FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

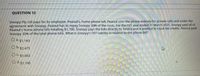

Transcribed Image Text:QUESTION 12

Snoopy Pty Ltd pays for its employee. Peanut's, home phone bill. Peanut uses the phone entirely for private calls and under the

agreement with Snoopy, Peanut has to repay Snoopy 30% of the costs. For the FBT year ended 31 March 2021, Snoopy paid all of

Peanut's home phone bills totalling $1,700. Snoopy pays the bills directly to Telstra and is entitled to input tax credits. Peanut paid

Snoopy 30% of the total phone bills. What is Snoopy's FBT liability in relation to the phone bill?

O a. 51,163

O b.$2,475

OC $1,662

Od.51.190

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 19 1. Use the 2018 Payroll Tax Withholding Tables from IRS Pub. 15. Circular E(see Mastering Payroll, 90-93), compute FITW for the following . Sandy is married, claims 3 allowances on her W-4 and is paid $645 a week. • Sofia is single, claims 6 allowances on her W-4 and is paid $1,500 every 2 weeks. • Carlos is married, claims 6 allowances on his W-4 and is paid $1,500 every week. • Sam is single, claims 0 allowance on his W-4 and is paid $959 every 2 weeks. For the toolbar, press ALT F10(P) or ALTIN+F1O (Mac) B Paragraph Arial 10pt Av I. F制制 x X, 田田用国 * () Sandys QUESTION 20 Clk Se and Suie to e and ir. Cick Se AllA ers se all ansers Save Al A ers !!arrow_forwardProblem 9-10 The FICA Tax (LO 9.3) Thuy worked as the assistant manager at Burger Crown through August 2021 and received wages of $81,000. Thuy then worked at Up and Down Burger starting in September of 2021 and received wages of $64,000. Calculate the amount of Thuy's overpayment of Social Security taxes that she should report on her 2021 Form 1040. Round your answer to two decimal places.arrow_forwardNonearrow_forward

- Shilpa tinot a director) receives a monthly salary of £3,500 from her employer, Larimar Ltd, where she is employed as a tax adviser. In addition, she received the following bonuses: Received: 31 May 2020 31 May 2021 Relates to: Larimar's profits for y/e 30 November 2019 Larimar's profits for y/e 30 November 2020 Bonus: £3,750 £4,375 Shilpa made the following payments in respect of her employment for the tax year 2020/21: Subscription to golf club solely for the use of entertaining clients Fees to CIOT (Chartered Institute of Tax) £ 1,200 450 Train ticket from home to normal place of work New suit for office Home telephone bill ti£40 business calls; £140 private; £20 line rental) 200 Calculate Shilpa's employment income for tax year 2020/21. 20 250arrow_forwardCase Study 2 Identify the relevant elements of Australian tax law in the following scenarios and calculate the total tax payable (including Medicare Levy and any other tax offsets) by James for the 2021/22 financial year. Show your workings. On 1 July 2021, James sold some jewellery for $5,000 which he bought on 1 April 2019 for S 2,780. On 1 August 2021, James sold his camera for $22,000 which he bought on 15 June 2019 for $23, 000. On 5 October 2021, James sold a painting for $950 which he bought on 4 April 2013 for S480. On 8 November 2021, James sold some listed shares for S49, 500 which he bought on 30 January 2021 for $42, 400 (net costs). On 30 June 2022, James receives interest income of $24,000.arrow_forward2 10 points How does an employer know how much to withhold from a your paycheck for federal income tax? Your employer withholds 27% of your gross pay per IRS Guideline WH-27. O You inform you employer how much you paid in taxes last year, then your employer divides that amount by this amount is then withheld. -- You complete and submit to your employer IRS Form W-4. Employers don't withhold federal income tax from paychecks -- this is a trick question.arrow_forward

- PSb 5-5 Calculate FUTA and SUTA Tax For each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer: NO TE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: An employer in Delaware City, Delaware, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $6,100 and $8,800. During the current pay period, these employees earn $1,450 and $2,000, respectively. The applicable SUTA tax rate is 2.1%, and the Delaware SUTA threshold is $16,500. FUTA tax = $ SUTA tax = $ 2: An employer in Bridgeport, Connecticut, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,500, $12,900, and $14,200. During the current pay period, these employees earn $2,200, $1,950, and $2,400, respectively. The applicable SUTA tax rate is 4.9%, and the Connecticut SUTA threshold is $15,000.…arrow_forward6arrow_forwardProblem 9-13----2019The FUTA Tax (LO 9.6) Thomas is an employer with two employees, Patty and Selma. Patty's wages are $12,450 and Selma's wages are $1,310. The state unemployment tax rate is 5.4 percent. Calculate the following amounts for Thomas: Round your answer to two decimal places. a. FUTA tax before the state tax credit $ b. State unemployment tax $ c. FUTA tax after the state tax credit $arrow_forward

- Problem 6-16 The Nanny Tax (LO 6.6) Sally hires a maid to work in her home for $400 per month. The maid is 25 years old and not related to Sally. During 2022, the maid worked ten months for Sally. Do not round immediate computations and round your final answers to two decimal places. a. What is the employer's share of Social Security tax Sally must pay? b. What is the employer's share of Medicare tax Sally must pay? Sally's employer's Medicare tax: $ c. What is the amount of Social Security and Medicare tax which must be withheld from the maid's wages? Sally should withhold for Social Security and Medicare tax of:arrow_forwardNote:hand written solution should be avoided.arrow_forwardQuestion 8 Jerrod Smith's gross earnings this pay period were $1350. Jerrod is paid weekly and he is single with 2 withholding allowances. His year-to-date is $59,875. Find his social security, medicare, and federal income tax deduction for this pay period.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education