Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

a4

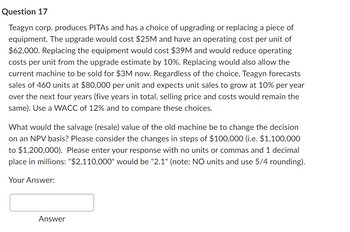

Transcribed Image Text:Question 17

Teagyn corp. produces PITAs and has a choice of upgrading or replacing a piece of

equipment. The upgrade would cost $25M and have an operating cost per unit of

$62,000. Replacing the equipment would cost $39M and would reduce operating

costs per unit from the upgrade estimate by 10%. Replacing would also allow the

current machine to be sold for $3M now. Regardless of the choice, Teagyn forecasts

sales of 460 units at $80,000 per unit and expects unit sales to grow at 10% per year

over the next four years (five years in total, selling price and costs would remain the

same). Use a WACC of 12% and to compare these choices.

What would the salvage (resale) value of the old machine be to change the decision

on an NPV basis? Please consider the changes in steps of $100,000 (i.e. $1,100,000

to $1,200,000). Please enter your response with no units or commas and 1 decimal

place in millions: "$2,110,000" would be "2.1" (note: NO units and use 5/4 rounding).

Your Answer:

Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please avoid images in solution thnkuarrow_forwardMKM International is seeking to purchase a new CNC ma-chine in order to reduce costs. Two alternative machines arein consideration. Machine 1 costs $500,000 but yields a 15 per-cent savings over the current machine used. Machine 2 costs$900,000 but yields a 25 percent savings over the current ma-chine used. In order to meet demand, the following forecastedcost information for the current machine is also provided.a. Based on the NPV of the cash flows for these five years,which machine should MKM International Purchase? As-sume a discount rate of 12 percent.b. If MKM International lowered its required discount rate to8 percent, what machine would it purchase?Year Projected Cost1 1,000,0002 1,350,0003 1,400,0004 1,450,0005 2,550,000arrow_forwardsolve thisarrow_forward

- need correct answerarrow_forwardSh2arrow_forwardAverage rate of returnnew product Hana Inc. is considering an investment in new equipment that will be used to manufacture a smart-phone. The phone is expected to generate additional annual sales of 10,000 units at 300 per unit. The equipment has a cost of 4,500,000, residual value of 500,000, and a 10-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Determine the average rate of return on the equipment.arrow_forward

- New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer’s base price is $1,080,000, and it would cost another $22,500 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $605,000. The MACRS rates for the first 3 years are 0.3333, 0.4445, and 0.1481. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $380,000 per year in before-tax operating costs, mainly labor. Campbell’s marginal tax rate is 35%. What is the Year-0 cash flow? What are the net operating cash flows in Years 1, 2, and 3? What is the additional Year-3 cash flow (i.e., the after-tax salvage and the return of working capital)? If the project’s cost of capital is 12%, should the machine be purchased?arrow_forwardPlease do not give salutations in image format thankuharrow_forwardApplying Differential Analysis to Equipment Replacement Decision TaylorMade - Adidas Golf Company a subsidiary of Adidas, manufactures golf clubs using "adjustable weight technology" or AWT. Suppose a European machine company has proposed to sell TaylorMade a new highly automated machine that would reduce significantly the labor cost of producing its golf clubs. The cost of the machine is $ 7,800,000, and would have an expected life of six years, at the end of which it would have a residual value of 10% of its original cost. The machine has an estimated operating cost of $39,000 per month. The direct labor cost savings per club from using the machine is estimated to be $16 per club, per month. In addition, other fixed overhead costs of $20,800 per month would be eliminated if the new machine is purchased. Also, the new machine would free up about 13,000 square feet of space from the displaced workers. Assume TaylorMade's building is held under a 10-year lease that has eight years…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning