Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

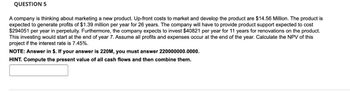

Transcribed Image Text:QUESTION 5

A company is thinking about marketing a new product. Up-front costs to market and develop the product are $14.56 Million. The product is

expected to generate profits of $1.39 million per year for 26 years. The company will have to provide product support expected to cost

$294051 per year in perpetuity. Furthermore, the company expects to invest $40821 per year for 11 years for renovations on the product.

This investing would start at the end of year 7. Assume all profits and expenses occur at the end of the year. Calculate the NPV of this

project if the interest rate is 7.45%.

NOTE: Answer in $. If your answer is 220M, you must answer 220000000.0000.

HINT. Compute the present value of all cash flows and then combine them.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 1 Frank Einstein Co. is a firm that specializes in selling Halloween decorations. It is evaluating a new project that requires an initial investment of $1.42 million. The asset will be depreciated to zero over its 3-year life. The company's analysts estimate that in the first year, the project will generate $1.09 million in revenues. The revenue will increase by 7% per year in the following two years. The costs in the first year will be $475,000 and they will increase by 5% per year thereafter. The corporate tax rate is 25% and the required return is 12%. What is the NPV of the project?arrow_forward#3 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $3.00 million, and sold for that amount in year 10. Net working capital will increase by $1.08 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $8.64 million per year and cost $1.58 million per year over the 10-year life of the project. Marketing estimates 17.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 21.00%. The WACC is 10.00%. Find the NPV (net present value). Answer format: Currency: Round to: 2 decimal places.arrow_forwardsac.3arrow_forward

- QUESTION 3 You are considering starting a new factory producing small electric heaters. Each unit will sell at a price of $55. The production cost of each heater is $35. You are expecting to sell 9000 units per year. This project has an economic life of 6 years. The project requires an investment of $700000 in plants and equipment. This equipment will be depreciated to zero salvage value based on 5-year MACRS schedule. The depreciation rates from year 1 to 6 are 20 % ,32 %, 19.2 %, 11.52 %, 11.52 %, and 5.76 percent, respectively. The company will sell its old equipment for $100,000. The old machine is fully depreciated. The required rate of return for the project is 12 percent, the working capital requirement is 10 percent of the next year's sales revenue. The marginal corporate tax rate is 20 percent. At the termination of the project, the plant and equipment will be sold for an estimated value of $50000. Based on these assumptions, estimate the cash flow for capital expenditures.…arrow_forward#4 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $27.00 million. The plant and equipment will be depreciated over 10 years to a book value of $2.00 million, and sold for that amount in year 10. Net working capital will increase by $1.48 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.35 million per year and cost $1.56 million per year over the 10-year life of the project. Marketing estimates 17.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 24.00%. The WACC is 10.00%. Find the IRR (internal rate of return). Answer format: Percentage Round to: 4 decimal places (Example: 9.2434%, % sign required. Will accept decimal format rounded to 6 decimal places (ex: 0.092434))arrow_forward18arrow_forward

- 11. I need help with finance home work question A company is considering a 7-year project. At the beginning of the project, a cash outflow in the amount of $340,000 would be required. The company expects the project would generate cash inflows in the amount of $70,000 at the end of each of the project's 7 years. Assume the company requires a return of 8%. What NPV does the company expect for this project?arrow_forward#3 Caspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $22.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.37 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.24 million per year and cost $2.26 million per year over the 10-year life of the project. Marketing estimates 20.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 33.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward#27 * Finding the Internal Rate of Return (IRR) of an Investment: A company is considering buying a new piece of machinery that costs $8M and has a salvage value of $1.5M at the end of its 10-year useful life. The machinery nets $2.3M per year in annual revenues. MARR = 10%. The internal rate of return (IRR) on this investment is approximately _____________. A. 26% B. 31% C. 19% D. 16%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education