ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

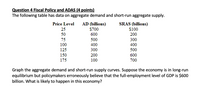

Transcribed Image Text:Question 4 Fiscal Policy and ADAS (4 points)

The following table has data on aggregate demand and short-run aggregate supply.

AD (billions)

$700

SRAS (billions)

$100

Price Level

25

50

600

200

75

500

300

100

400

400

125

300

500

150

200

600

700

175

100

Graph the aggregate demand and short-run supply curves. Suppose the economy is in long-run

equilibrium but policymakers erroneously believe that the full-employment level of GDP is $600

billion. What is likely to happen in this economy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Refer to the figure. Tax Revenue M Tax Size 0 a. What is curve from the figure called? b. If the economy is at point M on the curve, then a small increase in the tax rate will increase or decrease tax revenue? Increase or decrease deadweight loss? C. If the economy is at point N on the curve, then a decrease in the tax rate will increase or decrease tax revenue? Increase or decrease deadweight loss?arrow_forwardplease draw graph specify endpoints thanks 1 The table below shows the aggregate demand for the economy of Itera. Its potential GDP (LAS) is $725. Price Index Aggregate Quantity Demanded 70 725 90 675 110 625 130 575 a. Draw the aggregate demand curve and the potential GDP (LAS) curve in the graphing area below. Plot only curve in the graphing area using the appropriate tool. Once all points have been plotted, click on the line (not tool icon will pop up. You can use this to enter exact co-ordinates for your points as needed. for the economy of Itera AS Tools 120 AD (900, 120) Potential GDP 110 100 AD2 90 80 70 400 500 600 700 800 900 Real GDP b. The equilibrium level of GDP is $ and the price index is c. There is a recessionary v gap in Itera of $ d. If aggregate demand in Itera were to increase by $150, draw the new (AD2) curve in the graphing area above. Remember to only the endpoints of the curve. e. The new equilibrium level of GDP is $ and the price index is f. Now there is…arrow_forward6. Changes in taxes The following graph plots an aggregate demand curve. Using the graph, shift the aggregate demand curve to depict the impact that a tax hike has on the economy. PRICE LEVEL 130 120 110 g 100 90 80 Aggregate Demand 70 0 10 20 30 OUTPUT 40 50 60 Aggregate Demand (?) Suppose the governments of two very similar economies, economy Y and economy Z, implement a tax cut of equal size. The tax cut in economy Y is temporary, while the tax cut in economy Z is permanent. The economies are otherwise completely identical. The tax cut will have a smaller impact on aggregate demand in the economy with thearrow_forward

- Confused not sure how to answerarrow_forward7. Supply-side effects Consider a fictional economy that is operating at its long-run equilibrium. The following graph shows the aggregate demand curve (AD) and short-run aggregate supply curve (SRAS) for the economy. The long-run aggregate supply curve (LRAS) is represented by a vertical line at $6 trillion. The economy is initially producing at potential output. Suppose that fiscal authorities decide to decrease marginal tax rates. Assume that this change in marginal tax rates is perceived as a long-term change. Shift the appropriate curves to illustrate the supply-side view of the fiscal policy effect on output and the price level. (? 120 LRAS SRAS 100 AD 80 SRAS LRAS 40 AD 20 2 4 6 8 10 12 QUANTITY OF OUTPUT (Trillions of dollars) PRICE LEVELarrow_forwardWhich of the following would cause the Aggregate Supply curve to move from AS to AS2 in the graph below? A) A general increase in energy and labor cost for businesses. B) A general decrease in labor cost for businesses. C) An increase in productivity. D) A federal government increase in spending.arrow_forward

- Aggregate Supply and Aggregate Demand Real GDP Supplied Price $ 250 $ 500 $ 750 $1000 1500 3000 4500 4500 Real GDP Demanded 5500 5000 4500 4000 a. Plot the aggregate supply and aggregate demand curves on the same graph. b. State the equilibrium real GDP and price level. c. At the equilibrium GDP from part b, is the economy experiencing a recessionar gap? Explain why it is or is not experiencing a recessionary gap. d. State what happens to the nominal wages and the real wage in the short run phase of the aggregate supply.arrow_forwardNote: Line segments will automatically connect the points. PRICE LEVEL (Billions of dollars) 200 160 120 0 80 160 240 REAL GDP (Index numbers) The equilibrium price level is 320 400 Initial AD The change in government spending the multiplier effect. SRAS New AD ✓, and the equilibrium level of real output is Suppose that the government spending increases by $16 billion and the expenditure multiplier in this economy is 5. On the previous graph, use the purple points (diamond symbols) to illustrate the effect of the increase in government spending on the aggregate demand (New AD) curve. the equilibrium level of real output by . The price level increasearrow_forward5. Supply-side effects Consider a fictional economy that is operating at its long-run equilibrium. The following graph shows the aggregate demand (AD) curve and short-run aggregate supply (AS) curve for the economy. The long-run aggregate supply curve is represented by a vertical line at the potential GDP level of $6 trillion. The economy is initially producing at potential GDP. Suppose that fiscal authorities decide to decrease marginal tax rates. Assume that this change in marginal tax rates is perceived as a long-term change. Shift the appropriate curves to illustrate the supply-side view of the fiscal policy effect on output and the price level. Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back to its original position, just drag it a little farther 8 100 8 PRICE LEVEL 8 9 8 True Potential GDP O False AS AD 10 QUANTITY OF OUTPUT (Trillions of dollars) 12 True or False! Supply side…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education