ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

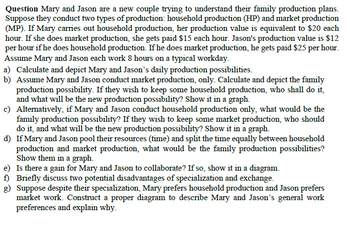

Transcribed Image Text:Question Mary and Jason are a new couple trying to understand their family production plans.

Suppose they conduct two types of production: household production (HP) and market production

(MP). If Mary carries out household production, her production value is equivalent to $20 each

hour. If she does market production, she gets paid $15 each hour. Jason's production value is $12

per hour if he does household production. If he does market production, he gets paid $25 per hour.

Assume Mary and Jason each work 8 hours on a typical workday.

a) Calculate and depict Mary and Jason's daily production possibilities.

b) Assume Mary and Jason conduct market production, only. Calculate and depict the family

production possibility. If they wish to keep some household production, who shall do it,

and what will be the new production possibility? Show it in a graph.

c) Alternatively, if Mary and Jason conduct household production only, what would be the

family production possibility? If they wish to keep some market production, who should

do it, and what will be the new production possibility? Show it in a graph.

d) If Mary and Jason pool their resources (time) and split the time equally between household

production and market production, what would be the family production possibilities?

Show them in a graph.

e) Is there a gain for Mary and Jason to collaborate? If so, show it in a diagram.

f) Briefly discuss two potential disadvantages of specialization and exchange.

g) Suppose despite their specialization, Mary prefers household production and Jason prefers

market work. Construct a proper diagram to describe Mary and Jason's general work

preferences and explain why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Charles lives in Houston and operates a small company selling drones. On average, he receives $849,000 per year from selling drones. Out of this revenue from sales, he must pay the manufacturer a wholesale cost of $390,000. He also pays several utility companies, as well as his employees wages totaling $359,000. He owns the building that houses his storefront; if he choose to rent it out, he would receive a yearly amount of $72,000 in rent. Assume there is no depreciation in the value of his property over the year. Further, if Charles does not operate the drone business, he can work as a programmer and earn a yearly salary of $25,000 with no additional monetary costs, and rent out his storefront at the $72,000 per year rate. There are no other costs faced by Charles in running this drone company. Identify each of Charles’s costs in the following table as either an implicit cost or an explicit cost of selling drones. Implicit Cost Explicit Cost The salary Charles could…arrow_forwardB) In his State of the Union address in 2003, President Bush supported the idea of changing from the use of internal combustion engines to fuel cells based on hydrogen as a way of reducing air pollution and the emission of greenhouse gases. Fuel cells are nonpolluting because they only emit water vapor. President Bush proposed having the government subsidize research and development of hydrogen fuel and fuel cell technology. The president did not propose raising taxes on gasoline as a way of encouraging the use of fuel cells and reducing greenhouse gases. Currently, hydrogen is more expensive than gasoline.arrow_forwardTim lives in Vancouver and runs a business that sells pianos. In an average year, he receives $733,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $433,000; he also pays wages and utility bills totalling $257,000. He owns his show room; if he chooses to rent it out, he will receive $13,000 in rent per year. Assume that the value of this show room does not depreciate over the year. Also, if Tim does not operate this piano business, he can work as a paralegal, receive an annual salary of $23,000 with no additional monetary costs, and rent out his show room at the $13,000 per year rate. No other costs are incurred in running this piano business.arrow_forward

- After Hurricane Maria, hundreds of nonprofit organizations streamed to Puerto Rico and other Caribbean islands to provide disaster relief. Research has found that coordination between nonprofits during disasters is difficult to maintain—it’s easy for individual nonprofits to fundraise and pursue programming on their own while ignoring other organizations working on the same issues. Additionally, there are incentives to do projects that are cheap and have fast turnaround, since donors respond to the visibility of organizations providing disaster relief. Consider two nonprofit organizations working in Puerto Rico. Together, they could spend time coordinating their efforts and run a shelter for hurricane victims, providing each organization with 100 utils. Alternatively, they could individually distribute paper towels—a simple, low-cost, fast, and visible project—and receive 5 utils. This situation can be modeled with the following payoff matrix: Nonprofit 2 Run Shelter…arrow_forwardSuppose Michelle owns a women's clothing boutique. Each year, her total revenue is $300,000 and her explicit costs are $160,000. In addition, Michelle estimates that the opportunity cost of the resources she puts into her business is $90,000 per year. What is Michelle's economic Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardKenji lives in Mississauga and runs a business that sells pianos. In an average year, he receives $723,000 from selling pianos. Of this sales revenue, he must pay the manufacturer a wholesale cost of $423,000; he also pays wages and utility bills totalling $267,000. He owns his show room; if he chooses to rent it out, he will receive $2,000 in rent per year. Assume that the value of this show room does not depreciate over the year. Also, if Kenji does not operate this piano business, he can work as a financial advisor, receive an annual salary of $20,000 with no additional monetary costs, and rent out his show room at the $2,000 per year rate. No other costs are incurred in running this piano business. Identify each of Kenji's costs in the following table as either an implicit cost or an explicit cost of selling pianos. Implicit Cost The wages and utility bills that Kenji pays The salary Kenji could earn if he worked as a financial advisor The rental income Kenji could receive if he…arrow_forward

- A gardener is trying to maximize profit by growing tomatoes (T) and carrots(C) with fertilizer(F). The production functions are: Tomatoes: T = 70F₁ - 1.5F-² Carrots: C = 90Fc - 2Fc² Constraint: FT + Fc = 60 The profit is $0.50 per tomato and $0.25 per carrot. There are 60 units of fertilizer available. How much fertilizer should go to the tomatoes?arrow_forwardSuppose that widgets can be produced using two different production techniques, A and B. The following table provides the total input requirements for each of five different total output levels. Q=1 Tech. K L 4 1 1 3 A B Total Cost L K Assuming that the price of labor (PL) is $1 and the price of capital (P) is $3, calculate the total cost of production for each of the five levels of output using the optimal (least-cost) technology at each level. To do this, complete the table below by calculating the total cost of production, filling in the missing values using the optimal (least-cost) technology at each level. (Enter your responses as whole numbers.) Q=1 $ 6 Q=2 K L 6 2 2 5 Q=1 Total Cost L K 31 Q=2 $ 11 Q=3 K L 9 4 4 8 How many labor hours (units of labor) would be employed at each level of output? How many machine hours (units of capital)? To answer this, complete the table below for the units of labor and units of capital that would be used to produce each level of output. (Enter…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education