FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Home

Excel File Edit View

CP

Page Layout

J28

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

Paste

34

35

36

Insert

X

Calibri (Body)

B I U v

A

1

Ratios

2 Operating profitability (OP) ratio

3 Capital requirement (CR) ratio

4 Return on invested capital (ROIC)

Economic value added (EVA)

B

I

fx

Balance Sheet

TAAREDZAV

C

O

Insert Format Tools

Formulas Data Review

V 12

V

Income Statement

Select destination and press ENTER or choose Paste

D

X

X

X

X

V

APR

23

A^ A

A

E

V

2038

Data Window Help

F

=

X

X

X

X

280

View

G

Percentage Change

2039

H

XA_FIN Statements, CFs and Taxes_Last Name.xlsx

ab Wrap Text

Merge & Center ✓

I

Statement of CFs

الله

J

FCF

S

General

K

V

♫

%

L

500

Performance Ratios

.00

M

+

Conditional Format

Formatting as Table

tv A i

N

S

X

O

Cell

Styles

P

Greenwolde

4

Insert v

Delete v

Format v

Q

XLSX

((.

WE

R

V

E

Sun Apr 23 6:58 PM

8. Ou

Sort &

Filter

Find &

Select

S

T

Sensitivity

Share

U

+ 100%

Transcribed Image Text:A

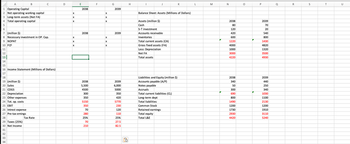

1 Operating Capital

2 Net operating working capital

3 Long-term assets (Net FA)

4 Total operating capital

5

6

7 (million $)

9 NOPAT

8 Necessary investment in OP. Cap.

10 FCF

B

11

12

13

14

O

2038

X

X

X

X

X

X

2038

2039

80

70

120

20

2038

2039

420

540

EGE 11

X

X

600

800

X

X

1220

1430

X

X

4000

4820

1000

1320

3000

3500

4220

C

18

19 (million $)

20 Sales

21 COGS

22 Depreciation

23 Other expenses

24 Tot. op. costs

25 EBIT

26 Intrest expense

27 Pre-tax ernings

28

29 Taxes (25%)

30 Net Income

31

32

33

34

15

16 Income Statement (Millions of Dollars)

17

Tax Rate

D

E

F

2038

5,500

4500

300

350

5150

350

70

280

25%

70

210

G

2039

2039

6,000

5000

350

420

5770

230

120

110

25%

27.5

82.5

لاع

H

LO

I

Assets (million $)

Cash

Balance Sheet: Assets (Millions of Dollars)

S-T investment

Accounts receivable

Inventories

J

Total current assets (CA)

Gross fixed assets (FA)

Less: Depreciation

Net FA

Total assets

K

Liabilities and Equity (million $)

Accounts payable (A/P)

Notes payable

Accruals

Total current liabilities (CL)

Long-term dept

Total liabilities

Common Stock

Retained earnings

Total equity

Total L&E

L

M

N

P

2038

340

50

300

690

800

1490

1200

1730

2930

4420

4930

2039

440

250

340

1030

1100

2130

1200

1910

3110

5240

Q

R

S

T

U

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A. 20Y5 Annual net cash flow is incorrect. B. Present value of annual net cash flow Less investment are incorrect. a. For each year, subtract the driver salaries and operating costs from the revenues. For 20Y3 only, add the residual value. b. Multiply the present value of $1 factor for each year by that year's net cash flow (from a). Subtract the amount to be invested from the total present value of the net cash flow.arrow_forwardWorking needarrow_forwardWhat is the annual after-tax operating cash flow? Table 3 Initial Equipment Project Life Sales Variable Costs Fixed Costs Tax rate Cost of Capital Ending Book Value Sales Price at Year 3 Net Working Capital $24,700 O $13,300 $32,250 $19,300 $55,000 3 Years $50,000 $20,000 $10,000 35% 10% $1,000 $20,000 $10,000arrow_forward

- Nonearrow_forwardThe following information pertains to Travis Concrete: Sales revenue $2,000,000 Gross margin 700,000 100,000 550,000 Income Invested capital The company's imputed interest rate is 8%. The capital turnover is: Multiple Choice 27.50. 3.64. 20.00.arrow_forwardHelp Saved ent i-Chapter 4O Provincial Inc. reported the following before-tax income statement itemns: $540, 000 Operating income Nonoperating losses (89,000) Provincial has a 25% income tax rate. Provincial would report the following amount of income tax expense as a separately stated line item in the income statement: Multiple Choice $11.000 Prev 1 of 15 Next >arrow_forward

