Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

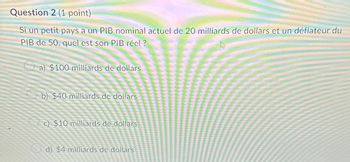

Transcribed Image Text:Question 2 (1 point)

Si un petit pays a un PIB nominal actuel de 20 milliards de dollars et un déflateur du

PIB de 50, quel est son PIB réel?

a) $100 milliards de dollars

b) $40 milliards de dollars

c) $10 milliards de dollars

d) $4 milliards de dollars

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Go to this website (http://www.measuringworth.com/ppowerus/) for the Purchasing Power Calculator at measuringWorth.com. How much money would it take today to purchase what one dollar would have bought in the year of your birth?arrow_forwardA - 7% C D 5% 100 150 200 300 Money ($ million) 27) Refer to Figure 11.1. Suppose the Quantity of money demanded is currently at Point D. A movement to point C could be caused by A) a decrease in nominal output. C) an increase in the price level. B) an increase in the interest rate. D) a decrease in the interest rate. Interest rate (%)arrow_forwardTopic: Geometric Gradient How much would you have to deposit now, so that you can withdraw of $10000 starting at the end of year 5, and subsequent withdrawals will decrease a rate of of 10% semiannual year over the previous year’s until at the end of year 8, if the interest rate is 6%, compounded semi-annually? Note: Draw the cash flow diagram and use interest rate with five decimal places.arrow_forward

- Dollars 0 Quantity (4) € (3) (2) Refer to the diagram. Other things equal, an decrease of product price would be shown as A) a decrease in the steepness of curve (3), a downward shift in curve (2), and an downward shift in curve (1). B) an increase in the steepness of curve (3), an upward shift in curve (2), and an upward shift in curve (1). C) an upward shift in curve (2) only. D) a downward shift in curve (4) and an upward shift in curve (1), with no changes in curves (2) and (3).arrow_forwardOnly typed answerarrow_forward6. (a) At time t = 0 a construction company pays £60,000 to purchase a plot of land and material to build a house that will be sold for £100,000 after one year (t = 1). For 11 months, from t = 0 to t = 11/12, the company has also to pay £35,000 for the salary of the workers. Assuming that the payment of the salaries can be modeled as an annuity paid continuously, calculate the net present value of the project. The interest rate is 3% p.a. effective. (b) For a 6-month internship, a student is paid £20 per day. The effective interest rate is 3% p.a. in the first three months and 2% p.a. in the final three months. Modeling the daily payments as an annuity paid continuously, compute the accumulated value of the salary at the end of the internship. Consider 30 days in each month and 360 days in a year.arrow_forward

- Typed and correct answer please. Consider the data shown below for the Canadian Consumer Price Index (CPI), drawn from the Bank of Canada's website. a. Compute the missing data in the table. (Round your responses to one decimal place.)arrow_forward27arrow_forwardTopic: Gradient Geometric What is the amount of 10 equal annual deposits that can provide five annual withdrawals, when a first withdrawal of $29695 is made at the end of year 11, and subsequent withdrawals increase at the rate of 10% per year over the previous year’s, if the interest rate is 10%, compounded annually? Note: Draw the cash flow diagram and use interest rate with five decimal places.arrow_forward

- TUNIS geoiduzil.AT/-3.02 Note: Please make sure to properly format your answers. All dollar figures in the answers need to include the dollar sign and any amount over 1,000 should include the comma ($2,354.67). All percentage values in the answers need to include a percentage sign (%). For all items without specific rounding instructions, round your answers to two decimal places, show both decimal places (5.06). If you borrow $220,000 at an APR of 3.5% for 25 years, you will pay $1,101.37 per month. If you borrow the same amount at the same APR for 30 years, you will pay $987.90 per month. a. What is the total interest paid on the 25-year mortgage? $110,411.00 b. What is the total interest paid on the 30-year mortgage? $135,644.00 X c. How much more interest is paid on the 30-year mortgage? Round to the nearest dollar. d. If you can afford the difference in monthly payments, you can take out the 25-year mortgage and save all the interest from part c. What is the difference between the…arrow_forward1arrow_forwardGeneral Journal ILLUSTRATION 1 The following is example of journal entries, Transaction 1 Safiyya invests $20,000 cash in Marine Engineering Services Sdn. On January 1 2010. Transaction 2 On 3rd January 2010, ME Services bought supplies for cash of $3,000. Transaction 3 Purchase supplies for credit of $5, 000 on 5th January from a supplier. Transaction 4 ME Services bought equipment by cheque of $35,000 on 15th January. Transaction 5 Paid salaries expense by cash to the workers on 25th January. Transaction 6 ME services receives payment of RM5,000 from the customer 26th January for consulting services on new motorboat engines. Transaction 7 The owner withdraws $500 cash from business account for personal use on January 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)EconomicsISBN:9781305971509Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:Cengage Learning