Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

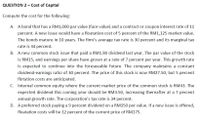

Transcribed Image Text:QUESTION 2 - Cost of Capital

Compute the cost for the following:

A. A bond that has a RM1,000 par value (face value) and a contract or coupon interest rate of 11

percent. A new issue would have a floatation cost of 5 percent of the RM1,125 market value.

The bonds mature in 10 years. The firm's average tax rate is 30 percent and its marginal tax

rate is 34 percent.

B. A new common stock issue that paid a RM1.80 dividend last year. The par value of the stock

is RM15, and earnings per share have grown at a rate of 7 percent per year. This growth rate

is expected to continue into the foreseeable future. The company maintains a constant

dividend-earnings ratio of 30 percent. The price of this stock is now RM27.50, but 5 percent

flotation costs are anticipated.

C. Internal common equity where the current market price of the common stock is RM43. The

expected dividend this coming year should be RM3.50, increasing thereafter at a 7 percent

annual growth rate. The corporation's tax rate is 34 percent.

D. A preferred stock paying a 9 percent dividend on a RM150 per value. If a new issue is offered,

floatation costs will be 12 percent of the current price of RM175.

Transcribed Image Text:E. A bond selling to yield 12 percent after floatation costs, but prior to adjusting for the marginal

corporate tax rate of 34 percent. In other words, 12 percent is the rate that equates the net

proceeds from the bond with the present value of the future cash flows (principal and intrest).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- what is the after tax ytm? what is the cost of common stock? what is the cost of preferred stock what is the total value of the capital"? what is the rsk free what is the weight of the bond what is weight of the stocksarrow_forwardThe firm can raise an unlimited amount of debt by selling R1,000 par value, 8% coupon interest rate, 20 year bonds on which annual interest payments will be made. To sell the issue, an average discount of R50 per bond would have to be given. The firm also must pay flotation costs of R50 per bond. Firm is in 40% tax bracket. Determine after tax cost of debt. A. 5.86% B. 5.48% C. 5.46% D. 5.55%arrow_forwardNonearrow_forward

- 3. Toran plc. is an all-equity financed firm and generates earnings of £200 per year. Its current required rate of return on equity is 10% per annum. It is planning to issue corporate debt at a rate of 8% to achieve a debt-equity ratio of 50%. Toran plc. Assume that debt and earnings are perpetuities. What happens to the firm value after the debt issuance? Assume there are perfect capital markets. 100 0 200 0 250 0 400 0 450 0arrow_forwardIntegrative Case Assume that you were recently hired as assistant to Jerry Lehman, financial VP of Coleman Technologies. Your first task is to estimate Coleman’s cost of capital. Lehman has provided you with the following data, which he believes is relevant to your task: Questions: The firm’s marginal tax rate is 40%. The current price of Coleman’s 12 % coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Coleman does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $113.10. Coleman would incur flotation costs of $2 per share on a new issue. Coleman’s common stock is currently selling at $50 per share. Its last dividend (D0) was $4.19, and dividends are expected to grow at a constant rate of 5% in the foreseeable future. Coleman’s beta is 1.2, the yield on Treasury…arrow_forwardTable 9.1 A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Long-term debt Preferred stock Common stock equity Target Market Proportions OA. 8.13 percent OB. 4.67 percent OC. 8 percent O D. 3.25 percent 20% 10 70 Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of 2 percent of the face value would be required in addition to the discount of $40. Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share. Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new…arrow_forward

- which option is correctarrow_forward4. Toran plc. is an all-equity financed firm and generates earnings of £200 per year. Its current required rate of return on equity is 10% per annum. It is planning to issue corporate debt at a rate of 8% to achieve a debt-equity ratio of 50%. Toran plc. Assume that debt and earnings are perpetuities. What happens to the return on equity after the debt issuance? Assume there are perfect capital markets. 2 % 5 % % ∞o do % 11 %arrow_forwardQuestion 2 Assume the yield curve is flat shown as following table. A cash and $duration-neutral butterfly is to be constructed by selling one thousand 7-year coupon paying bonds and purchasing qs and ql coupon paying bonds with maturities 3 and 15 years respectively. More information on the bonds to be used in the strategy is given Note that we are assuming all bonds pay interest semi-annually. (a) Explain how to interpret the modified duration of -8.86 corresponding to the 15-year maturity bond. (b) Write down the system of equations that needs to be solved in order to find qs and ql and verify that the solution to this system is qs = 679.32 and ql =366.23. (c) Find the profit from this strategy if yield curve moves: (i) up to 8% pa and (ii) down to 5% pa. (d) Explain why in practice it may be difficult to profit from the cash and $duration neutral butterfly. (e) Explain the major differences between the 50-50 butterfly strategy and the cash and $duration neutral butterfly.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education