FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:R

Ith security updates, fixes, and Improvements, choose Check for

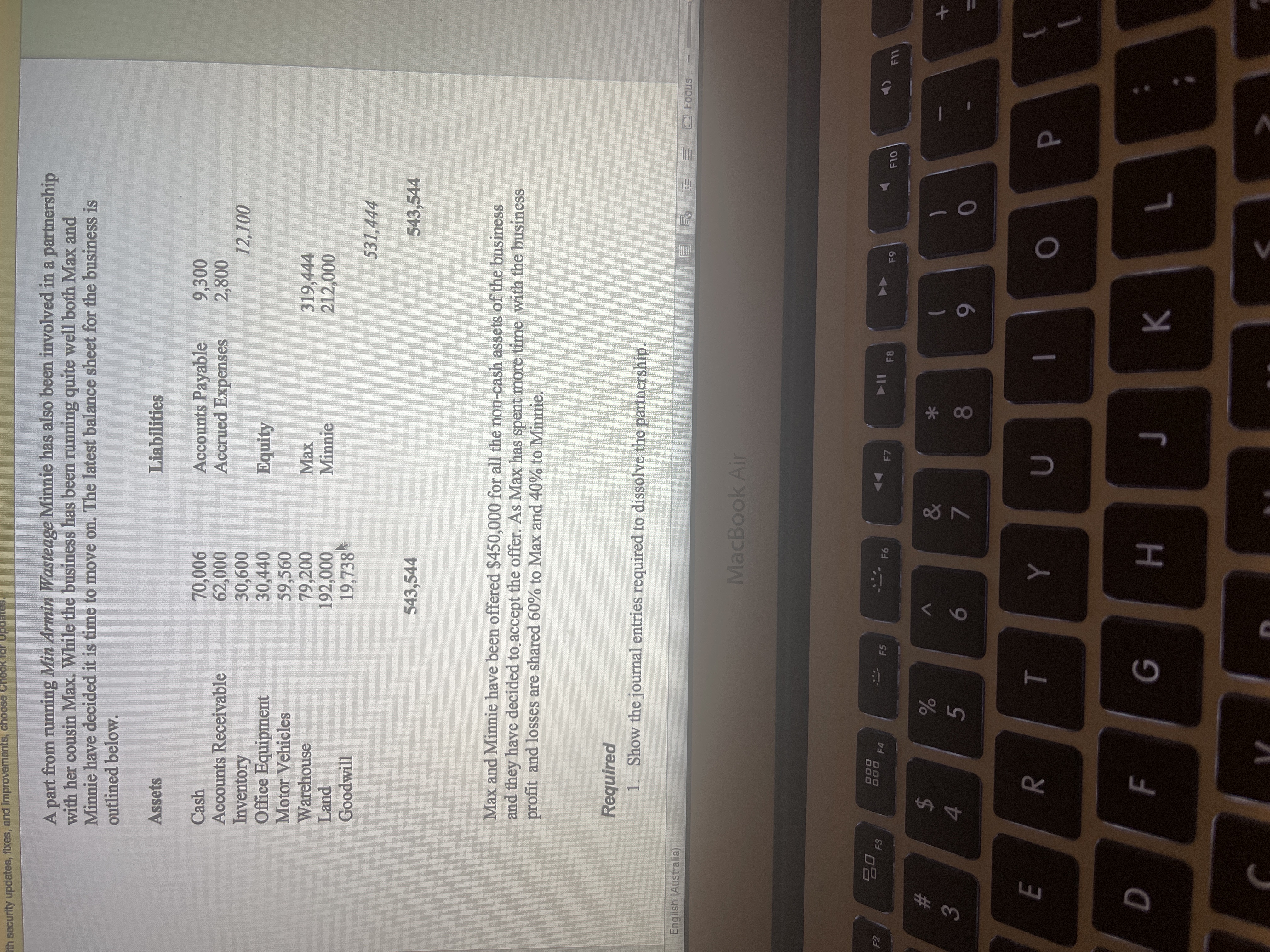

A part from running Min Armin Wasteage Minnie has also been involved in a partnership

with her cousin Max. While the business has been running quite well both Max and

Minnie have decided it is time to move on. The latest balance sheet for the business is

outlined below.

Assets

Liabilities

Accounts Payable

Accrued Expenses

Cash

Accounts Receivable

Inventory

Office Equipment

Motor Vehicles

Warehouse

Land

Goodwill

9,300

900'0

000

30,600

30,440

59,560

79,200

192,000

19,738

Equity

319,444

Minnie

531,444

543,544

543,544

Max and Minnie have been offered $450,000 for all the non-cash assets of the business

and they have decided to accept the offer. As Max has spent more time with the business

profit and losses are shared 60% to Max and 40% to Minnie.

Required

1. Show the journal entries required to dissolve the partnership.

English (Australia)

Focus

三

MacBook Air

000

000 F4

F5

F6

F7

F8

LL

24

4.

&

%23

V

5

)

3.

8

7.

6

}

F

H.

