Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

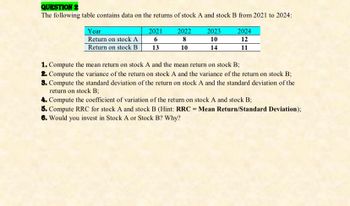

Transcribed Image Text:QUESTION 2

The following table contains data on the returns of stock A and stock B from 2021 to 2024:

Year

2021

2022

2023

2024

Return on stock A

6

8

10

12

Return on stock B

13

10

14

11

1. Compute the mean return on stock A and the mean return on stock B;

2. Compute the variance of the return on stock A and the variance of the return on stock B;

8. Compute the standard deviation of the return on stock A and the standard deviation of the

return on stock B;

4. Compute the coefficient of variation of the return on stock A and stock B;

5. Compute RRC for stock A and stock B (Hint: RRC = Mean Return/Standard Deviation);

6. Would you invest in Stock A or Stock B? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- how to calculate a stocks average monthly returnn, its return variance, standard deviation and betasarrow_forwardWhat is the standard deviation of Stock B returns given the information below about its returns across future states of nature? Enter return in decimal form, rounded to 4th digit, as in "0.1234"arrow_forwardUse the following information: Stock A B Good state 10% 14% Bad state 2% -2% Assume there is 60% probability that the good state occurs and 40% chance the bad state occurs. What is the standard deviation of stock A? (Please use 5 decimal places, this should be written in percentage, so an answer of 23.143% should be written as .23143)arrow_forward

- Sh19 Please help me. Solutionarrow_forwardHow many covariances appear in the variance equation of a six-stock portfolio 15 10 18 12 5arrow_forwardStock A Stock B 1 0.09 0.06 2 0.05 0.01 3 0.15 0.05 4 5 -0.04 0.08 0.01 -0.04 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.44, what is the expected return and standard deviation of a portfolio of 59% stock A and 41% stock B?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education