FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

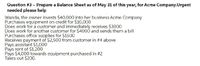

Transcribed Image Text:Question #3 - Prepare a Balance Sheet as of May 31 of this year, for Acme Company.Urgent

needed please help

Wanda, the owner invests $40,000 into her business Acme Company

Purchases equipment on credit for $10,000

Does work for a customer and immediately receives $3000

Does work for another customer for $4000 and sends them a bill

Purchases office supplies for $1500

Receives payment of $2,500 from customer in #4 above

Pays assistant $1,000

Pays rent of $1,200

Pays $4,000 towards equipment purchased in #2

Takes out $200.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- | alphacollege.ddns.net:5056/moodle/ be A Maps gnment#3-Handwritten Group Assignment is due Thursday, 18 March, 6:30 PM Course event 1. May1, Business owner Bill Doors invested $200,000 in cash and office equipment worth $48,000 in the business bank account 2. May1st, prepaid $14,400 cash for three month office rent. 3. May2nd, made credit purchase of office equipment for $24,000 and office supplies for $4800 4. May6, completed services for a client and received $4000 cash. 5. May9, completed a $16,000 project service for a patient, who will pay within 30 days. 6. May10, paid balance owing on May2nd. 7. May19, paid $12,000 cash for the annual liability insurance premium 8. May22, received $12,800 as partial payment for the services done on May9. 9. May25, completed consulting services for another client for $5280 on account. 10. May31, Bill Doors withdrew $12,400 cash for personal use 11. May31, purchased $1600 additional office supplies on account 12. May31, paid $1400 for the monthly…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardusiness AccountingQ&A LibraryGet live help whenever you need from online tutors!Try bartleby tutor todayarrow_forward Question Asked Sep 11, 2020 1 views Jordan Shi operates a consulting firm called X, which began operations on August1. On August 31 the company's records show the following accounts and the amount of August. Cash =$25,460. Acct Receivable =$22,510; Land = $44,130 Office equipment =20,160 Office Supplies =$5,380; Acct payable =$10,370 Dividends =$ 6130 Consulting fees earned =$27,130 Rent expense =$9690 Salaries expense =$5710 Telephone expense =$1010 Miscellaneous expense =$ 620 Common stock =$103,300 Use the above information to prepare an August statement of retained ernigs for the company.(Net income for August is $10,100) Get live help whenever you need from online tutors!Try bartleby tutor todayarrow_forward Question Asked Sep 11, 2020 1 views Jordan Shi operates a consulting firm called X, which began operations on August1. On August 31 the…arrow_forward

- REQUIRED: • JOURNAL ENTRIES • T-Accounts Note: PLEASE NO TO HANDWRITTEN. Make it TYPEWRITTEN thank you!arrow_forwardhi how do we record this in MYOB. Please help me Transactions from early January 2021 2 Obtained a loan of $14,000 from Uncle Oliver (a family relative of Beatrice Reed) at a simple interest rate of 10% per year, Cheque No. 145, ID #CR000001. The principal and interest on the loan are payable in six months time. 3 Received Cheque No. 227 from Pikea for the full amount outstanding on their account, ID #CR000002. 4 Issued Cheque No. 4098 for $10,065 to Mega Tech in payment of Purchase #303 (Supplier Inv#230). 4 Purchased 9 units MePod multimedia players from Pony at $979 each (includes 10% GST), Purchase #306, Supplier Inv#328. Issued Cheque No. 4099 for $3,900 to this supplier for this particular invoice at the time of the purchase. 4 Issued Cheque No. 4100 for $1,320 (includes 10% GST) to Discount Office Supplies for the cash purchase of office supplies. 6 Sold the following items on credit to Jerry Technology, Invoice #3284: 3 units BG90 plasma televisions for…arrow_forwardFP#1 SEPTEMBER 2019: In September 2019, Kate incorporated Kate’s Cards after investigating different organizational forms, and began the process of getting her business up and running. The following events occurred during the month of September 2019: Kate deposited $10,000 that she had saved into a newly opened business checking account. She received common stock in exchange. Kate designed a brochure that she will use to promote her greeting cards at local stationery stores. Kate paid Fred Simmons $50 to critique her brochure before undertaking her final design and printing. Kate purchased a new iMac computer tablet, specialized graphic arts software, and commercial printer for the company, paying $4,800 in cash. She decided to record all of these items under the same equipment account. Kate purchased supplies such as paper and ink for $350 at the local stationery store. She opened a business account with the store and was granted 30 days credit on all purchases, including the one she…arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThank you for your helparrow_forwardndow Help mework.pdf Aa v Question 5 You have been recently hired as general manager of Lucky's. It is September 1, and you must prepare the operating budget of this establishment for the first quarter of the upcoming calendar year, and submit it to the corporate office. Since you have been at the operation for only a month or so, you must rely solely on historical data. You gather sales reports and records for the months of January through August of the current year. Using the data provided, prepare the operating budget for Lucky's for the months of January through March of the upcoming year. Here is the information you determined from the most recent sales and costs records: Sales are 10 percent higher than those of the same month during the previous year. Food cost percentage is steady at 32 percent. Fixed labor costs are steady at $9,000 per month. Variable labor costs are 15 percent of sales. Occupancy costs will remain steady at $2,000 per month. Other controllable costs are…arrow_forward

- June 12, 2024 Provide services to customers on account for $33,800. September 17, 2024 Receive $19,000 from customers on account. December 31, 2024 March 4, 2025 May 20, 2025 July 2, 2025 October 19, 2025 December 31, 2025 Estimate that 40% of accounts receivable at the end of the year will not be received. Provide services to customers on account for $48,800. Receive $10,000 from customers for services provided in 2024. Write off the remaining amounts owed from services provided in 2024. Receive $39,000 from customers for services provided in 2025. Estimate that 40% of accounts receivable at the end of the year will not be received. Required: 1. Record transactions for each date. 2. Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncollectible Accounts. 3. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required…arrow_forwardMultiple Select Question Select all that apply On Jan. 2, Callie Company purchased $300 worth of supplies. She paid $100 immediately and put the rest on credit. The journal entry to record this transaction in Callie Company's books would include which of the following? (Check all that apply.) Credit the Cash account for $100. Debit the Supplies account for $100. Credit Accounts payable for $200. Debit the Cash account for $100. Debit the Accounts payable account for $200. Debit the Supplies account for $300. Rate your confidence to submit your answer High Medium .Low Readingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education