ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

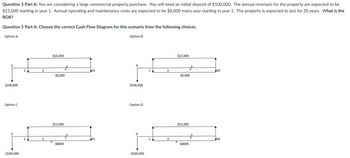

Transcribed Image Text:Question 5 Part A: You are considering a large commercial property purchase. You will need an initial deposit of $100,000. The annual revenues for the property are expected to be

$15,000 starting in year 1. Annual operating and maintenance costs are expected to be $8,000 every year starting in year 1. The property is expected to last for 30 years. What is the

ROR?

Question 5 Part A: Choose the correct Cash Flow Diagram for this scenario from the following choices.

Option A

$100,000

Option C

-$100,000

1

2

$15,000

$8,000

$15,000

2

-$8000

Option B

$15,000

0

А

31

1

2

30

$8,000

$100,000

Option D

$15,000

0

А

31

1

2

30

-$8000

-$100,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Laguna Memorial Hospital (LMH) buys $800,000 in Personal Protective Equipment (PPE) each year from Colorado Medical Supply Corporation (CMSC), which offers LMH terms 3.2/20, net 60. Currently, LMH is paying the supplier the full amount due on Day 60, but it is considering taking the discount, paying on Day 20 and replacing the trade credit with a bank loan that has a 6 percent annual cost. Assume 360 days per year. a. what is the amount of free trade credit that LMH obtains from CMSC? b. What is the amount of costly trade credit? c. What is the approximate annual cost of the costly trade credit? d. Should LMH replace its trade credit with the bank loan? Please explain.arrow_forwardFind the Future Worth (F) of the following geometric series cash flow: 0 1 1000 i = 10% 23 4 1100 1210 g= 10% 10 2,358arrow_forwardPlease answer question 4 with details on how to do it. Thank you.arrow_forward

- Your company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardYou are considering a large commercial property purchase. You will need an initial deposit of $100,000. The annual revenues for the property are expected to be $15,000 starting in year 1. Annual operating and maintenance costs are expected to be $8,000 every year starting in year 1. The property is expected to last for 30 years. What is the ROR?arrow_forwardA new baseball stadium is being considered to be built in a metropolitan area by High Tech, Inc., at a cost of $50M. It is estimated that the annual maintenance cost will be $100K. The construction company recommends a major renovation every 50 years at a cost of $10M. If the corporation wants to set up a trust fund to pay for the stadium, its maintenance, and periodic renovations for an undefined number of years to come, what amount should be invested in the trust fund if the fun earns an annual interest rate of 6%? Group of answer choices $52,223,000 $60,566,667 $60,666,667 $73,500,429 $58,600,000arrow_forward

- A regional municipality is studying a water supply plan for its tri-city and surrounding area to the end of year2070. To satisfy the water demand, one suggestion is to construct a pipeline from a major lake some distanceaway. Construction would start at the beginning of 2030 and take five years at a cost of $30 million per year.The cost of maintenance and repairs starts after completion of construction and for the first year is $2 million,increasing by 2 percent per year thereafter. At an interest rate of 8 percent, what is the present worth of thisproject? Assume all cash flows take place at year-end. Consider the present to be the end of 2025/beginningof 2026. Assume there is no salvage value at the end of year 2070.Click the icon to view the table of compound interest factors for discrete compounding periods when i=8%.The present worth of this project is $ million.(Round to two decimal places as neededarrow_forwardA regional municipality is studying a water supply plan for its tri-city and surrounding area to the end of year 2070. To satisfy the water demand, one suggestion is to construct a pipeline from a major lake some distance away. Construction would start at the beginning of 2030 and take five years at a cost of $15 million per year. The cost of maintenance and repairs starts after completion of construction and for the first year is $3 million, increasing by 2 percent per year thereafter. At an interest rate of 6 percent, what is the present worth of this project? Assume all cash flows take place at year-end. Consider the present to be the end of 2025/beginning of 2026. Assume there is no salvage value at the end of year 2070. Click the icon to view the table of compound interest factors for discrete compounding periods when i = 6%. The present worth of this project is $ million. (Round to two decimal places as needed.)arrow_forwardIf the interest rate is 4%, what is the approximate future value of $15,000 in 10 years? $15,900 $17,949 $10,133 $22,204arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education