Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

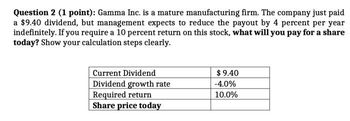

Transcribed Image Text:Question 2 (1 point): Gamma Inc. is a mature manufacturing firm. The company just paid

a $9.40 dividend, but management expects to reduce the payout by 4 percent per year

indefinitely. If you require a 10 percent return on this stock, what will you pay for a share

today? Show your calculation steps clearly.

Current Dividend

Dividend growth rate

Required return

Share price today

$ 9.40

-4.0%

10.0%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Questions 3. Bella Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to retain its earnings to fuel growth. The company will pay a dividend of $17 per share 10 years from today and will increase the dividend by 3.9 percent per year thereafter. If the required return on this stock is 12.5 percent, what is the current share price?arrow_forwardSolve thisarrow_forwardNonearrow_forward

- LBM Company just paid a $1.23 annual dividend. You noticed that the firm paid an annual dividend of $0.91 ten years ago. You expect the same growth rate to continue in the long run. If you require a return of 16 percent, how much are you willing to pay for one share of LBM stock? Group of answer choices $9.33 $9.59 $9.80 $9.29 $10.21arrow_forwardSynovec Company is growing quickly. Dividends are expected to grow at a rate of 23 percent for the next 3 years, with the growth rate falling off to a constant 7 percent thereafter. If the required return is 12 percent and the company just paid a $2.60 dividend. what is the current share price? Multiple Choice O O $79.69 $83.13 $84.79arrow_forwardQuantitative Problem 1: Hubbard Industries just paid a common dividend, D0, of $1.10. It expects to grow at a constant rate of 3% per year. If investors require a 12% return on equity, what is the current price of Hubbard's common stock? Do not round intermediate calculations. Round your answer to the nearest cent.? $ per share Zero Growth Stocks: The constant growth model is sufficiently general to handle the case of a zero growth stock, where the dividend is expected to remain constant over time. In this situation, the equation is (see attached image):arrow_forward

- H3. Capello's Deli traditionally pays an annual dividend of $1.65 per share. The firm is projecting dividends of $1.80 and $2.05 over the next two years, respectively. After that, the company expects to pay a constant dividend of $2.25 a share. What is the maximum amount you are willing to pay for one share of this stock if your required return is 10 percent? Please show proper step by step calculationarrow_forwardPlease I need fast answer and no plagiarism please no plagiarism pleasearrow_forwardSynovec Company is growing quickly. Dividends are expected to grow at a rate of 22 percent for the next 3 years, with the growth rate falling off to a constant 5 percent thereafter. If the required return is 11 percent and the company just paid a $2.30 dividend. what is the current share price? Multiple Choice C $61.80 $63.04 $60.57 #56 51arrow_forward

- Company Z-prime's earnings and dividends per share are expected to grow by 4% a year. Its growth will stop after year 4. In year 5 and afterward, it will pay out all earnings as dividends. Assume next year's dividend is $9, the cost of equity is 9%, and next year's EPS is $14. What is Z-prime's stock price? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Stock pricearrow_forwardPlease help with answers asaparrow_forward7. I need help with finance home work question asap please A company just paid a dividend of $4.15 per share. The company is expected to increase its dividend by 19% per year for each of the next 2 years and then maintain a constant dividend growth rate of 5% forever. What is this stock's expected price per share 2 years from now if the required return on this stock is 13.45%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education