ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

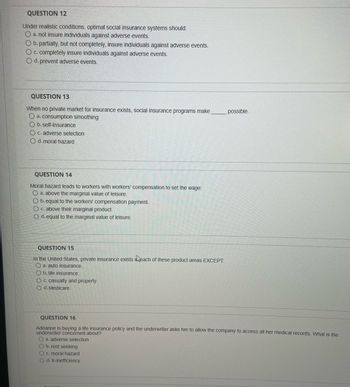

Transcribed Image Text:QUESTION 12

Under realistic conditions, optimal social insurance systems should:

O a. not insure individuals against adverse events.

O b. partially, but not completely, insure individuals against adverse events.

O c. completely insure individuals against adverse events.

O d. prevent adverse events.

QUESTION 13

When no private market for insurance exists, social insurance programs make

O a. consumption smoothing

Ob. self-insurance

Oc. adverse selection

Od. moral hazard

QUESTION 14

Moral hazard leads to workers with workers' compensation to set the wage:

O a. above the marginal value of leisure.

Ob.equal to the workers' compensation payment.

O c. above their marginal product.

O d. equal to the marginal value of leisure.

QUESTION 15

In the United States, private insurance exists in each of these product areas EXCEPT:

a. auto insurance.

b. life insurance.

Oc. casualty and property.

d. Medicare.

possible.

QUESTION 16

Adrianne is buying a life insurance policy and the underwriter asks her to allow the company to access all her medical records. What is the

underwriter concerned about?

a. adverse selection

O b. rent seeking

O c. moral hazard

O d. X-inefficiency

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please answer. Thank you!arrow_forwardShort questions a. Describe the first and second Welfare Theorem b. Describe the difference between risk aversion, risk neutrality and risk prefering c. Describe and explain the non-satiation assumption d. Describe and explain the difference between adverse selection and moral hazard e. Describe and explain the difference between income effect and substitution effectarrow_forward3. Consider the adverse selection model of health insurance. ● (a) Why is the marginal cost curve negatively sloped?arrow_forward

- 5arrow_forwardPRINCIPLE OF HEALTHCARE FINANCEarrow_forward(d) Suppose Antonio has utility function over wealth given by Va (y) = Vy and suppose Dillon has the following utility function over wealth: va (y) = In %3D Who is more risk aversc, Antonio or Dillon? Show this using two approachcs. (e) Who is more risk averse, Chelsca or Dillon'? Explain.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education