FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Chapter 3: Audit of receivables

Chapter 3: Audit of receivables

60 days old and below

61 to 90 days

Over 90 days

Advances to officers

P750,000

510,000

280,000 P1,540,000

We have not yet sold Merchandise billed for P125,000

the goods. We will remit were consigned to Mark on

the proceeds as soon October 10, 2021. The goods cost

as the goods are sold.

Mark

150,000

(90,000)

P1,600,000

P62,000.

Accounts with credit balances

Accounts receivable per SL

We do not owe you

P60,000. We already The sale of merchandise on

Reymond paid our accounts as November 26, 2021 was paid by

by Reymond on January 4, 2022.

The credit balance in customers account represents collection froma

customer whose account has been written off as uncollectible in prior ves

Accounts receivable for more than a year totaling P75,000 should be

written off. A total of P45,000 was provided as bad debts during the period

based on the company's policy of providing bad debts.

evidenced

OR#5678.

This amount represents freight

paid

my

merchandise

by

for

shipped

20, 2021,

customer

the

Kindly

balance by P10,000.

reduced

A confirmation letters were sent to various customers, the result of

confirmation were as follows:

Pierce

on

FOB

December

destination.

Customer Customer's comments

Remarks

on The client failed to record credit

memo No. 155 for P60,000. The

The goods sold

December

returned on December merchandise was included in the

20, 2021.

Based on your inquiry with the credit and collections manager of

Malapascua, you noted that the company's policy in estimating bad debts

(which is based on your judgment as an auditor is fair) uses the following

4

were

Alger

ending inventory at cost.

Investigation revealed that goods

sold for P80,000 were shipped to

Aeson on December 30., 2021;

FOB shipping point. The goods

rates:

60 days old and below

61 to 90 days

Over 90 days

6%

12%

24%

We do not owe this

amount. We do not

receive

merchandise from

company.

Aeson

any

were lost in transit and the

shipping

acknowledged its responsibility for

the loss of merchandise.

Alloy

Determine the following as a result of your audit:

1. What are your proposed adjusting journal entries in relation to your

audit of the accounts receivable balance?

2. How much is the adjusted gross balance of accounts receivable as of

December 31, 2021?

3. How much is the adjusted balance of allowance for bad debts as of

December 31, 2021?

4. How much is the correct bad debts expense to be reported in its 2021

statement of comprehensive income?

your

company

has

is

an

employee

I am entitled to a 10% Malapascua who started working

employee

Your bill should be employees are entitled for spece

reduced.

Alloy

discount.

November of 2021, all company

3. How much is the amount of accounts receivable reported in its

December 31, 2021 statement of financial position?

of

10% discount. Sales invoice

Alloy amounting to P30,000 was

dated December 15, 2021.

Page (165

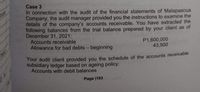

Transcribed Image Text:Case 3

In connection with the audit of the financial statements of Malapascua

Company, the audit manager provided you the instructions to examine the

details of the company's accounts receivable. You have extracted the

following balances from the trial balance prepared by your client as of

December 31, 2021:

Accounts receivable

Allowance for bad debts - beginning

us

P1,600,000

43,500

Your audit client provided you the schedule of the accounts receivable

subsidiary ledger based on ageing policy:

Accounts with debit balances

Page |163

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction:

VIEW Step 2: (1) Prepare the adjusting entries in audit of accounts receivable:

VIEW Step 3: Working Note:- Determine the additional adjustment required for allowance for doubtful accounts:

VIEW Step 4: (2) Determine the adjusted gross balance of accounts receivable as on Dec 31, 2021:

VIEW Step 5: (3) Determine the adjusted balance of bad debts as on Dec 31, 2021:

VIEW Solution

VIEW Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume you are a new hire in the accounting department of an organization. One of your responsibilities is the reconciliation of the operating account. After the end of the month you are given a copy of the bank statement and the cancelled checks, and are instructed to perform your reconciliation. You notice that there are some faint markings on a portion of the bank statement that could be alterations. What steps would you take in performing the reconciliation?arrow_forwardThe following items were included in Wong Company's January Year 1 bank reconciliation. Required: Determine whether each item will require adjustments to the book balance of Wong's cash account and indicate the amount of any necessary adjustment. Note: Amounts to be deducted should be indicated with a minus sign. a. Service charges of $14 for the month of January were listed on the bank statement. b. The bank charged a $164 check drawn on Wing Restaurant to Wong's account. The check was included in Wong's bank statement. c. A check of $29 was returned to the bank because of insufficient funds and was noted on the bank statement. Wong received the check from a customer and thought that it was good when it was deposited into the account. d. A $908 deposit was recorded by the bank as $980. e. Four checks totaling $328 written during the month of January were not included with the January bank statement. f. A $84 check written to OfficeMax for office supplies was recorded as $48. g. The…arrow_forwardThe accountant for Beaume Corp. was preparing a bank reconciliation as of April 30. The following items were identified: Beaume's book balance $43,145 Outstanding cheques 900 Interest earned on chequing account 63 Customer's NSF cheque returned by the bank 375 In addition, Beaume made an error in recording a customer's cheque; the amount was recorded in cash receipts as $370; the bank recorded the amount correctly as $730. Required: What amount will Beaume report as its adjusted cash balance at April 30?arrow_forward

- The information below was taken from the bank transfer schedule prepared during the audit of Fox Co.'s financial statements for the year ended December 31, 2005. Assume all checks are dated and issued on December 30, 2005. Check No. 101 202 303 404 Bank Accounts From National Federal County State Federal American Dec. 31 State Republic Jan. 2 To Disbursement Date Per Books Per Bank Dec. 30 Jan. 4 Jan. 2 Jan. 3 Jan. 3 Jan. 2 Receipt Date Per Books Dec. 30 Dec. 30 Jan. 2 Jan. 2 Per Bank Jan. 3 Dec. 31 Which of the following checks illustrate deposits/transfers in transit at December 31, 2005? Jan. 2 Dec. 31arrow_forwardAccompanying a bank statement for Santee Company is a credit memo for $24,516 representing the principal ($22,700) and interest ($1,816) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Required: On March 1, journalize the entry that should be made by the company to bring the accounting records up to date. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardThe Treasury Accounts-MDS, Regular account of Agency ABC as of December 31, 2020, had the following transactions: Outstanding Check P25,850, Bank Charges P4,750, Overstatement of MDS Account due to erroneous recording of NCA (with ARO) received P150,000, Overstatement of MDS Account due to erroneous recording of the amount of check issues issued P20,000, Understatement of NCA for regular recorded by bank P800,000, Lapsed NCA for regular account with ARO P420,000, Understatement of MDS Account due to erroneous recording of the amount of checks issued P8,000, NCA received by bank but not recognized by the Agency P543,210. Agency Book Balance P11,043,540, Balance per Bank P10,225,850.How much is the Adjusted balance per book and bank? *arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education