EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Question

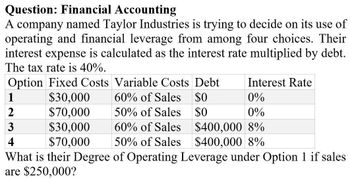

Transcribed Image Text:Question: Financial Accounting

A company named Taylor Industries is trying to decide on its use of

operating and financial leverage from among four choices. Their

interest expense is calculated as the interest rate multiplied by debt.

The tax rate is 40%.

Option Fixed Costs Variable Costs Debt

Interest Rate

1

$30,000

60% of Sales

$0

0%

2

$70,000

50% of Sales

$0

0%

3

$30,000

60% of Sales

$400,000 8%

4

$70,000

50% of Sales

$400,000 8%

What is their Degree of Operating Leverage under Option 1 if sales

are $250,000?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- SUBJECT: FINANCIAL ACCOUNTINGarrow_forwardWhich of the following calculations is correct if sales are $25,000, operating profit after tax is $1,000, the tax rate is 30%, there are no ‘other comprehensive income’ items, operating liabilities (OL) are $5,000, the short-term borrowing rate (STBC) is 3% after tax, and the asset turnover ratio (ATO) is 2? 1. Operating liability leverage (OLLEV) = 0.286 2. RNOA = 0.092 3. RNOA = 0.066 4. Operating profit margin after tax = 0.046arrow_forwardGeneral Accountarrow_forward

- QUESTION: FINANCIAL ACCOUNTING INC. HAS INTERNATIONAL, SALES OF $150. FIXED OPERATING COSTS OF $20, AND A VARIABLE COST RATIO OF 0.55. IT HAS HAS 40 COMMON SHARES OUTSTANDING AND A TAX RATE OF 0.26. WHAT IS INTERNATIONAL, INC.'S DOL?arrow_forwardNeed help with this question solution general accountingarrow_forwardConsider the following income statement for Larry & Harry drug stores: Revenue - 90mm Variable costs- 48mm Interest on debt- 6mm Depreciation- 0 mm It’s tax rate is 25% and the book value of its equity is 150mm. What is L&H’s coverage ratio? A) 0.18 B) 5.25 C) 6 D) 7 E) 8 F)15arrow_forward

- You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt financing. Scenario Bad year Normal year Good year Total assets Tax rate Debt Equity Borrowing rate Sales Interest expense for Debt Free Interest expense for Debt Spree $200 $275 $380 Debt Free $ 250 21% EBIT $12 $ 34 $ 51 $0 $ 250 16% Required: a. Calculate the interest expense for each firm: Debt Spree $ 250 21% $150 $ 100 16%arrow_forwardplease solve this question general accountingarrow_forwardprovide correct answer general accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning