FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

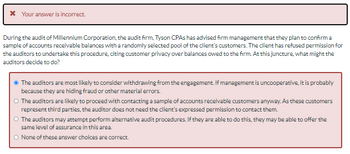

Transcribed Image Text:Your answer is incorrect.

During the audit of Millennium Corporation, the audit firm, Tyson CPAs has advised firm management that they plan to confirm a

sample of accounts receivable balances with a randomly selected pool of the client's customers. The client has refused permission for

the auditors to undertake this procedure, citing customer privacy over balances owed to the firm. At this juncture, what might the

auditors decide to do?

Ⓒ The auditors are most likely to consider withdrawing from the engagement. If management is uncooperative, it is probably

because they are hiding fraud or other material errors.

O The auditors are likely to proceed with contacting a sample of accounts receivable customers anyway. As these customers

represent third parties, the auditor does not need the client's expressed permission to contact them.

O The auditors may attempt perform alternative audit procedures. If they are able to do this, they may be able to offer the

same level of assurance in this area.

O None of these answer choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume that the auditors find serious weaknesses in the internal control of Oak Canyon, Inc., a producer and distributor of fine wines. Would these internal control weaknesses cause the auditors to rely more or less upon accounting records during their audit of Oak Canyon? Why?arrow_forwardIndicate whether the information indicates an increased risk for fraud. If the information indicates an increased risk of fraud, indicate which fraud condition (incentives/pressures, opportunities, or attitudes/rationalization) is indicated. During audit planning, an auditor obtained the following information: Management has a strong interest in employing inappropriate means to minimize reported earnings for tax-motivated reasons. The company’s board of directors includes a majority of directors who are independent of management. Assets and revenues are based on significant estimates that involve subjective judgments and uncertainties that are hard to corroborate. The company is marginally able to meet exchange listing and debt covenant requirements. New accounting pronouncements have resulted in explanatory paragraphs for consistency for the company and other firms in the industry.arrow_forwardIn the normal course of performing their responsibilities, auditors often conduct audits or reviewsof the following:1. The computer operations of a large corporation to evaluate whether the internal controlsare likely to prevent misstatements in accounting and operating data.2. Financial statements for use by stockholders when there is an internal audit staff.3. A bond indenture agreement to make sure a company is following all requirements of thecontract.4. Internal controls at a casino to ensure the casino is in compliance with federal and stateregulations.5. Computer operations of a corporation to evaluate whether the computer center is beingoperated as efficiently as possible.6. Annual statements for the use of management.7. Operations of the IRS to determine whether the internal revenue agents are using theirtime efficiently in conducting audits.8. Statements for bankers and other creditors when the client is too small to have an auditstaff.9. Financial statements of a branch of…arrow_forward

- Assume a third party such as a successor audit firm quickly discovers a fraud that the predecessor external auditor has overlooked for years. Do you think this provides evidence supporting scienter? Explain.arrow_forwardThe following questions concern types of audit tests.Choose the best response.a. The auditor looks for an indication on duplicate sales invoices to see whether theaccuracy of invoices has been verified. This is an example of(1) a test of details of balances. (3) a substantive test of transactions.(2) a test of control. (4) both a test of control and a substantivetest of transactions.arrow_forwardRead the case. Then answer the questions based on it. BACKGROUND: Audit standards indicate that there is a presumption that auditors will confirm accounts receivable unless the balance is immaterial, confirmations are deemed ineffective, or the auditors' assessment of risk is low and other procedures will achieve the same objective. However, these instances are considered few and far between and current trends in auditing indicate that there is an expectation that accounts receivable will be confirmed. Auditors may stratify the population, use haphazard or judgmental sampling, and send positive or negative requests. Jenner & Jenner CPAs are the auditors for the Leno Company. In reviewing the accounts receivable aging, the auditors learn that there is a high number of accounts with balances, there are some very large and very small balances, and many customers' balances consist of multiple invoices. 2. How should the auditors mitigate the risk associated with both very large and…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education