FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

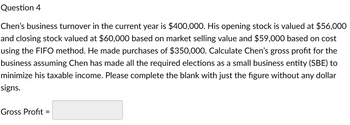

Transcribed Image Text:Question 4

Chen's business turnover in the current year is $400,000. His opening stock is valued at $56,000

and closing stock valued at $60,000 based on market selling value and $59,000 based on cost

using the FIFO method. He made purchases of $350,000. Calculate Chen's gross profit for the

business assuming Chen has made all the required elections as a small business entity (SBE) to

minimize his taxable income. Please complete the blank with just the figure without any dollar

signs.

Gross Profit=

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3 Net Income. A calendar year S corporation has the following information for the current taxable year: Sales $180,000 Cost of goods sold. Dividend income Net capital loss Salary to Z. Life insurance for Z (70,000) 5,000 (4,000) 12,000 500 Other operating expenses Cash distributions to owners 40,000 20,000 Assume Z is single and her only other income is $30,000 salary from an unrelated employer. She is a 20% owner with a $10,000 basis in the S stock at the beginning of the year. Calculate the S corporation's net ordinary income and Z's adjusted gross income and ending basis in the S corporation stock.arrow_forwardNonearrow_forward1.(3)arrow_forward

- Aarrow_forwardVijayarrow_forward55)Grounds for Divorce Coffee Corporation had sales of $3 million this past year. Its cost ofgoods sold was $1.1 million and its operating expenses were $400,000. Interest expenseson outstanding debts were $160,000, and the company paid $40,000 in preferred stockdividends. The company received interest income of $14,000. Determine Grounds’taxable income.arrow_forward

- Income from Continuing Operationsarrow_forward2 Nunez Company, a retail hardware store, began business in August and elected a calendar year for tax purposes. From August through December, Nunez paid $319,000 for inventory to stock the store. According to a physical inventory count on December 31, Nunez had $64,600 of inventory on hand. Required: a. Compute Nunez's cost of goods sold for its first year assuming Nunez adopted the cash method as its overall method of accounting. b. Compute Nunez's cost of goods sold for its first year assuming Nunez adopted the accrual method as its overall method of accounting. Complete this question by entering your answers in the tabs below. Required A Required B Compute Nunez's cost of goods sold for its first year assuming Nunez adopted the cash method as its overall method of accounting. Cost of goods soldarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education