- Gross Profit from Operations Tax Exempt Interest Capital gains Capital Loss carryforward Compensation expense Depreciation: Tax=$8,000/ E&P=$6,500 Other expenses Total Expense Book/ Taxable Income (1) Federal Income Tax (21%) Book Income $100,000 10,000 5,000 0 Total Income $115,000 $-12,000 30,000 6,000 10,000 46,000 (2) 69,000 M-1s 0 -10,000 0 -2000 0 2,000 0 2,000 -14,000 (3) Tax Income $100,000 0 5000 -2000 $103,000 30,000 8,000 10,000 48,000 55,000 0 After making your adjustments, what is ABC Corporation's current year E&P? (4) E&P Adjustment 0 0 n/a 0 0 n/a n/aarrow_forward($ thousands) Present value at 19% Net cash flow Net present value 0 1 4 -13,700 -1,594 -13,700 -1,339 3,541 (sum of PVs). Period 2 3 6 3,057 6,433 10,644 10,095 5,867 2,159 3,817 5,308 4,230 2,066 5 7 3,379 1,000 Restate the above net cash flows in real terms. Discount the restated cash flows at a real discount rate. Assume a 19% nominal rate and 11% expected inflation. NPV should be unchanged at +3,541, or $3,541,000. Note: Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in thousands rounded to the nearest whole number. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Real Net Cash Flows NPVarrow_forwardBaghibenarrow_forward

- Assignment: Chapter 11 Cost of Capital Attempts 2. An overview of a firm's cost of debt Keep the Highest/3 To calculate the after-tax cost of debt, multiply the before-tax cost of debt by Three Waters Company (TWC) can borrow funds at an interest rate of 12.50% (2+T)od of four years. Its marginal federal-plus-state tax rate is 40%. TWC's after-tax cost of debt is (rounded to two decimal(1-T) At the present time, Three Waters Company (TWC) has 10-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,278.41 per bond, carry a coupon rate of 11%, and distribute annual coupon payments. The company incurs a federal- plus-state tax rate of 40%. If TWC wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to tw decimal places)? O4.22% O 3.80 % O 5.06% 4.85%arrow_forwardYears Revenue Cash Expense Book Depreciation Book Income Pre-Tax Book Tax at 32% After Tax Book Income Financial Measures Profit Margin % Net Assets ROA % Cashflow Revenue Cash Expense Tax Depreciation Pretax Income Tax at 32% After Tax Income After Tax Cashflow Cumulative Cashflow Payback Period Present Worth 10 PW12 PW15 IRR PV Index(15) Facility Cost Income Tax Rate 0 C. -9.5 d. -12.4 $ 100,000.00 2.2 Years 91740.92679 0.395702526 1 0.684350818 $ 100,000.00 32% $30,000.00 $100,000.00 $120,000.00 $140,000.00 $150,000.00 $150,000.00 $50,000.00 $60,000.00 $70,000.00 $75,000.00 $75,000.00 2 $20,000.00 $20,000.00 $20,000.00 $20,000.00 $20,000.00 $0.20 $20,400.00 $27,200.00 $0.26 $9,600.00 $12,800.00 $16,000.00 $17,600.00 $17,600.00 $20,400.00 ($100,000.00) $40,400.00 $51,040.00 ($100,000.00) -$59,600.00 -$8,560.00 $40,000.00 $50,000.00 $55,000.00 $55,000.00 $0.23 3 $0.45 $36,727.27 $80,000.00 $60,000.00 $40,000.00 $20,000.00 $0.85 $1.87 4 $19,040.00 5 $34,000.00 $37,400.00 $0.24…arrow_forward5 Edmonds Industries is forecasting the following income statement: Sales Operating costs (excl. Depr. & Amort.) EBITDA Depreciation EBIT Interest EBT Taxes (40%) Net income $10,000,000 5,500,000 4,500,000 1,200,000 $ 3,300,000 500,000 $ 2,800,000 1,120,000 $ 1,680,000 The CEO would like to see higher sales and a forecasted net income of $2,100,000. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 6%. The tax rate, which is 40%, will remain the same. (Note that while the tax rate remains constant, the taxes paid will change.) What level of sales would generate $2,100,000 in net income?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education