ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

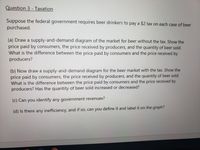

Transcribed Image Text:Question 3 - Taxation

Suppose the federal government requires beer drinkers to pay a $2 tax on each case of beer

purchased.

(a) Draw a supply-and-demand diagram of the market for beer without the tax. Show the

price paid by consumers, the price received by producers, and the quantity of beer sold.

What is the difference between the price paid by consumers and the price received by

producers?

(b) Now draw a supply-and-demand diagram for the beer market with the tax. Show the

price paid by consumers, the price received by producers, and the quantity of beer sold.

What is the difference between the price paid by consumers and the price received by

producers? Has the quantity of beer sold increased or decreased?

(c) Can you identify any government revenues?

(d) Is there any inefficiency, and if so, can you define it and label it on the graph?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 25 The burden of a tax on a good is said to fall completely on the producers if the: a. wages received by workers who produce the good increase by the amount of the tax. b. price paid by consumers for the good increases by the amount of the tax. c. price paid by consumers does not change. d. price paid by consumers for the good declines by the amount of the tax.arrow_forwardQuestion 5 Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the questions. D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after the tax. Price 18 12 10 10 12 Qua (a) For the market for cigarettes without the tax. Indicate: Price paid by consumers (1) Price paid by producers (ii) Quantity of cigarettes sold (iv) Buyer's reservation price (v) Seller's reservation price Seller's reservation price Choose. + Choose. + Choose. Price paid by consumers Choose. + 12 18 Quantity of cigarettes sold Choose. 10 7 Buyer's reservation price 3 Choose. 8 Price paid by producers Choose.arrow_forwardAttached is a graph diagram depicting the market for soft drinks. If an excise tax equal to $1 per liter is levied on soft drink sellers, please answer the following questions: a. The new equilibrium quantity of soft drinks bought and sold would be ___________ million liters. b. The new equilibrium price paid by buyers of soft drinks would be $__________ per liter. c. The new equilibrium price received by sellers (after-tax) would be $__________ per liter.arrow_forward

- Only typed answerarrow_forwardUsing the supply and demand data for wheat below, what would happen if the government placed a $3 per bushel tax on wheat? Bushels demanded 45 50 56 61 67 Price per bushel $6 $5 $4 LA LA LA $3 $2 Bushels supplied 77 73 68 61 57 O the producer price would fall, the consumer price would rise, and the quantity sold would increase. The producer price would fall, the consumer price would rise, and the equilibrium quantity would fall O Both the consumer price and the producer price would rise the consumer price would rise by less than $3 while the producer price would fall by more than $3 O the equilibrium consumer price would rise by $3arrow_forward1-3 pleasearrow_forward

- 2- The demand curve for a good is q = 100 p/c where c is a constant and c ≥ 0. The supply curve for the good is q=10+p. A quantity tax of t=$10 per unit is imposed on this product. a. By how much will the price of the product rise? b. What are the maximum and minimum possible changes in price? C. What is the producer's share of the tax? d. Find the elasticity of demand at p=10. (Assuming c≥ 0.1).arrow_forwarda)Show in four diagrams the incidence of an indirect (specific) tax in the case of elastic and inelastic demand and elastic and inelastic supply. b)Consider supply in the long run. Assume that a specific tax is imposed on a good that was previously untaxed. How will the incidence of this tax change as time passes?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education