Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

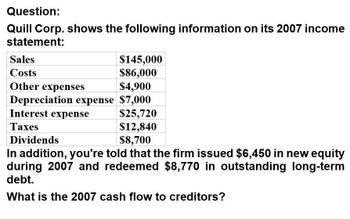

Transcribed Image Text:Question:

Quill Corp. shows the following information on its 2007 income

statement:

Sales

Costs

Other expenses

$145,000

$86,000

$4,900

Depreciation expense $7,000

Interest expense

Taxes

Dividends

$25,720

$12,840

$8,700

In addition, you're told that the firm issued $6,450 in new equity

during 2007 and redeemed $8,770 in outstanding long-term

debt.

What is the 2007 cash flow to creditors?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question: Schwert Corp. shows the following information on its 2007 income statement: Sales Costs Other expenses $145,000 $86,000 $4,900 Depreciation expense $7,000 Interest expense Taxes Dividends $15,000 $12,840 $8,700 In addition, you're told that the firm issued $6,450 in new equity during 2007 and redeemed $6,500 in outstanding long-term debt. What is the 2007 cash flow to creditors?arrow_forwardNeed Answerarrow_forwardAccounting Questionarrow_forward

- Quantitative Problem: At the end of last year, Edwin Inc. reported the following income statement (in millions of dollars): Sales $4,300.00 Operating costs (excluding depreciation) 3,095.00 EBITDA $1,205.00 Depreciation 325.00 EBIT $880.00 Interest 160.00 EBT $720.00 Taxes (40%) 288.00 Net income $432.00 Looking ahead to the following year, the company's CFO has assembled this information: Year-end sales are expected to be 6% higher than $4.3 billion in sales generated last year. Year-end operating costs, excluding depreciation, are expected to increase at the same rates as sales. Depreciation costs are expected to increase at the same rate as sales. Interest costs are expected to remain unchanged. The tax rate is expected to remain at 40%. On the basis of this information, what will be the forecast for Edwin's year-end net income? Round your answers to two decimal places. Do not round intermediate calculations. Enter all values as positive numbers. (in…arrow_forwardSmashed Pumpkins Co. paid $208 in dividends and $631 in interest over the past year. The company increased retained earnings by $528 and had accounts payable of $702. Sales for the year were $16,580 and depreciation was $756. The tax rate was 40 percent. What was the company's EBIT? Multiple Choice O $1,858 $2,129 O $1,511 O $6.632 O $1,227arrow_forwardWhat is Tikki's ROE for 2008 on these general accounting questionarrow_forward

- A. Income StatementAt the end of the last year, King Power Company achieved $6 million in income (EBITDA). Depreciation expense was $1.2 million, interest expense was $800,000 and the corporate tax rate was 35%. At the end of the fiscal year the company had current assets totaling $12 million, $4 million in accounts payable, $1.5 million in accrued liabilities, $1.3 million in other payables, and $8 million in property, plant, and equipment. Assume that King Power has no excess cash, uses debt and equity to finance its operations, has no current liabilities, and recognizes depreciation periodically. Determine the company's net income or loss. Explain how this result can help the manager in making decisions in the company.2. Calculate net and operating working capital. Explain the difference between the two results.3. If the company had $6 million in property, plant, and equipment in the previous year and net operating working capital remained constant, what is the company's available…arrow_forwardQUESTION: Panda Inc.'s net income for the most recent year was $15,985. The tax rate was 35 percent. The firm paid $3,886 in total interest expense and deducted $2,565 in depreciation expense. What was the company's cash coverage ratio for the year?arrow_forwardProvide Correct answer from bellow options. Please answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning