FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

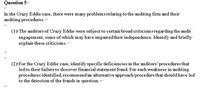

Transcribed Image Text:Question 5-

In the Crazy Eddie case, there were many problemsrelating to the auditing firm and their

auditing procedures. <

(1>The auditors of Crazy Eddie were subject to certain broad criticismsregarding the audit-

engagem ent, some of which may have impaired their independence. Identify and briefly

explain these criticisms.

(2)>For the Crazy Eddie case, identify specific deficiencies in the auditors' proceduresthat

ledto their failureto discover financial statement fraud. For each weakness in auditing

procedures identified, recommendan alternative approach/procedure that should have-led:

to the detection of the frauds in question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain how the circumstances under each of the following might reflect failed leadership by auditors and the audit firm: • Under-reporting of time on an engagement• Premature sign-off on audit procedures• Accepting weak client explanations for accountingarrow_forwardQuestion 4 Respond to each of the following independent situations involving auditor reports. For each scenario (1)identify the reporting issue involved; (2) explain the type of opinion that should be issued; (3) identify any requiredmodifications of the standard auditor'sreport. The auditor has a disagreem ent with a client overthe adequacy of the recorded bad debt expense and allowance for doubtful accounts. The auditor is convinced that the expense and allowance are understatedby amaterial (but not highly material) amount, but the client has refused to adjust the accounts. 1.4 The auditor has issued a report on a client's financial statem ents prepared on a regulatory basis of accounting. The auditor is also preparing to issue a separate report- on the same client's GAAP financial statements, which will be issued to the public. The auditor feels that the issuance of the report on the regulatory basis statements should be disclosed in the report on the GAAP statements. The auditor…arrow_forwardQuestion 4 The auditor of a large public company has determined that a material weakness exists in the client's internal controls over financial reporting. Which of the following statements is true? Weakness require an adverse opinion on the financial statements taken as a whole. The auditor should express an adverse opinion on internal controls only if a material misstatement was found in the financial statements. The auditor should express and adverse opinion on internal controls even though no material misstatements were found in the financial statements. The auditor is not required to express an opinion on internal controls.arrow_forward

- Which two of the following characterize the work of fraud examiners?a. Analysis of control weaknesses for determination of acceptable fraud risk.b. Analysis of control strengths as a basis for planning other audit procedures.c. Determination of a materiality amount that represents a significant misstatement of the financial statements.d. Consideration of a materiality amount in cumulative terms—that is, becoming large over a number of yearsarrow_forwardRead the case. Then answer the questions based on it. BACKGROUND: Audit standards indicate that there is a presumption that auditors will confirm accounts receivable unless the balance is immaterial, confirmations are deemed ineffective, or the auditors' assessment of risk is low and other procedures will achieve the same objective. However, these instances are considered few and far between and current trends in auditing indicate that there is an expectation that accounts receivable will be confirmed. Auditors may stratify the population, use haphazard or judgmental sampling, and send positive or negative requests. Jenner & Jenner CPAs are the auditors for the Leno Company. In reviewing the accounts receivable aging, the auditors learn that there is a high number of accounts with balances, there are some very large and very small balances, and many customers' balances consist of multiple invoices. 2. How should the auditors mitigate the risk associated with both very large and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education