Step by stepSolved in 5 steps with 5 images

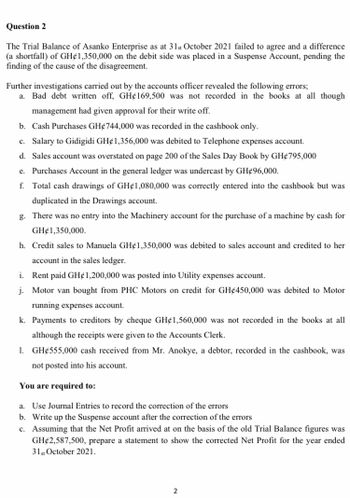

1. For the sales account overcast, shouldn't the sales account debited to reduce the amount by the overcast figure?

2. If there wasn't any entry into the Machine account which the cash used to buy the machine was recorded, the accounts going to be machine and suspense?

3. Amount received from Mr Anokye was recorded in the

1. For the sales account overcast, shouldn't the sales account debited to reduce the amount by the overcast figure?

2. If there wasn't any entry into the Machine account which the cash used to buy the machine was recorded, the accounts going to be machine and suspense?

3. Amount received from Mr Anokye was recorded in the

- Problem 7-4 (Bad Debt Reporting) From inception of operations to 31 December 2019, Fortner Corporation provided for uncollectible accounts receivable under the allowance method. The provisions were recorded based on analysis of customers with different risk characteristics. Bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the allowance account were made. Fortner's usual credit terms are net 30 days. The balance in Allowance for Doubtful Accounts was $130,000 at 1 January 2019. During 2019, credit sales totalled $9,000,000, the provision for doubtful accounts was determined to be $180,000, $90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $15,000. Fortner installed a computer system in November 2019, and an aging of accounts receivable was prepared for the first time as of 31 December 2019. A summary of the…arrow_forwardExercise 7-4 (Algo) Direct write-off method LO P1 Dexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $10,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions.arrow_forwardDon't give answer in image formatarrow_forward

- Please help mearrow_forward! Required information Problem 7-2A (Static) Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31, Hawke Company reports the following results for its calendar year. Cash sales Credit sales $ 1,905,000 $ 5,682,000 In addition, its unadjusted trial balance includes the following items. Accounts receivable Allowance for doubtful accounts Problem 7-2A (Static) Part 1 $ 1,270,100 debit $ 16,580 debit Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 1.5% of credit sales. b. Bad debts are estimated to be 1% of total sales. c. An aging analysis estimates that 5% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31).arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education