FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Provide 10, 11 and 12 Question answer please all otherwise I give negative

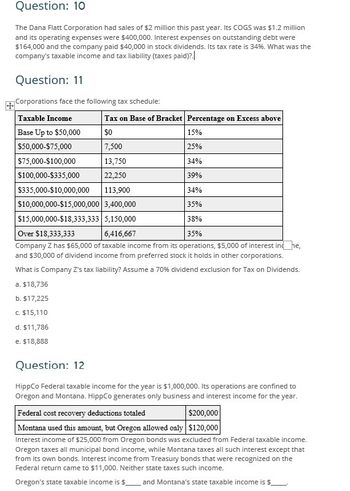

Transcribed Image Text:Question: 10

The Dana Flatt Corporation had sales of $2 million this past year. Its COGS was $1.2 million

and its operating expenses were $400,000. Interest expenses on outstanding debt were

$164,000 and the company paid $40,000 in stock dividends. Its tax rate is 34%. What was the

company's taxable income and tax liability (taxes paid)?.

Question: 11

Corporations face the following tax schedule:

Taxable Income

Tax on Base of Bracket Percentage on Excess above

Base Up to $50,000

$0

15%

$50,000-$75,000

7,500

25%

$75,000-$100,000

13,750

34%

$100,000-$335,000

22,250

39%

$335,000-$10,000,000 113,900

34%

$10,000,000-$15,000,000 3,400,000

35%

$15,000,000-$18,333,333 5,150,000

38%

Over $18,333,333

6,416,667

35%

Company Z has $65,000 of taxable income from its operations, $5,000 of interest in he

and $30,000 of dividend income from preferred stock it holds in other corporations.

What is Company Z's tax liability? Assume a 70% dividend exclusion for Tax on Dividends.

a. $18,736

b. $17,225

c. $15,110

d. $11,786

e. $18,888

Question: 12

HippCo Federal taxable income for the year is $1,000,000. Its operations are confined to

Oregon and Montana. HippCo generates only business and interest income for the year.

Federal cost recovery deductions totaled

$200,000

Montana used this amount, but Oregon allowed only $120,000

Interest income of $25,000 from Oregon bonds was excluded from Federal taxable income.

Oregon taxes all municipal bond income, while Montana taxes all such interest except that

from its own bonds. Interest income from Treasury bonds that were recognized on the

Federal return came to $11,000. Neither state taxes such income.

Oregon's state taxable income is $

and Montana's state taxable income is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardReq1-Req2 were incorrect. Can you try the problem again ?arrow_forward18 pts Multiple Functions 88 MULTIPLE CHOICE Question 2 ◄ Listen When f(x)=-3x-6 and g(x) = x²-x-6, what is ? A B C f 54 g = 3 fg = -3 x-3x=3 f 51 g = -2x+2; x=1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education