FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:< Prev

Next

>

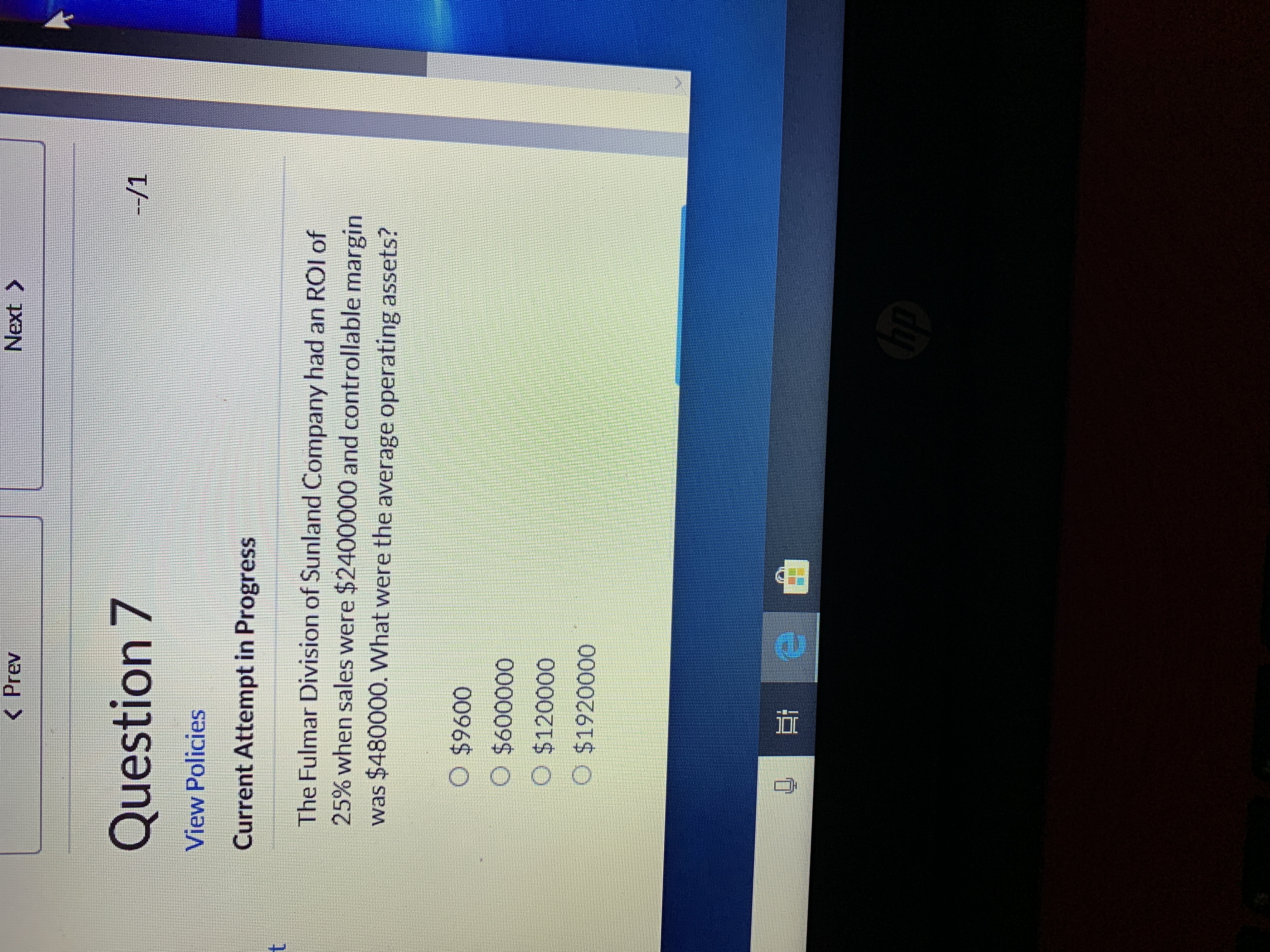

Question 7

--/1

View Policies

Current Attempt in Progress

The Fulmar Division of Sunland Company had an ROI of

25% when sales were $2400000 and controllable margin

was $480000. What were the average operating assets?

