a product cost, it should

also be classified as either direct or indirect.)

2. Compute the average product cost of one patio set.

3. Assume that production drops to only 1,000 sets annually. Would you expect the average product cost

per set to increase, decrease, or remain unchanged?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Please correct and incorrect option explain and correct answerarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardWhen should you use Power BI Services?arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThis question has not been submitted previously. Thank youarrow_forwardSolve all the problemsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education