Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Please help with the following.

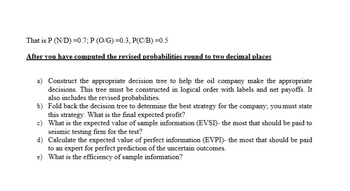

Transcribed Image Text:That is P (N/D)=0.7; P (O/G)=0.3, P(C/B) =0.5

After you have computed the revised probabilities round to two decimal places

a) Construct the appropriate decision tree to help the oil company make the appropriate

decisions. This tree must be constructed in logical order with labels and net payoffs. It

also includes the revised probabilities.

b) Fold back the decision tree to determine the best strategy for the company; you must state

this strategy. What is the final expected profit?

c) What is the expected value of sample information (EVSI)- the most that should be paid to

seismic testing firm for the test?

d) Calculate the expected value of perfect information (EVPI)- the most that should be paid

to an expert for perfect prediction of the uncertain outcomes.

e) What is the efficiency of sample information?

Transcribed Image Text:Question 2

An oil company must decide whether or not to drill an oil well in a particular area that they already

own. The decision maker (DM) believes that the area could be dry, reasonably good or a bonanza.

See data in the table which shows the gross revenues for the oil well that is found.

Decision

Drill

$0

Abandon

$0

Probability 0.3

Dry (D)

Seismic Results

No structure(N)

Open(0)

Closed (C)

Reasonably

good(G)

$85

$0

0.3

Drilling costs 40M. The company can take a series of seismic soundings at a cost of 12M) to

determine the underlying geological structure. The results will be either "no structure", "open

structure or "closed structure". The reliability of the testing company is as follows that is, this

reflects their historical performance.

Bonanza(B)

Note that if the test result is "no structure" the company can sell the land to a developer for 50 m.

otherwise (for the other results) it can abandon the drilling idea at no benefit to itself.

$200 m

$0

0.4

Dry(d)

0.7

0.2

0.1

Conditional Probability for a given state of nature

Reasonably good(g)

0.3

0.3

0.4

Bonanza(b)

0.1

0.4

0.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 10 images

Knowledge Booster

Similar questions

- Scenario E.1 SimQuick is being used to simulate the following bank process: Entrance Door Buffer Line Work Station Teller Buffer Served Customers Customer arrivals at the Entrance Door of the bank with an average time between arrivals of 2.5 minutes. The Line Buffer holds 6 customers. If a customer arrives and the buffer line is filled, the customer leaves. The Work Station Teller's processing time per customer is normally distributed, with a mean of 3.0 minutes and a standard deviation of 0.5 minutes. The Served Customer Buffer in the flow chart is used to count the number of customers processed during the period simulated. A 2-hour period was simulated. The SimQuick simulation is run, and the results are as follows: Overall Element Types Element Names Statistics Means Entrance Door Objects entering process 41.80 Objects unable to enter 6.23 Service level 0.87 Buffer Line Objects leaving 37.83 Final inventory 3.98 Minimum inventory 0.00 Maximum inventory 5.85 Mean inventory 3.08 Mean…arrow_forwardHow may data flows be monitored in a variety of ways?arrow_forwardCould you explain the below answer in short?arrow_forward

- Have you figured out what makes service methods unique?arrow_forwardHurry please: Do you believe that social media have any impact on customer service. If yes how? Explain!arrow_forwardDear Junior Associate I’ve just finished my meeting with Kevin. He provided us additional information about the events that transpired. Since you are already in this case, I would highly appreciate if you can draft our advice to Kevin, taking into account the additional information he has provided. Here are some notes I managed to take down: Kevin has always understood that the clause on ‘Services’ is an important term. Although he did not communicate this to Marie on this particular occasion, he pointed out that in a previous equipment hire about three months ago for a wedding event, he told Marie that it is very important that the equipment should be of acceptable quality and fit for the particular purpose disclosed. Marie replied, ‘I am your sister. I will never let you down. I guarantee you that my equipment is the best in Australia.’ Marie has sent Kevin demand letters, asking him to pay $10000 for the equipment hire, plus the amount for the damaged smoke and fog…arrow_forward

- Describe the role of an IT help desk in an organization. What are the key responsibilities of IT support staff, and how do they handle common technical issues?arrow_forwardExplain the concept of Total Cost of Ownership (TCO) in IT resource management and its importance in decision-making.arrow_forwardBackground ZumaJay International, a software developer, employs you as Global Corporate Security Manager. Your company employs 5,000 workers in 15 countries, including UK, USA, Germany, India, China, and Russia. Last year, the firm made almost £1bn. The UK Office in 22b Canary Wharf, London, is proposing an access control upgrade. ZumaJay International is the only tenant. JumaJay's Canary Wharf headquarters. This office handles group communications, administration, IT (including servers), and software development. 100 people will work. Visitors, clients, and contractors use the premises for meetings, but the public cannot. Staff and tourists may park in the basement of the three-story structure. The main building contains a lobby and reception desk at its front entrance/exit. The building has a back entrance/exit. Visitors, clients, and contractors utilize the front entrance/exit; deliveries use the back. The basement parking immediately beneath the building has one entrance/exit from…arrow_forward

- Define the term "IT service" and provide examples of different types of IT services commonly used in organizations.arrow_forwardDescribe the significance of system monitoring and alerting in effective system management.arrow_forwardIs there a point in implementing the Cyber Kill Chain Model?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.