Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Answer required parts for a thumbs up!!!

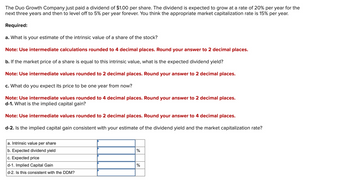

Transcribed Image Text:The Duo Growth Company just paid a dividend of $1.00 per share. The dividend is expected to grow at a rate of 20% per year for the

next three years and then to level off to 5% per year forever. You think the appropriate market capitalization rate is 15% per year.

Required:

a. What is your estimate of the intrinsic value of a share of the stock?

Note: Use intermediate calculations rounded to 4 decimal places. Round your answer to 2 decimal places.

b. If the market price of a share is equal to this intrinsic value, what is the expected dividend yield?

Note: Use intermediate values rounded to 2 decimal places. Round your answer to 2 decimal places.

c. What do you expect its price to be one year from now?

Note: Use intermediate values rounded to 4 decimal places. Round your answer to 2 decimal places.

d-1. What is the implied capital gain?

Note: Use intermediate values rounded to 2 decimal places. Round your answer to 4 decimal places.

d-2. Is the implied capital gain consistent with your estimate of the dividend yield and the market capitalization rate?

a. Intrinsic value per share

b. Expected dividend yield

c. Expected price

d-1. Implied Capital Gain

d-2. Is this consistent with the DDM?

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNot a previously submitted question. Thank youarrow_forward

- AutoSave Off H Document2 - Word P Search (Alt+Q) Sign in File Design References Mailings Review View Help Grammarly Picture Format P Comments A Share Home Insert Draw Layout P Find - - A A Aa v A = - E - E G Times New Roman v 12 Normal No Spacing Heading 1 Replace = = 1E v Editor Open Grammarly Paste BIU I U v - 2. A - ab x, x' A . A Select v Undo Clipboard a Font Paragraph Styles Editing Editor Grammarly a. At the beginning of the year, Addison Company's assets are $200,000 and its equity is $150,000. During the year, assets increase $80,000 and liabilities increase $46,000. What is the equity at year-end? Assets Liabilities Equity Beginning $ 200,000 = 150,000 Change 80,000 = 46,000 + Ending Page 1 of 1 O words Text Predictions: On * Accessibility: Good to go O Focus 110% 9:58 PM P Type here to search 49°F 3/20/2022 近arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- This question has not been submitted previously. Thank youarrow_forwardList Paragraph For the... badiya aldujaili BA AutoSave ff Search EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut - A^ A° Aav A E - E - E E E O Find - Calibri (Body) 11 AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 5 6. 7 If Busby Corporation's variable cost ratio is 0.75, targeted after tax net income is $27,580 (tax rate of 20%), and targeted sales volume in dollars is $219,000 then Busby's total fixed costs are: a. $27,170 b. $71,380 c. $20,275 d. $136,670 e. $129,775 f. $26,350 g. $54,750 Page 3 of 3 331 words English (United States) Focusם 160% 8:28 PM O Type here to search ENG 2/11/2021 (凸) . I . I ..?. . . E • . . L. . . t .. I ..arrow_forwardAny help is appreciated, here is the question. https://drive.google.com/file/d/0B-AOAJtLKPhfOEJhR0RWRWtmT3BGVVljQUZaRko0Zkh2NDRr/view?usp=sharingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education