ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

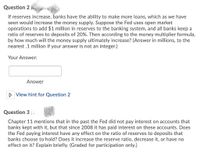

Transcribed Image Text:Question 2

If reserves increase, banks have the ability to make more loans, which as we have

seen would increase the money supply. Suppose the Fed uses open market

operations to add $1 million in reserves to the banking system, and all banks keep a

ratio of reserves to deposits of 20%. Then according to the money multiplier formula,

by how much will the money supply ultimately increase? (Answer in millions, to the

nearest .1 million if your answer is not an integer.)

Your Answer:

Answer

D View hint for Question 2

Question 3 (.

Chapter 11 mentions that in the past the Fed did not pay interest on accounts that

banks kept with it, but that since 2008 it has paid interest on these accounts. Does

the Fed paying interest have any effect on the ratio of reserves to deposits that

banks choose to hold? Does it increase the reserve ratio, decrease it, or have no

effect on it? Explain briefly. (Graded for participation only.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2. Suppose that in 2018 customers deposit $4,000 into their bank accounts. Based on the extended money multiplier calculated in part (1), calculate the total amount which the money supply in the banking system will eventually increase to. Show all steps involved in the calculation. part 1 answer DRR = Ratio (4% or 0.04) CDR = % of money in wallets (3% or 0.03) = (1 + 0.03) / (0.04 + 0.03) = 1.03 / 0.07 Answer = 14.71 Therefor Every $1 in the bank will allow the bank to create $14.71arrow_forwardOne effect of the September 11, 2001, terrorist attacks was to temporarily prevent banks from accessing reserves they needed to meet the demands of their customers. (This occurred because the attacks destroyed many records as well as the computers required to access backup records, and it took affected banks several weeks to become fully operational.) In response, the Fed made many billions of dollars of reserves available to banks, gradually withdrawing the new reserves from the banking system as that system returned to normal. Suppose the Fed had not injected reserves in this way. What would likely have happened to interest rates as a result? What would have been the likely impact on the stock market and on spending by consumers and businesses? Would the unemployment rate have gone up or down? Explain your reasoning in each case.arrow_forwardAssume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $100. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 25 10 A lower reserve requirement is associated with a money supply. Suppose the Federal Reserve wants to increase the money supply by $100. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to worth of U.S. government bonds. Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions.…arrow_forward

- International Gold Standard (19th century): If different countries fix the price of their currencies e in terms of gold this immediately implies that e are fixed. If the Central Bank of two countries stand ready to buy and sell gold at a fixed price in terms of their respective domestic currencies, then there is only one value of e that eliminates the possibility of arbitrage. Suppose that S100 buys 1 ounce of gold and 100 pounds buys lounce of gold. Under fixed exchange rates, this implies that IS buys Ipound. Explains what would happen (arbitrageurs' action and result) if instead e-1S buys 2 poundsarrow_forwardThe Federal Reserve and the money supply Suppose the money supply (as measured by checkable deposits) is currently $300 billion. The required reserve ratio is 25%. Banks hold $75 billion in reserves, so there are no excess reserves. The Federal Reserve (“the Fed”) wants to decrease the money supply by $32 billion, to $268 billion. It could do this through open-market operations or by changing the required reserve ratio. Assume for this question that you can use the simple money multiplier. If the Fed wants to decrease the money supply using open-market operations, it should ______(buy/sell) $_________ billion worth of U.S. government bonds. If the Fed wants to decrease the money supply by adjusting the required reserve ratio, it should ______(increase/decrease) the required reserve ratio. THis is one question . please answer with an explanation.arrow_forwardAs a result of the Fed's sale of $3,000 worth of government securities to First Main Street Bank, the bank becomes reserve deficient. Suppose that Nick, a First Main Street Bank's customer, re-pays back the $3,000 loan he took out a few months ago. STEP: 2 of 3 Which of the following most accurately describes First Main Street Bank's actions? The bank keeps the $3,000 as reserves. The bank creates a $42,000 loan. The bank keeps the $450 as reserves. The bank creates a $3,000 loan. The money supply in the economy is $arrow_forward

- In the situation depicted above, an increase in the money supply from $100 billion to $150 billion will cause the equilibrium rate of interest to: Group of answer choices a)Decrease from 4 percent to 2 percent. b)Increase from 2 percent to 4 percent. c)Decrease from 6 percent to 2 percent. d)Increase from 4 percent to 6 percent. e)Decrease from 6 percent to 4 percent.arrow_forwardSuppose the Federal Reserve conducts an open market purchase from a bank for $300 million. Assuming the required reserve ratio is 10%, what would be the effect on the money supply in each of the following situations? If there are many banks, all of which make loans for the full amount of their excess reserves, the money supply will increase by $ million. (Enter your response as a whole number.)arrow_forwardAssume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $200. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 25 10arrow_forward

- view picturearrow_forwardAssume that banks do not hold excess reserves and that households do not hold currency, so the only form of money is demand deposits. To simplify the analysis, suppose the banking system has total reserves of $300. Determine the money multiplier and the money supply for each reserve requirement listed in the following table. A higher reserve requirement is associated with a __larger, smaller__money supply.Suppose the Federal Reserve wants to increase the money supply by $200. Again, you can assume that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to ____buy / sell_$___________worth of U.S. government bonds. Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic conditions. Specifically, banks increase the percentage of deposits held as reserves from 10% to 25%. This increase in the reserve…arrow_forward2. Money supply, money demand, and adjustment to monetary equilibrium The following table gives the quantity of money demanded at various price levels (P), the money demand schedule. In the following table, fill in the column labeled Value of Money. Quantity of Money Demanded Price Level (P) Value of Money (1/P) (Billions of dollars) 1.00 1.00 1.33 0.75 2.00 0.50 4.00 0.25 1.5 2.0 3.5 7.0 Now consider the relationship between the quantity of money that people demand and the price level. The lower the price level, the less required to complete transactions, and the less money people will want to hold in the form of currency or demand deposits. Assume that the Federal Reserve initially fixes the quantity of money supplied at $3.5 billion. Use the orange line (square symbol) to plot the initial money supply (MS₁) set by the Fed. Then, referring to the previous table, use the blue connected points (circle symbol) to graph the money demand curve. moneyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education