Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

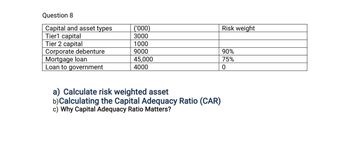

Transcribed Image Text:Question 8

Capital and asset types

Tier1 capital

Tier 2 capital

Corporate debenture

Mortgage loan

Loan to government

('000)

3000

1000

9000

45,000

4000

a) Calculate risk weighted asset

b) Calculating the Capital Adequacy Ratio (CAR)

c) Why Capital Adequacy Ratio Matters?

Risk weight

90%

75%

0

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question content area top Part 1 (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year A B C 1 $ 20,000 $ 20,000 2 20,000 3 20,000 4 20,000 5 20,000 $ 20,000 6 20,000 100,000 7 20,000 8 20,000 9 20,000 10 20,000 20,000 (Click on the icon in order to copy its contents into a spreadsheet.) Assuming an annual discount rate of 23 percent, find the present value of each investment. Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 23…arrow_forwardQuestion content area top Part 1 (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year A B C 1 $ 14,000 $ 14,000 2 14,000 3 14,000 4 14,000 5 14,000 $ 14,000 6 14,000 70,000 7 14,000 8 14,000 9 14,000 10 14,000 14,000 (Click on the icon in order to copy its contents into a spreadsheet.) Assuming an annual discount rate of 15 percent, find the present value of each investment. Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 15 percent?…arrow_forwardplease give me answer dont give answer in image formatarrow_forward

- Question content area top Part 1 Assuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions? Question content area bottom Part 1 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax rate of return is 1.711.71%. (Round to two decimal places.) Part 2 Assuming a 1-year, money market account investment at 2.282.28% (APY), a 2525% marginal tax bracket, and a constant $ 50 comma 000$50,000 balance, the after-tax monetary return is $855855. (Round to the nearest dollar.) Part 3 Given an after-tax return of 1.711.71% and an inflation rate of…arrow_forwardPls do fast and i will rate instantly for sure Solution must be in typed formarrow_forwardQuestion: 1. Fair Hevan Mutual fund cooperation provides investment services over 10-year period. The table below has information on some of the mutual funds they holds. Fund A C D Number of funds 9651 2752 1490 3045 Total return (%) 4.7 18.5 11.6 6.9 Based on number of funds in each category, Calculate the weighted average total return. 2. What are the other possible measures for weights, if number of mutual funds is not the best option. 3.Based on the following details on investment, calculate the expected retrun of the portfolio.arrow_forward

- Question content area top Part 1 (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment End of Year A B C 1 $ 16,000 $ 21,000 2 16,000 3 16,000 4 16,000 5 16,000 $ 16,000 6 16,000 63,000 7 16,000 8 16,000 9 16,000 10 16,000 21,000 (Click on the icon in order to copy its contents into a spreadsheet.) Assuming an annual discount rate of 19 percent, find the present value of each investment. Question content area bottom Part 1 a. What is the present value of investment A at an annual discount rate of 19 percent? $enter your response here (Round…arrow_forwardAsset End of year Amount Appropriate Required Return D 1 through 5 $1,500 12% 6 $8,500 Cash Flow By using cell references to the given data and the function PV, Calculate the value of asset D.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education