O $9600

O $600000

O $120000

O $1920000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Problem 12-15 Return on Investment (ROI) and Residual Income [LO12-1, LO12-2] Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc.Balance Sheet BeginningBalance EndingBalance Assets Cash $ 129,000 $ 140,000 Accounts receivable 336,000 473,000 Inventory 561,000 477,000 Plant and equipment, net 834,000 810,000 Investment in Buisson, S.A. 400,000 432,000 Land (undeveloped) 254,000 247,000 Total assets $ 2,514,000 $ 2,579,000 Liabilities and Stockholders' Equity Accounts payable $ 384,000 $ 346,000 Long-term debt 967,000 967,000 Stockholders' equity 1,163,000 1,266,000 Total liabilities and stockholders' equity $ 2,514,000 $ 2,579,000 Joel de Paris, Inc.Income Statement Sales $ 4,324,000 Operating expenses 3,805,120 Net operating income 518,880 Interest and taxes: Interest expense 124,000 Tax expense 193,000 317,000 Net income $ 201,880…arrow_forwardExercise 10-9 (Algo) Return on Investment (ROI) and Residual Income Relations [LO10-1, LO10-2] A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be indicated by a minus sign. Do not round your intermediate calculations.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income $ $ Company A 480,000 168,000 15 % 12 % $ $ $ Company B 660,000 46,000 17% 47,000 % Company C $ 570,000 $ *+ $ 158,000 % 12 % 7,000arrow_forwardQUESTION 28 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 2 Sales $9,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $66,000 $60,000 $50,000 $55,000arrow_forward

- Businessarrow_forwardPROBLEM SET B Problem 21-1B Cost estimation using high-low method P1 Sun Co.'s monthly data for the past year follow. Management wants to use these data to predict future variable and fixed costs. Units Sold 1.... 2.... 195.000 125,000 3.... 105,000 4.... 155,000 5.... 95,000 6.... 215,000 Month Total Cost $ 97,000 87,000 73,000 89,000 81,000 110,000 Month 7 ... 8... 9... 10 ... 11 ... 12 ... Units Sold 145,000 185,000 135,000 85,000 175,000 115,000 Total Cost $ 93,000 105,000 85,000 58,000 95,000 79,000 Required 1. Estimate both the variable costs per unit and the total monthly fixed costs using the high-low method. 2. Use the answers for variable and fixed costs from part 1 to predict future total costs when sales volume is (a) 100,000 units and (b) 170,000 units. Analysis Component page 799 3. Use these data to prepare a scatter diagram. Draw an estimated line of cost behavior and determine whether the cost appears to be variable, fixed, or mixed.arrow_forwardA2arrow_forward

- Exercise 10-9 (Algo) Return on Investment (ROI) and Residual Income Relations [LO10-1, LO10-2] A family friend has asked your help in analyzing the operations of three anonymous companies operating in the same service sector industry. Supply the missing data in the table below: (Loss amounts should be Indicated by a minus sign. Do not round your Intermediate calculations.) Sales Net operating income Average operating assets Return on investment (ROI) Minimum required rate of return: Percentage Dollar amount Residual income Company A Company B Company C $ 450,000 $ 650,000 $ 610,000 $ 44,000 $ 166,000 24 % $ 155,000 19 % % 13 % % 10 % $ 51,000 $ 7,000arrow_forwardQUESTION 26 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 1 Sales $10,000,000 Operating income 200,000 Average operating assets 2,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $40,000 $0 $50,000 $(40,000)arrow_forwardQUESTION 30 Management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 3 Sales $6,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $66,000 $75,000 $60,000 $70,000arrow_forward

- -/1 Question 1 rences View Policies borations Current Attempt in Progress PLUS Support Jackson Manufacturing is introducing a new product with a unit selling price of $12.50. The product required an investment of $500,000, and the company requires a 20 % ROI. Projected sales 100,000 units. Compute the target cost per unit. Central e 365 es O $14.50 a O $15.50 O $11.50 O $10 hp noll ins prt sc home delete 4 num backspacearrow_forwardQUESTION 25 Top management is trying to determine which would be the best choice of the following: Data of investment choices: 1 Sales $10,000,000 Operating income 200,000 Average operating assets 2,000,000 Required: Compute the Return on Investment 9% 12% 8% 10%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education