FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

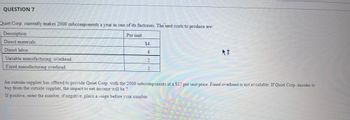

Transcribed Image Text:QUESTION 7

Quiet Corp. currently makes 2000 subcomponents a year in one of its factories. The unit costs to produce are:

Description

Per unit

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

$4

4

2

IMI

An outside supplier has offered to provide Quiet Corp. with the 2000 subcomponents at a $17 per unit price. Fixed overhead is not avoidable. If Quiet Corp. decides to

buy from the outside supplier, the impact to net income will be ?

If positive, enter the number, if negative, place a-sign before your number

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need A,B,C answered pleasearrow_forwardProblem 6-18 (Algo) Relevant Cost Analysis In a Variety of Situations [LO6-2, LO6-3, LO6-4] Andretti Company has a single product called a Dak. The company normally produces and sells 87,000 Daks each year at a selling price of $60 per unit. The company's unit costs at this level of activity are given below: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 7.50 8.00 2.90 5.00 ($435,000 total) 2.70 2.50 ($217,500 total) $28.60 A number of questions relating to the production and sale of Daks follow. Each question is independent. Required: 1-a. Assume that Andretti Company has sufficient capacity to produce 113,100 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 30% above the present 87,000 units each year if it were willing to increase the fixed selling expenses by $110,000. What is the financial…arrow_forwardPlease sir Solve all problemsarrow_forward

- Zeus, Incorporated produces a product that has a variable cost of $6 per unit. The company's fixed costs are $40,000. The product sells for $11 a unit and the company desires to earn a $25,000 profit. What is the volume of sales in units required to achieve the target profit? Note: Do not round Intermediate calculations. Multiple Choice 8,500 units 13,000 units 8,000 units 7,625 unitsarrow_forwardApplying Differential Analysis to Alternative Profit Scenarios Epson produces color cartridges for inkjet printers. Suppose cartridges are sold to mail-order distributors for $5.20 each. Total fixed costs per year are $1,881,000. Variable cost per unit are $1.85 for direct materials, $0.10 for direct labor, $0.30 for factory overhead, and $0.05 for distribution. The variable distribution costs are for transportation to mail-order distributors. Also assume the current annual production and sales volume is 990,000 and annual capacity is 1,210,000 units. REQUIRED The company would like to increase profitability in the upcoming year. Estimate the effect of the following separate proposals on annual profits. a. A 15% increase in the unit selling price would likely decrease annual sales by 99,000 units. Note: enter all numbers as positive numbers, do NOT use a negative sign. x . Net estimated profits would increase ✔ by $ 0 b. A 10% decrease in the unit selling price would likely increase…arrow_forwardThe information below relates to the only product of Catherine Company: Exercise 4-13 Sales price per unit Variable cost per unit Fixed costs per year P48 36 P240,000 REQUIRED: i Compute the contribution margin ratio and the peso sales volume required to break-even. 2. Assuming that the company sells 75,000 units during the year, compute the margin of safety sales volume. Exercise 4-14 Cristina Corporation has fixed costs of P72,000 per month. It sells two products as follows: Sales Variable Contribution Price Cost Margin Product A P20 P8 P12 B 20 14 REQUIRED: 1. What monthly peso sales volume is required to break-even if three units of product A are sold with one unit of product B? 2. What monthly peso sales volume is required to break-even if one unit of product A is sold with three units of product B?arrow_forward

- QUESTION 38 Insourcing incurs an annual fixed cost of $30,000 and a variable cost of $60 per unit. Outsourcing incurs an annual fixed cost of $50,000 and a variable cost of $20 per unit. Using the Make-or-Buy analysis, what is the indifference point between the two alternatives? (Note your answer for question 39) a) 500 units b) 1000 units c) 1500units d) 2000 units e) 800 units QUESTION 39 For the scenario in Q38, anticipated demand is then forecast to be 1000 units. Which option would be most appropriate? a) Insource b) Outsource c) Either option d) Not enough information to evaluate e) Nonearrow_forwardPlease help mearrow_forwardVishuarrow_forward

- 9arrow_forwardBreak-Even Point in Units for a Multiple-Product Firm Suppose that Chillmax Company now sells both pairs of shoes and fabric carryalls. The pairs of shoes are priced at $60 and have variable costs of $21 each. The carryalls are priced at $36 and have variable costs of $9 each. Total fixed cost for Chillmax as a whole equals $91,500 (includes all fixed factory overhead and fixed selling and administrative expense). Next year, Chillmax expects to sell 3,500 pairs of shoes and 875 carryalls. Required: 1. Form a package of shoes and carryalls based on the sales mix expected for the coming year. Package Unit Unit Unit Variable Contribution Sales Contribution Product Price Cost Margin Mix Margin Shoes Carryall Package total 2. Calculate the break-even point in units for pairs of shoes and for carryalls. Break-Even Pairs of Shoes units Break-Even Carryalls units 3. Check your answer by preparing a contribution margin income statement. Enter all amounts as positive value. Chillmax Company…arrow_forwardThe following information is available for Division X of Meisels, Inc.: Fixed cost per unit (based on capacity) Variable cost per unit Capacity in units Selling price to outside customers $5.25 $32 24,000 $41 Division Y would like to purchase 6,000 units each year from Division X. Division X has enough excess capacity to handle all of Division Y's needs. Division Y now purchases from an outside supplier at a price of $39 and insists that it should be charged that same price by Division X. If Division X refuses to accept the $39 price for transfers to Division Y, what effect would this have on the total annual profit of Meisels, Inc.?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education