Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

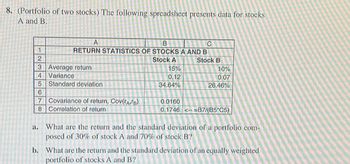

Transcribed Image Text:8. (Portfolio of two stocks) The following spreadsheet presents data for stocks

A and B.

A

B

C

1

2

RETURN STATISTICS OF STOCKS A AND B

Stock A

Stock B

3

Average return

15%

10%

4 Variance

0.12

0.07

5 Standard deviation

34.64%

26.46%

6

7 Covariance of return, Cov(AIB)

0.0160

0.1746 <=B7/(B5*C5)

a.

8 Correlation of return

What are the return and the standard deviation of a portfolio com-

posed of 30% of stock A and 70% of stock B?

b. What are the return and the standard deviation of an equally weighted

portfolio of stocks A and B?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- K -61 =1 2 N (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Probability 0.25 0.50 0.25 Common Stock A Probability 0.25 0.25 0.25 0.25 (Click on the icon in order to copy its contents into a spreadsheet.) @ 2 a. Given the information in the table, the expected rate of return for stock A is 16.25 %. (Round to two decimal places.) The standard deviation of stock A is %. (Round to two decimal places.) b. The expected rate of return for stock B is%. (Round to two decimal places.) The standard deviation for stock B is%. (Round to two decimal places.) c. Based on the risk (as measured by the standard deviation) and return of each stock, which investment is better? (Select the best choice below.) 30² F2 W OA. Stock A is better because it has a higher expected rate of return with less risk B. Stock B is…arrow_forward1. 1- Calculate the beta adjusted by the degree of freedom for stock X relative to the equity market using the information from the table (performance): A B 0.82 1.22 42.07 Year 1 2 3 4 5 6 7 None of the options is true X -7 -11 21 15 8 9 -2 Market 7 15 20 17 10 7 -1arrow_forwardThe index model has been estimated for stocks A and B with the following results: = 0.12 +0.670RM+еA RA= RB=0.04 +1.512RM + еB °M= 0.330 σ(eд) = 0.20 σ(eB) = 0.10 What is the covariance between each stock and the market index? (Round your answers to 4 decimal places.) Stock A covariance Stock B covariancearrow_forward

- Suppose you are given the following information about 2 stocks, what is the Sharpe Ratio of a portfolio weighted 55% in stock A and 45% in stock B? E(RA)=16% E(RB)=8% σA=22% σB=12% σA,B=−0.003696 rf=3% Enter rate in decimal form, rounded to 4th digit, as in "0.1234"arrow_forwardplease help with this questionarrow_forwardUse the following information: Stock A B Good state 10% 14% Bad state 2% -2% Assume there is 60% probability that the good state occurs and 40% chance the bad state occurs. What is the standard deviation of stock A? (Please use 5 decimal places, this should be written in percentage, so an answer of 23.143% should be written as .23143)arrow_forward

- Sh19 Please help me. Solutionarrow_forwardA 277.arrow_forwardSuppose you are given the following information about 2 stocks, what is the return standard deviation of a portfolio weighted 55% in stock A and 45% in stock B? E(RA)=16% E(RB)=8% σA=22% σB=12% σA,B=−0.003696 Enter rate in decimal form, rounded to 4th digit, as in "0.1234"arrow_forward

- Q4: Assume the following information for stocks A and B. • Expected return on Stock A = 18%. • Expected return on Stock B = 23%. • Correlation between returns of Stock A and Stock B = 0.10. • Standard deviation of returns on Stock A = 40%. • Standard deviation of returns on Stock B = 50%. Compute The expected return Standard deviationarrow_forwardSuppose that the Index model for stocks A and B is estimated from excess returns with the following results: RA 3.5% 8.65RM + A Rg -1.6% +0.88RM + ep OM 21%; R-squareд 0.22; R-squareg 0.14 What are the covariance and the correlation coefficient between the two stocks? Note: Do not round intermediate calculations. Calculate using numbers in decimal form, not percentages. Round your answers to 4 decimal places. Covariance Correlation coefficientarrow_forwardSuppose you are given the following information about 2 stocks, what is the expected return of a portfolio weighted 55% in stock A and 45% in stock B? E(RA)=16% E(RB)=8% σA=22% σB=12% σA,B=−0.003696 Enter rate in decimal form, rounded to 4th digit, as in "0.1234"arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education