FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

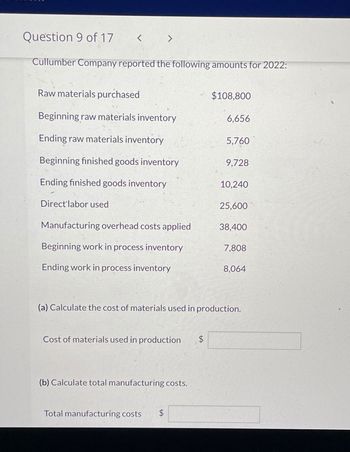

Transcribed Image Text:Question 9 of 17

Cullumber Company reported the following amounts for 2022:

<

Direct'labor used

Raw materials purchased

Beginning raw materials inventory

Ending raw materials inventory

Beginning finished goods inventory

Ending finished goods inventory

>

Manufacturing overhead costs applied

Beginning work in process inventory

Ending work in process inventory

Cost of materials used in production $

(b) Calculate total manufacturing costs.

Total manufacturing costs $

tA

$108,800

+A

6,656

5.760

9,728

10,240

(a) Calculate the cost of materials used in production.

25,600

38,400

7,808

8,064

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aa.45.arrow_forwardPlease do not give solution in image format thankuarrow_forwardDirect materials: Beginning inventory Purchases Ending inventory Direct manufacturing labor Manufacturing overhead Beginning work-in-process inventory Ending work-in-process inventory Beginning finished goods inventory Ending finished goods inventory P 40,000 123,200 20,800 32,000 24,000 8,000 1,600 48,000 32,000 Required: A. What is the cost of direct materials used during 2022? B. What is cost of goods manufactured for 2022? C. What is cost of goods sold for 2022? D. What amount of prime costs was added to production during 2022? E. What amount of conversion costs was added to production during 2022?arrow_forward

- Edit question Case Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. On June 1, 2020, the general ledger for Case Inc. contains the following data. Raw Materials Inventory $ 3,900 Manufacturing Overhead Applied $ 35,600 Work in Process Inventory $ 5,975 Manufacturing Overhead Incurred $ 29,400 Subsidiary data for Work in Process Inventory on June 1 are as follows. Job Cost Sheets Customer Job Cost Element Rodgers Stevens Linton Direct materials $ 700 $ 900 $ 1,000 Direct labor 300 500 700 Manufacturing overhead 375 625 875 $ 1,375 $ 2,025 $ 2,575 During June, raw materials purchased on account were $ 4,600, and all wages were paid. Additional overhead costs consisted of depreciation on equipment $ 800 and miscellaneous costs of $ 400 incurred on account.A summary of materials…arrow_forwardPlease do not give solution in image format thankuarrow_forwardQ.1 Late Corporation is in the business of producing furniture, previously the company has had a policy of preparing costing statements annually. The following data was taken from the general ledger and other records of Jaric0 Manufacturing Co. at December 31 2023, the end of the second year of operations in the fiscal year: Revenue Inventories at January 1: Materials inventory Work in process inventory Finished goods inventory Inventories at January 31: Materials inventory Work in process inventory Finished goods inventory Materials purchased Labor Costs: Finishing workers' wages Supervisors' salaries Depreciation: Admin personnel salaries Factory Equipment Admin office Indirect materials used Factory utilities Employee Fringe Benefits Insurance (30% Admin & 70% Factory) Workers Compensation Insurance Overtime Premium Defective Work Lubricants Rent (40% Factory & 60 % Admin) Property Tax Spoilage Heating & Lighting (40% Admin and 60% Factory) Carriage Inwards Carriage Outwards Trade…arrow_forward

- Aarrow_forwardCurrent Attempt in Progress Vaughn Inc's accounting records reflect the following inventories: Raw materials inventory Work in process Inventory Finished goods inventory Dec. 31, 2021 Dec. 31, 2022 $79000 $63000 O $1466000 O $1450000 $1387000 O $1434000 103000 100000 115000 92000 During 2022, Vaughn purchased $1450000 of raw materials, incurred direct labor costs of $250000, and incurred manufacturing overhead totaling $160000. (Assume that all raw materials used were direct materials.) What was the cost of raw materials transferred to production during 2022 for Vaughn?arrow_forwardQuestion: 2014 Date Explanation Debit Dec. Direct materials cost $1,250,000 31 31 Direct labor cost 31 Overhead costs $ 300,000 $400,000 31 To finished goods Credit Balance $1,250,000 $1,800,000 $2,400,000 $2,350,000 $50,000 1) Determine the overhead rate used (based on the direct material cost). 2) Only one job remained in the goods in process inventory at December 31, 2014. Its direct materials cost is $30,000. How much direct labor cost and overhead cost are assigned to it?arrow_forward

- 31 Current information for the Healey Company follows: Beginning raw materials inventory Raw material purchases Ending raw materials inventory Beginning work in process inventory Ending work in process inventory Direct labor Total factory overhead $ 17,200 62,000 18,600 24,400 30,000 44,000 32,000 All raw materials used were direct materials. Healey Company's cost of goods manufactured for the year is:arrow_forwardaccountsarrow_forwardpls help asaparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education