FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Question 22 of 25

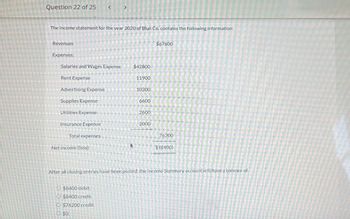

The income statement for the year 2020 of Blue Co. contains the following information:

Revenues

$67800

Expenses:

Salaries and Wages Expense

$42800

Rent Expense

11900

Advertising Expense

10300

Supplies Expense

6600

Utilities Expense

2600

Insurance Expense

2000

Total expenses

76200

Net income (loss)

$(8400)

After all closing entries have been posted, the Income Summary account will have a balance of

O $8400 debit.

O $8400 credit.

O $76200 credit.

O $0.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Statements and Closing Entries You can download the following information. Williams Inc. has the following information for calendar year 2020: 2020 Prepaid Insurance 400 Bank Service Charge Expense 30 Allowance for Doubtful Accounts 80 Cost of Goods Sold 5,900 Inventory 550 Rent Expense 20 Common Stock 14,000 Depreciation Expense 800 Sales Revenue 14,925 Income Tax Expense 2,400 Cash 3,700 Bad Debt Expense 75 Accounts Receivable 1,300 Interest Revenue 5 Accumulated Depreciation 3,750 Retained Earnings 15,550 Salaries Expense 1,200 Dividends 50 Building 32,375 Accounts Payable 490 Prepare, in good form, the classified Balance Sheet ONLY through the Current Asset section for Williams Inc. for 2020.arrow_forwardProblem 3 On January 1,2020, Jamin Company had a credit balance of P260,000 in the allowance for uncollectible accounts. Based on past experience, 2% of credit sales would be uncollectible. During the year, the entity wrote off P325,000 of uncollectible accounts. Credit sales for the year were P9,000,000. On December 31,2020, what amount should be reported as allowance for uncollectible accounts?arrow_forwardnkj.2arrow_forward

- Year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Inventory Prepaid rent Current Year 1 Year Ago 2 Years Ago $ 26,725 77,457 $ 31,858 95,459 8,436 240,403 30,967 41,290 43,529 52,503 73,671 8,200 220,389 3,372 193,642 $ 312,800 $ 42,115 69,129 162,500 Machinery, net Total assets $ 448,480 $ 386,621 Liabilities and Equity Accounts payable $ 110,555 Long-term notes payable 83,471 $ 65,992 88,034 Common stock 162,500 Retained earnings 91,954 162,500 70,095 39,056 Total liabilities and equity $ 448,480 $ 386,621 $ 312,800 Complete this question by entering your answers in the tabs below. Required 3A Required 3B Compute times interest earned for the current year and one year ago. Current Year 1 Year Ago Times Interest Earned Choose Numerator: / Choose Denominator: I II 11 Times interest earned times timesarrow_forwardTimes interest earned A company reports the following: Income before income tax expense $4,300,000 Interest expense 600,000 Determine the times interest earned ratio. Round your answer to one decimal place.fill in the blank 1arrow_forwardA ezto.mheducation.com M Question 18 - Midterm 1- Connect b Accounting Question | bartleby Bb Announcements - 2021 Spring Term (1) Principles of .. Midterm 1 Saved Help Save & Exit Submit 18 Torrid Romance Publishers has total receivables of $2,800, which represents 20 days' sales. Total assets are $73,000. The firm's operating profit margin is 5.9%. Find the firm's ROA and asset turnover ratio. (Use 365 days in a year. Do not round intermediate calculations. Round your final answers to 2 decimal places.) X 01:45:00 Asset turnover ratio ROA % Mc Graw Hill Educationarrow_forward

- View Policies Show Attempt History Current Attempt in Progress Sarasota Limited had net sales in 2023 of $2.3 million. At December 31, 2023, before adjusting entries, the balances in selected accounts were as follows: Accounts Receivable $236,900 debit; Allowance for Expected Credit Losses $2,300 credit. Assuming Sarasota has examined the aging of the accounts receivable and has determined the Allowance for Expected Credit Losses should have a balance of $29,700, prepare the December 31, 2023 journal entry to record the adjustment to Allowance for Expected Credit Losses. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation eTextbook and Media Debit Creditarrow_forwardSubject: accountingarrow_forwardIdentifying Current Assets and Liabilities Dunn Sporting Goods sells athletic clothing and footwear 10 retailcustomers. Dunn's accountant indicates that the firm's operating cycleaverages 6 months. At December 31, 2019, Dunn has the following assetsand liabilities: a. Prepaid rent in the amount of 58,500. Dunn's rent is $500 permonth.b. A $9,700 account payable due in 45 days.c. Inventory in the amount of $46,230. Dunn expects to sell $38,000 ofthe inventory within 3 months. The remainder will be placed instorage until September 2020. The items placed in storage shouldbe sold by November 2020.d. An investment in marketable securities in the amount of $1,900.Dunn expects to sell $700 of the marketable securities in 6 months.The remainder are not expected to be sold until 2022. e. Cash in the amount of $1,050.f. An equipment loan in the amount of $60,000 due in March 2024.Interest of $4,500 is due in March 2020 ($3,750 of the interestrelates to 2019. with the remainder relating to the…arrow_forward

- < Pk 10:53 The following information relates to Oriole Co. for the year 2022. Owner's capital, January 1, 2022 Owner's drawings during 2022 Service revenue Salaries and wages expense 28 W Untitled document.docx 1 of 2 • Page 1 Ơ $53.827 6,728 71,321 33,081 After analyzing the data, prepare an income statement for the year ending December 31, 2022. Advertising expense Rent expense Utilities expense $2.019 11,663 3,476 ORIOLE CO. Income Statement For the Year Ended December 31, 2022 $ [7 S : Sharearrow_forwardcomplete part 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education