FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer in 1 hour

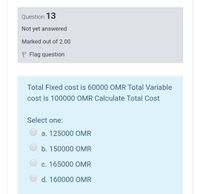

Transcribed Image Text:Question 13

Not yet answered

Marked out of 2.00

P Flag question

Total Fixed cost is 60000 OMR Total Variable

cost is 100000 OMR Calculate Total Cost

Select one:

a. 125000 OMR

b. 150000 OMR

c. 165000 OMR

d. 160000 OMR

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Finance class You borrow $10 from your brother 2 days ago and you are paying him back $11 today. What is the APR? What is the EAR?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardJust answers plzarrow_forward

- What will be interest paid?arrow_forwardData table T Plan A: Pay $0.09 per minute of long-distance calling. Plan B: Pay a fixed monthly fee of $18 for up to 300 long-distance minutes and $0.06 per minute thereafter (if she uses fewer than 300 minutes in any month, she still pays $18 for the month). Plan C: Pay a fixed monthly fee of $23 for up to 480 long-distance minutes and $0.05 per minute thereafter (if she uses fewer than 480 minutes, she still pays $23 for the month).arrow_forwardPls solve this question correctly instantly in 5 min i will give u 3 like for surearrow_forward

- You have a Visa credit card account lemi with a 24.99% annual percentage rate calculated on the average daily balance. The billing date is the first day of each month, and the billing cycle is the number of days in that month. Your credit card balance on June 1 was $252. On June 8th you made a $109 purchase. You made another purchase, a $75 gift card, on June 18th. You made a $100 payment on June 28th. Show your work for all parts of the problem. (a) What is the average daily balance for July? (b) What is your finance charge on the account as of July 1st? (c) What is your new credit card balance?arrow_forwardQuestion: A debenture of $100 each is issued at $90 per debenture. How much is the discount? A. $0 B. full C . $10 D. $90arrow_forwardPlease solve max please in 15-22 minutes and no reject thank u. Im needed please no rejectarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education