ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

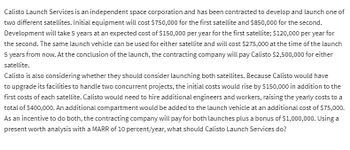

Transcribed Image Text:### Project Evaluation for Calisto Launch Services

**Problem Description:**

Calisto Launch Services is an independent space corporation tasked with developing and launching one of two different satellites. The following presents the cost and financial structures involved in these projects.

#### Costs for Individual Satellites:

1. **Satellite 1:**

- **Initial Equipment Cost:** $750,000

- **Development Duration:** 5 years

- **Development Cost per Year:** $150,000

- **Launch Vehicle Cost (in 5 Years):** $275,000

2. **Satellite 2:**

- **Initial Equipment Cost:** $850,000

- **Development Duration:** 5 years

- **Development Cost per Year:** $120,000

- **Launch Vehicle Cost (in 5 Years):** $275,000

#### Revenue:

- **Payment by Contracting Company (per satellite):** $2,500,000 (at the conclusion of the launch).

#### Combined Launch Option:

- **Additional Initial Costs:** $150,000 to upgrade facilities.

- **Additional Development Cost per Year:** $400,000 for hiring engineers and workers.

- **Additional Launch Vehicle Cost:** $75,000 for an extra compartment.

- **Contracting Company Incentive for Both Launches:** Additional payment of $1,000,000.

#### Present Worth Analysis:

A MARR (Minimum Attractive Rate of Return) of 10 percent per year is used to evaluate the project financially. Calisto Launch Services must determine the economic viability of their options.

The financial decision involves calculating the present value of each option, factoring in both costs and revenues, and comparing the net present value (NPV) to guide the decision-making process.

---

**Graphical or Diagrammatic Explanation:**

While there are no graphs or diagrams provided in this text, a financial present worth analysis might typically include:

- **Cash Flow Diagrams:** Illustrating inflows (revenues) and outflows (costs) over the project's timeline.

- **NPV Calculations:** Detailing yearly costs, revenues, and the discounting process at the given MARR.

- **Comparative Tables:** Summarizing the present worth of each option for easy comparison.

In order to perform detailed calculations, each year's costs and revenues would be discounted to present value terms using the formula:

\[ PV = \frac{FV}{{(1 + r)^n}} \

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please handwriten solutionarrow_forwardMost likely estimates for a project are as follows. MARR Useful life Initial investment Receipts - Expenses (R-E) Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12per year. (a) Determine whether the statement "An initial investment of $7,150 keeps the investment economical." is true or false. True False (b) To which variable is the PW most sensitive to? OA. Usefule life B. Receipts Expenses 12% per year 14 years $5,500 $1,000/year OC. Initial Investmentarrow_forwardAn investor with a MARR of 15% and at least $40k to invest is using rate of return analysis to determine which, if either, of two mutually exclusive investment alternatives (X and Y) should be selected. Perform the analysis and make a recommendation. Alternative Initial cost (Sk) ROR (%) Life (years) Assume that the ROR of the incremental NCF (X - Y) is 10%. X Y 40 30 22 26 8 Choose do-nothing Choose Y because the ROR of Y is greater than the ROR of X Choose Y because the incremental ROR 0arrow_forward

- Option i C/R Option ii C/R One Time Costs One Time Costs Land-$10 million (Year 1) C Renovations- $35M (Year 0) C Construction- $100 million ($50 M per year for 2 years C Medical Equipment- $20M (Year 0) C Medical equipment- $25million (Year 0) C Licensing & Consulting- $5M (Year 0) C Licensing & Consulting- $15M (spread across year 1 and 2) C Initial Marketing Campaign- $2M (Year 1) C Initial Marketing Campaign- $5 million (Year 3) C Annual Values Annual Values Operations & Staff- $7M / year (Year 2+) C Operations & Staff- $11M / year (Year 3+) C Maintenance- $2M / year (Year 2+) C Maintenance- $2.5M / year (Year 3+) C Tech Updates- $1.2M / year (Year 3+) C Tech Updates-$1.5M / year (Year 5+) C Overhauls Overhauls Equipment Repairs- $13M (Year 10) C Equipment Repairs- $18M (Year 10) C Facilities Upgrades- $20M (Year 15) C…arrow_forwardLinda deposits $60,000 into an account that pays simple interest at a rate of 6% per year. Bob deposits $60,000 into an account that also pays 6% interest per year. But it is compounded annually. Find the interest Linda and Bob earn during each of the first three years. Then decide who earns more interest for each year. Assume there are no withdrawals and no additional deposits. Year First Second Third Interest Linda earns (Simple interest) $3600 $3600 $3600 Interest Bob earns (Interest compounded annually) $3600 $3960 $4176 Who earns more interest? Linda earns more. Bob earns more. They earn the same amount. Linda earns more. Bob earns more. They earn the same amount. Linda earns more. Bob earns more. O They earn the same amount. X Sarrow_forwardHadeel borrows money in the senior year to buy a new car. The car dealership allows to defer payments for 12 months, and Hadeel makes 36 end of month payments thereafter. If the original loan is $24,000 and interest rate is 0.5% per month on the unpaid balance, how much will Hadeel payments be? $698.80 $774.62 $620.65 $700.56 detailed answer without usage of excelarrow_forward

- answer plzz...arrow_forwardIncorrect Question 8 When calculating the Break Even Analysis, one needs to subtract the FW of the cash inflows from the PW of the cash outflows. True Falsearrow_forwardAnalyze a CSR capital investment proposal for Ganon Inc. Ganon Inc. is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed: Line Item Description Value HID watt hour consumption per fixture 500 watts per hr. LED watt hour consumption per fixture 300 watts per hr. Number of fixtures 800 Lifetime investment cost (in present value terms) to replace each HID fixture with LED $300 Operating hours per day 10 Operating days per year 300 Metered utility rate per kilowatt-hour (kwh)* $0.12 *Note: A kilowatt-hour is equal to 1,000 watts per hour. a. Determine the investment cost for replacing the 800 fixtures.fill in the blank 1 of 1$ b. Determine the annual utility cost savings from employing the new energy solution.fill in the blank 1 of 1$ c. Should…arrow_forward

- Galvanized Products is considering the purchase of a new computer system for their enterprise data management system. The vendor has quoted a purchase price of $80,000. Galvanized Products is planning to borrow 1/4th of the purchase price from a bank at 19% compounded annually. The loan is to be repaid using equal annual payments over a 3-year period. The computer system is expected to last 5 years and has a salvage value of $7,000 at that time. Over the 5-year period, Galvanized Products expects to pay a technician $29,000 per year to maintain the system but will save $58,000 per year through increased efficiencies. Galvanized Products uses a MARR of 17%/year to evaluate investments. What is the external rate of return of this investment?arrow_forwardRequired information The tabulation of the incremental cash flows between alternatives A and B is shown. Alternative A has a 3-year life and alternative B a 6-year life. Year Incremental Cash Flows (BA), $ -22,500 5,000 5,000 11,000 5,000 5,000 5,000 NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. 0123456 If neither alternative has a salvage value, what is the first cost of alternative A? The first cost of alternative A is $-arrow_forwardProblem #3 Solve for the following: 1) Present worth equivalence 2) Annual worth equivalence spread from years 1 to 10 3) Future worth equivalence at the end of year 5 4) Future worth equivalence at the end of year 10 i = 13% 10 $500 $1000 $1500 $2000 P=? $2500 $3000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education