Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Predetermined OH Rates; Capacity Measures

Alberton Electronics makes inexpensive GPS navigation devices and uses a normal cost system that applies

| Variable factory overhead at 100,000 machine hours | $1,250,000 |

| Variable factory overhead at 150,000 machine hours | 1,875,000 |

| Fixed factory overhead at all levels between 10,000 and 180,000 machine hours | 1,440,000 |

Practical capacity is 180,000 machine hours; expected capacity is two-thirds of practical.

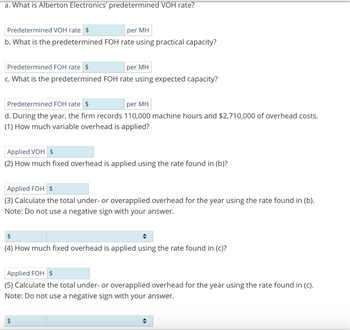

Transcribed Image Text:a. What is Alberton Electronics' predetermined VOH rate?

Predetermined VOH rate $

per MH

b. What is the predetermined FOH rate using practical capacity?

Predetermined FOH rate

per MH

c. What is the predetermined FOH rate using expected capacity?

Predetermined FOH rate $

per MH

d. During the year, the firm records 110,000 machine hours and $2,710,000 of overhead costs.

(1) How much variable overhead is applied?

Applied VOH $

(2) How much fixed overhead is applied using the rate found in (b)?

Applied FOH $

(3) Calculate the total under- or overapplied overhead for the year using the rate found in (b).

Note: Do not use a negative sign with your answer.

$

(4) How much fixed overhead is applied using the rate found in (c)?

Applied FOH $

(5) Calculate the total under- or overapplied overhead for the year using the rate found in (c).

Note: Do not use a negative sign with your answer.

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General Account Questionsarrow_forwardIn a new, highly automated factory, labor costs are expected to decrease at an annual rate of 5%; material costs will increase at an annual rate of 4%; overhead costs will increase at 8%. The labor, material, and overhead costsat the end of the first year are $2 million, $3 million, and $1.6 million, respectively. The time value of money rate is 11% and the time horizon is 7years. a. Determine the dollar value for each cost category (labor, material,overhead) for each year and the total cost for each year. b. Determine the present worth of each cost category and the total cost. c. Determine the annual worth over 7 years that is equivalent to the present worth of the total cost.arrow_forwardWorld Navigation Systems Ltd designs and manufactures specialist navigation equipment. A typical product has a commercial life of three years. Analysis of demand for 1000 various navigation systems found that 325 enjoyed high demand throughout their commercial lives, 480 moderate demand and 195 low demand. The NPV of a new project for various demand predictions were calculated as follows: High Demand Moderate Demand Low Demand 41,936 173 (1,336) Using probabilities derived from the past demand data the expected NPV of the new project is equal to: A. 41,936 B. 173 C. -1,336 D. 13452arrow_forward

- The costs and revenue projections for a new product are estimated. What is the estimated profit at a production rate of 20% above breakeven? Fixed cost = $668,000 per year Production cost per unit = $191.0 Revenue per unit = $286.0 The estimated profit is determined to be $ per year.arrow_forwardA process for producing the mosquito repellant Deet has an initial investment of $200,000 with annual costs of $50,000. Income is expected to be $90,000 per year. (a) What is the payback period at i = 0% per year? A i = 12% per year? (Note: Round your answers to the nearest integer.) (b) What is the annual breakeven production quantity for both payback periods (determined above) if net profit, that is, income minus cost, is $10 per gallon?arrow_forwardPlease use excelarrow_forward

- Assume that the moving activity has an expected cost of $80,000. Expected directlabor hours are 20,000, and expected number of moves is 40,000. The best activity ratefor moving isa. $4 per move.b. $1.33 per hour-move.c. $4 per hour.d. $2 per move.e. None of these.arrow_forwardCompany D is planning to perform an ABC analysis for its products. An information table is given below. Item Annual Demand Unit Cost 180 $100 130 $140 C 600 $220 D. 60 $70 50 $80 Assuming that class A items represent about 75% of the total dollar usage, class B about 20%, class C less than 5%, what is the annual dollar volume of Item D? a. 132000 b. 4200 C. 18200 d. 4000 e. 18000arrow_forwardAssume that the operations manager of a small semi-conductor manufacturer wants to run a Simulation model to better understand the uncertainties related to cost and demand for a particular product. He assumes that the total cost per month could be anywhere between $150,000 and $200,000 with equal likelihood. He also assumes that the demand is normally distributed with a mean of 5,000 items per month and a standard deviation of 1,000. Each item is sold for $95. a) Use the random numbers in the following table to simulate the costs, revenues and profits per month. Use Random Number A to generate the costs and Random Number B to generate the revenues per month and then calculate the profit as the difference between revenues and costs. Complete the table by reporting the minimum, maximum and average profit per month according to this simulation. Trial 1 2 3 4 5 6 7 8 9 10 you b) Can Random A 0.23 you 0.04 0.14 0.07 0.03 0.67 0.26 0.03 0.83 0.32 Cost Random B 0.75 0.89 0.82 0.33 0.96 0.67…arrow_forward

- Example: A new process for a manufacturing process will have a first cost of $55,000 with annual costs of $38,000. Extra income associated with the new process is expected to be $62,000 per year. What is the payback period at j = 12% per year? a) 2.29 b) 3.00 c) 6.00 d) 2.14arrow_forward37. An analyst predicts that an 80 percent experience curve should be an accurate pre- dictor of the cost of producing a new product. Suppose that the cost of the first unit is $1,000. What would the analyst predict is the cost of producing the a. 100th unit? b. 10,000th unit?arrow_forwardThe management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. The selling price for the product will be $45 per unit. Probability distributions for the purchase cost, the labor cost, and the transportation cost are estimated as follows: ProcurementCost ($) Probability LaborCost ($) Probability TransportationCost ($) Probability 10 0.2 18 0.25 2 0.74 12 0.35 20 0.35 5 0.26 13 0.45 22 0.1 25 0.3 Compute profit per unit for the base-case, worst-case, and best-case scenarios.Profit per unit for the base-case: $ fill in the blank 1Profit per unit for the worst-case: $ fill in the blank 2Profit per unit for the best-case: $ fill in the blank 3 Construct a simulation model to estimate the mean profit per unit. If required, round your answer to the nearest cent.Mean profit per unit = $ fill in the blank 4 Why is the simulation approach to risk analysis preferable to generating a variety of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning