FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:31

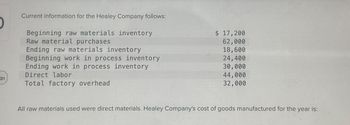

Current information for the Healey Company follows:

Beginning raw materials inventory

Raw material purchases

Ending raw materials inventory

Beginning work in process inventory

Ending work in process inventory

Direct labor

Total factory overhead

$ 17,200

62,000

18,600

24,400

30,000

44,000

32,000

All raw materials used were direct materials. Healey Company's cost of goods manufactured for the year is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current information for the Healey Company follows: Beginning raw materials inventory $ 15,700 Raw material purchases 65,000 Ending raw materials inventory 17,100 Beginning work in process inventory 22,900 Ending work in process inventory 28,500 Direct labor 45,300 Total factory overhead 30,500 All raw materials used were direct materials. Healey Company's total manufacturing costs for the year are:arrow_forwardSuperior Company provided the following data for the year ended December 31 (all raw materials are used in production as direct materials): Selling expenses Purchases of raw materials Direct labor Administrative expenses Manufacturing overhead applied to work in process Actual manufacturing overhead cost Beginning and ending inventory balances were as follows: Beginning $ 218,000 $ 261,000 ? $ 155,000 $ 374,000 $ 360,000 Raw materials Work in process Finished goods Ending $ 59,000 $ 39,000 ? $ 24,000 $ 39,000 ? The total manufacturing costs added to production for the year were $680,000; the cost of goods available for sale totaled $745,000; the unadjusted cost of goods sold totaled $662,000; and the net operating income was $39,000. The company's underapplied or overapplied overhead is closed to Cost of Goods Sold. Required: Prepare schedules of cost of goods manufactured and cost of goods sold and an income statement. (Hint: Prepare the income statement and schedule of cost of goods…arrow_forwardThe following information pertains to the most recent quarter at Precious Production Limited. Purchases of raw materials Raw materials inventory, beginning Raw materials inventory, ending Depreciation, factory Insurance, factory Direct labour Maintenance, factory Administrative expenses Sales Utilities, factory Supplies, factory Selling expenses Indirect labour Work in process inventory, beginning Work in process inventory, ending Finished goods inventory, beginning Finished goods inventory, ending Required: 1. Prepare a schedule of cost of goods manufactured. PRECIOUS PRODUCTION $ 388,500 47,600 77,500 215,500 21,900 253,300 127,600 295,200 2,256,000 117,500 4,190 337,100 273,300 28,950 123,800 42,850 171,400arrow_forward

- Cost of Goods Manufactured for a Manufacturing Company The following information is available for Ethtridge Manufacturing Company for the month ending July 31: Cost of direct materials used in production $105,600 Direct labor 126,700 47,500 64,400 58,100 Work in process inventory, July 1 Work in process inventory, July 31 Total factory overhead Determine Ethtridge's cost of goods manufactured for the month ended July 31. Ethtridge Manufacturing Company Statement of Cost of Goods Manufactured For the Month Ended July 31 Add manufacturing costs incurred during July: Total manufacturing costs incurred Total manufacturing costs Cost of goods manufacturedarrow_forward[The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare an income statement for Delray Manufacturing (a manufacturer). Assume that its cost of goods manufactured is $534,300.arrow_forwardPrepare a schedule of cost of good manufactured.arrow_forward

- Comet Company accumulated the following account information for the year: Beginning raw materials inventory Indirect materials cost Indirect labor cost Maintenance of factory equipment Direct labor cost Multiple Choice Using the above information, total factory overhead costs would be: O $17,000. O $14.200 $11,000. O $18,400. $6,400 2,400 $8.600. 5,400 3,200 7,400arrow_forwardWasson Company reported the following year-end information: Beginning work in process inventory Beginning raw materials. inventory Ending work in process inventory Ending raw materials inventory Raw materials purchased Direct labor Manufacturing overhead $ 35,000 18,000 38,000 15,000 560,000 210,000 120,000 What is Wasson's total cost of work in process for the year?arrow_forwardProvide correct solution for this questionarrow_forward

- The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company Pepper Company Finished goods inventory, beginning $ 14,100 $ 18,400 Work in process inventory, beginning 15,500 21,450 Raw materials inventory, beginning 8,800 12,450 Rental cost on factory equipment 31,500 23,200 Direct labor 20,400 41,000 Finished goods inventory, ending 18,500 16,100 Work in process inventory, ending 26,800 19,600 Raw materials inventory, ending 6,700 8,800 Factory utilities 10,500 12,500 General and administrative expenses 23,000 44,500 Indirect labor 14,450 13,860 Repairs—Factory equipment 4,700 2,150 Raw materials purchases 39,000 58,000 Selling expenses 50,000 55,300 Sales 274,470 395,150 Cash 34,000 22,700 Accounts Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for…arrow_forwardThe following data is provided for Garcon Company and Pepper Company. Garcon Pepper Company $ 16,600 23,100 12,300 26,500 Company $ 13,300 17,600 Beginning finished goods inventory Beginning work in process inventory Beginning raw materials inventory (direct materials) Rental cost on factory equipment Direct labor Ending finished goods inventory Ending work in process inventory Ending raw materials inventory Factory utilities Factory supplies used (indirect materials) General and administrative expenses Indirect labor 10,100 30,750 20,000 19,400 23,200 5,700 10,200 9,100 22,000 2,200 43,800 16,700 21,000 7,800 17,750 4,700 46,000 9,220 Repairs-Factory equipment Raw materials purchases Selling expenses Sales Canh Factory equipment, net Accounts receivable, net 6,860 44,000 52,400 246,030 21,000 247,500 16,400 2,700 65,500 51, 100 300,010 17,200 172,825 22,950 Required: 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of the…arrow_forwardPlease complete all the requirements!.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education