FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

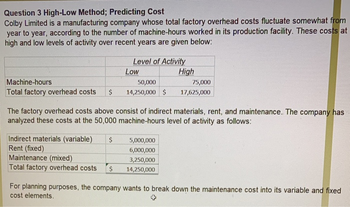

Transcribed Image Text:Question 3 High-Low Method; Predicting Cost

Colby Limited is a manufacturing company whose total factory overhead costs fluctuate somewhat from

year to year, according to the number of machine-hours worked in its production facility. These costs at

high and low levels of activity over recent years are given below:

Level of Activity

Machine-hours

50,000

Total factory overhead costs $ 14,250,000 $

Indirect materials (variable) $

Rent (fixed)

Low

Maintenance (mixed)

Total factory overhead costs $

The factory overhead costs above consist of indirect materials, rent, and maintenance. The company has

analyzed these costs at the 50,000 machine-hours level of activity as follows:

High

5,000,000

6,000,000

3,250,000

14,250,000

75,000

17,625,000

For planning purposes, the company wants to break down the maintenance cost into its variable and fixed

cost elements.

+

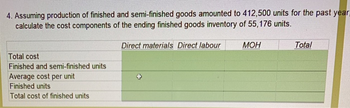

Transcribed Image Text:4. Assuming production of finished and semi-finished goods amounted to 412,500 units for the past year.

calculate the cost components of the ending finished goods inventory of 55,176 units.

Total cost

Finished and semi-finished units

Average cost per unit

Finished units

Total cost of finished units

Direct materials Direct labour

MOH

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer all parts completely and correctly with all working and steps remember answer all parts in text formarrow_forwardLynch Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials $ 10 Direct labor $7 $3 Variable manufacturing overhead Variable selling and administrative Fixed costs per year: $3 Fixed manufacturing overhead $ 380,000 Pixed selling and administrative $ 290,000 During the year, the company produced 38,000 units and sold 18,000 units. The selling price of the company's product is $61 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. A b. Prepare an income statement for the year. Complete this question by entering your answers in the tabs below. Req 1A Reg 28 Reg 2A Req 18 Compute the unit product cost. Assume that the company uses absorption costing. During the year, the…arrow_forwardService Emphasis The following analysis of selected data is for each of the two services Rockville Corporation provides. Service G Service H Per-unit data at 10,000 services Sales price Service costs: Variable Fixed Selling and administrative expenses: Variable Fixed $ Revenue Less: Variable cost Contribution margin Labor hours per unit Contribution margin per labor hour $ $36 $ 19 6 G 5 3 In the Rockville's operation, labor capacity is the company's constraining resource. Each unit of G requires 3 hours of labor, and each unit of H requires 1 hours of labor. Assuming that all service can be sold at a normal price, prepare an analysis showing which of the two services should be provided with any unused productive capacity that Rockville might have. Service $23 36 $ 25 X 11 * $ 3 3.67 × $ 15 4 2 1 H 23 19 x 4 x 1 4 × Any unused capacity should be devoted to Service H, which has $2 less contribution margin per labor hour than does Service G. Any unused capacity should be devoted to…arrow_forward

- Nonearrow_forwardHigh-Low Method The manufacturing costs of Rosenthal Industries for the first three months of the year follow: Total Costs Production January $75,240 855 units February 86,530 1,700 March 117,040 2,755 Using the high-low method, determine (a) the variable cost per unit and (b) the total fixed cost. a. Variable cost per unit $fill in the blank 1 b. Total fixed cost $fill in the blank 2arrow_forwardNonearrow_forward

- Assume a company has variable manufacturing costs of $20 per unit and total fixed manufacturing overhead per period is $150,000. In its first year of the operations, the company produced 12.500 units and sold 10,300 units and reported absorption costing net operating income of $38,000. What is the company's variable costing net operating income in its first year of operations? Multiple Choice $27,600 $47,600 $21,600 $11,600arrow_forwardvaion Company manuell ve prvous me ivivning mvmvn perwina w eULT VIDE Lumpanya m www youro vi operations: Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, It produced 40,000 units and sold 50,000 units. The selling price of the company's product is $57 per unit. Required: 1. Assume the company uses variable costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an Income statement for Year 1 and Year 2. 2. Assume the company uses absorption costing: a. Compute the unit product cost for Year 1 and Year 2. b. Prepare an income statement for Year 1 and Year 2. 3. Reconcile the difference between variable costing and absorption costing net operating Income In Year 1.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education