FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

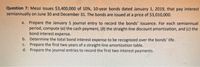

Transcribed Image Text:Question 7: Messi issues $3,400,000 of 10%, 10-year bonds dated January 1, 2019, that pay interest

semiannually on June 30 and December 31. The bonds are issued at a price of $3,010,000.

a. Prepare the January 1 journal entry to record the bonds' issuance. For each semiannual

period, compute (a) the cash payment, (6) the straight-line discount amortization, and (c) the

bond interest expense.

b. Determine the total bond interest expense to be recognized over the bonds' life.

C. Prepare the first two years of a straight-line amortization table.

d. Prepare the journal entries to record the first two interest payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need complete and correct answer for all parts with steps and working answer in textarrow_forwardE-Tech Initiatives Limited plans to issue $650,000, 10-year, 7.00 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2019. Show how the bonds would be reported on the January 2, 2019, balance sheet if they are issued at 105. How would I create a partial balance sheet with the carrying vaule for the problem above?arrow_forwardLegacy issues $660,000 of 5.5%, four-year bonds dated January 1, 2019, that pay interest semiannually on June 30 and December 31. They are issued at $648,412 when the market rate is 6%. Problem 14-4A Part 4 4. Prepare the journal entries to record the first two interest payments. Record the interest payment and amortization on June 30. Record the interest payment and amortization on December 31.arrow_forward

- On January 1, 2021, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Cash Effective Increase in Outstanding Payment Payment Interest Balance Balance 5,802,315 1 332,000 348,139 16,139 5,818,454 2 332,000 349,107 17,107 5,835,561 3 332,000 350,134 18,134…arrow_forwardony Hawk's Adventure (THA) issued callable bonds on January 1, 2021. THA's accountant has projected the following amortization schedule from issuance until maturity: Date cash paid Interest Expense Increase in carrying value carrying value 01/01/2021 $218,690 06/30/2021 $11,500 $13,121 $1,621 220,311 12/31/2021 11,500 13,219 1,719 222,030 06/30/2022 11,500 13,322 1,822 223,852 12/31/2022 11,500 13,431 1,931 225,783 06/30/2023 11,500 13,547 2,047 227,830 12/31/2023 11,500 13,670 2,170 230,000 THA issued the bonds for: Multiple Choice $230,000. $218,690. $299,000. Cannot be determined from the given information.arrow_forwardOn January 1, 2024, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Payment Cash Payment Effective Interest Increase in Balance Outstanding Balance 6,095,749 1 228,000 243,830 15,830 6,111,579 2 228,000 244,463 16,463 6,128,042 3 228,000 245,122 17,122 6,145,164 4 228,000 245,807 17,807 6,162,971 5 228,000 246,519 18,519 6,181,490 6 228,000 247,260 19,260 6,200,750 ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ 38 228,000 295,564 67,564 7,456,656 39 228,000 298,266 70,266 7,526,922 40 228,000 301,078 73,078 7,600,000 Required: What is the face amount of the bonds? What is the initial selling price of the bonds? What is the term to maturity in years? Interest is determined by what approach? What is the stated annual interest rate? What is the effective annual interest rate? What is the total cash interest paid over the term to maturity? What is the total effective interest…arrow_forward

- Moore Inc. issued bonds with a $500,000 face value, 8% interest rate, and a 4-year term on July 1, 2020 and received $475,000. Interest is payable annually. The discount is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2020: entry to record issuing the bonds. B. June 30, 2021: entry to record payment of interest to bondholders. C. June 30, 2021: entry to record amortization of discount. D. June 30, 2022: entry to record payment of interest to bondholders. E. June 30, 2023: entry to record amortization of discount.arrow_forwardOn January 1, 2019, Company C issues $200,000 of its 6% bonds which mature in 10 years. Interest is paid annually on December 31. The market (effective) rate of interest is 4%. If the bond sells as 88.2, what the amount of interest expense reported on the Income Statement for 2019 (hint: prepare an amortization schedule)arrow_forwardOn January 1, 2024, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below: Payment Cash Payment Effective Interest Increase in Balance Outstanding Balance 6,627,273 1 320,000 331,364 11,364 6,638,637 2 320,000 331,932 11,932 6,650,569 3 320,000 332,528 12,528 6,663,097 4 320,000 333,155 13,155 6,676,252 5 320,000 333,813 13,813 6,690,065 6 320,000 334,503 14,503 6,704,568 ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ 38 320,000 389,107 69,107 7,851,247 39 320,000 392,562 72,562 7,923,809 40 320,000 396,191 76,191 8,000,000 Required: What is the face amount of the bonds? What is the initial selling price of the bonds? What is the term to maturity in years? Interest is determined by what approach? What is the stated annual interest rate? What is the effective annual interest rate? What is the total cash interest paid over the term to maturity?…arrow_forward

- On April 1, 2019, Ellison Co. issued 4-year, 7%, $100,000 face value bonds. The bonds were issued at 107.0919 , the interest payable annually on April 1. The bonds were sold to yield 5%. a) Complete the following table: Carrying Cash Interest Premium Date amount of Paid Expense Amortization bonds April 1 2019 April 1 2020 April 1 2021 April 1 2022 April 1 2023 b) Journalize the required entries on the following dates April 1, 2019 December 31, 2019 – adjusting entry April 1, 2020 2arrow_forwardAn accounting example: Otter Products inc issued bonds on January 1, 2019. Interest to be paid semi-annually. Term in years is 2; Face value of bonds issued is $200,000; Issue Price $206,000; Specified Interest Rate each payment period is 6% Question. Calculate a. the amount of interest paid in cash every payment period. b. The amount of amortization to be recorded at each interest payment date (use straight-line method) c. complete amoritzation table by calculating interest expense and beginning and ending bond carrying amounts at the each period over 2 years. The term is for 2 years however 3 years is showing on the workbook. How do I calcuate the 3rd year if the problem only says the term is 2 years?arrow_forwardOn January 1, 2024, a company issues a $3, 500, 000, 10%, 5-year bonds that pays semiannual interest on July 1 and January 1. Assume the bonds were sold at: A. 92% B. 102% Instructions: For A and B journalize the issuance of the bonds. Journalize the first and second interest payment, using straight line amortization. Compute the bond's price (present value) assuming the following market interest: A. 12.5% B. 8.5%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education