K.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- LEARNING TASK NO. 1 GENERAL INSTRUCTION: Write your solution and answer on a separate paper and put initials/signature on every final answer. Problem #1 Pedro and Jose form a partnership for the first time. Their investments are; Pedro is to invest cash amounting to P 70, 000 and Jose is to contribute Merchandise inventory at a P 10,000 cost with fair value of P 20, 000 and Computer equipment at a cost of P 50, 000 with a fair value of P 30, 000. Required: Prepare the necessary journal entries to record the investment of each partner. Problem #2 Jose has been operating a retail store for a number of years. A statement of financial position on July 1, 2021 is prepared for Jose Company as follows: Assets Cash Accounts receivable P 60, 000 50, 000 Inventory Equipment Less: Accumulated Depreciation 70, 000 P 40, 000 4. 000 36, 000 P 216, 000 Total Assets Liabilities and Equity P 86, 000 Accounts payable Jose Capital Total Liabilities and Equity 130, 000 P 216, 000 Jose needs additional…arrow_forwardHi I need an answer key to the questions in the picture thank youarrow_forwardQuestion 40 Grace is a self employeed sales consultant who spends significant time entertainment potential customers. She keeps all the appropriate records to substantiate her entertainment. She has the following expenses in the current year: meals where business was conducted $5000 Greens fees (all fees) 500 tickets to baseball games (all business) 500 country cup dues (all business use) 6000 what are the tax-deductible meals and entertainment expenses Grace May claim in the current year? $ on which tax form should she claim the deduction?arrow_forward

- Ratio Analyses for Victor and Maria Review the financial statements of Victor and Maria Hernandez and the financial ratios provided below. Balance Sheet for a Couple with Two Children-Victor and Maria Hernandez, January 1, 2018 Dollars Percent ASSETS Monetary Assets Cash on hand 1,200 0.3 Savings account 4,200 1.1 Victor's checking account 2,700 0.7 Maria's checking account 3,300 0.8 Tax refund due 700 0.2 Rent receivable 650 0.2 Total Monetary Assets $ 12,750 3.3% Tangible Assets Home 192,000 49.0 Personal property 9,000 2.3 Automobiles 9,500 2.4 Total Tangible Assets $ 210,500 53.7% Investment Assets Fidelity mutual funds 4,000 1.0 Scudder mutual fund 4,500 1.1 Ford Motor Company stock 2,500 0.6 New York 2038 bonds 4,100 1.0 Life insurance cash value 5,400 1.4 IRA accounts 34,400 8.8 Real estate investment 114,000 29.1…arrow_forwardeBook E Calculator Print Item Admitting New Partner With Bonus Cody Jenkins and Lacey Tanner formed a partnership to provide landscaping services. Jenkins and Tanner shared profits and losses equally. After all the tangible A... assets have been adjusted to current market prices, the capital accounts of Cody Jenkins and Lacey Tanner have balances of $69,000 and $90,000, respectively. Valeria Solano has expertise with using the computer to prepare landscape designs, cost estimates, and renderings. Jenkins and Tanner deem these skills useful; thus, Solano is admitted to the partnership at a 30% interest for a purchase price of $43,000. A... a. Determine the recipient and amount of the partner bonus. 5. LA... b. Provide the journal entry to admit Solano into the partnership. For a compound transaction, if an amount box does not require an entry, leave it blank. T.A... T.A... C. Why would a bonus be paid in this situation? offered by Solano. Apparently, Jenkins and Tanner value ET.A...…arrow_forwardoctoring Enable x + getproctorio.com/secured #lockdown octoring Enabled: Chapter 4 Required Homework (G... i 03:48:29 5 The Home Depot is the largest home improvement retailer in the United States. Home Depot financial statements for 2024 are shown below (in thousands): 2024 Income Statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 10,000 (6,550) 3,450 (2,350) (300) (320) $ 480 Comparative Balance Sheets Accounts receivable Inventory Property, plant, and equipment (net) Bonds payable Common stock Retained earnings Liabilities and Shareholders' Equity Current liabilities December 31 2024 Saved $ 700 700 900 3,000 $ 5,300 1,700 1,900 700 1,000 $ 5,300 2023 $ 600 500 700 3,100 $ 4,900 $ 1,450 1,900 700 850 $ 4,900 Help Required: Calculate Home Depot ratios for 2024. Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.arrow_forward

- This question is a question found in the library and the explanation is given on how you all worked it in excel I want to know how to solve it manually. This helps me to better grasp the concepysarrow_forwardI - PROBLEM SOLVING: Eugene and Alfred are partners in their Ghost Fighting business. Alfred is the managing partner. As of December 2020, their capital account showed the following: Eugene Capital_ 45000 300000 1-Jan Alfred Capital 90000450000 1-Jan 1-Jul -Apr 1-Dec 30000 30000 1-Apr 1-Dec 105000 150000 1-Jun 105000 1-Nov 195000 1-0ct 75000 435000 195000 795000| CASE I: Assuming the partnership earned a net profit of P360,000. CASE II: Assuming the partnership incurred a net los of P60,000 Required: On your answer sheet (yellow pad), using the following agreements, distribute the profit and losses in Case I & II to Eugene & Alfred. Make a journal entry after your computation. 1) Equally 2:4 ratio to Eugene and Alfred, respectively 3) 2) 4) 5) 6) Based on average capital balances 60%:40% ratio respectively Based on beginning capital balances Based on ending capital balances Using Case I only, the partners agreed to divide the net profit by: a) allowing 10% interest on average…arrow_forwardoctoring Enable x + getproctorio.com/secured #lockdown ctoring Enabled: Chapter 4 Required Homework (G... i 5 The Home Depot is the largest home improvement retailer in the United States. Home Depot financial statements for 2024 are shown below (in thousands): 2024 Income Statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 10,000 (6,550) 3,450 (2,350) Bonds payable Common stock Retained earnings (300) (320) $ 480 Comparative Balance Sheets Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 Saved $ 700 700 900 3,000 $ 5,300 $ 1,700 1,900 700 1,000 $ 5,300 2023 $ 600 500 700 3,100 $ 4,900 $ 1,450 1,900 700 850 $ 4,900 Help Required: Calculate Home Depot ratios for 2024. Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places. ₁ Save &arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education