FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

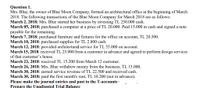

Transcribed Image Text:Question 1.

Mrs. Blue, the owner of Blue Moon Company, formed an architectural office at the beginning of March

2018. The following transactions of the Blue Moon Company for March 2018 are as follows:

March 2, 2018: Mrs. Blue started her business by investing TL 250.000 cash.

March 05, 2018: purchased a computer at a price of TL 20.000. Paid 15.000 in cash and signed a note

payable for the remaining.

March 7, 2018: purchased furniture and fixtures for the office on account, TL 20.500.

March 10, 2018: purchased supplies for TL 2.800 cash.

March 12, 2018: provided architectural service for TL 55.000 on account.

March 15, 2018: received TL 25.000 from a customer in advance and agreed to perform design services

of that customer's house.

March 23, 2018: received TL 15.200 from March 12 customer.

March 26, 2018: Mrs. Blue withdrew money from the business, TL 15.000.

March 30, 2018: earned service revenue of TL 22.500 and received cash.

March 30, 2018: paid the first month's rent, TL 10.200 (not in advance).

Please make the journal entries and post to the T-accounts ·

Prepare the Unadjusted Trial Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dogarrow_forwardProcedures: 1. Analyze the following business transactions below. For the month of December 2022, Mr. Mira Shikigami had the following transactions: Dec. Mr. Mira Shikigami invested P1,200,000 to start the business, Shikigami Accounting Firm 1 1 The firm obtained a note from Solar Bank amounting to P300,000. The note bears a 6% annual interest payable every June 1 of the following year. The principal is payable in two (2) equal annual installments. 1 The firm paid P15,000 for the necessary permits and licenses for its operation. 1 The firm paid P180,000 for the annual rent of the office space. The lease contract will expire on June 1 of the following year and will be renewed yearly. 3 The firm rendered service to Kyubi Realties, Inc. worth P250,000 on credit. 3 The firm purchased supplies worth P50,000. 9 The firm purchased a laptop in cash, P50,000. The laptop has an estimated useful life of three (3) years with no residual value. The company treats purchases during the first half of…arrow_forwardplease help solve the blank with red markarrow_forward

- Dave Shurek started Hindsight Electric in February 2020. Hindsight completed the following transactions during February of the current year: Feb. 1 Began a Hindsight Electric company by investing $7,000 in cash and computer equipment having a $5,000 fair value. Feb. 2 Purchased electrical tools for $1,100 on account. Feb. 4 Completed hot tub electrical work for $1,900 on account. Feb. 8 Completed electrical panel upgrade for $500 cash. Feb. 10 Paid for the items purchased on credit on February 2. Feb. 14 Paid $1,600 for the annual rent. Feb. 18 Received $900 for the work completed on February 4. Feb. 27 D. Shurek withdrew $200 cash from the practice to pay personal expenses. Feb. 28 Paid the February utility bills, $100. Prepare general journal entries to record the transactions. Include a brief description for each entry.arrow_forwardhi how do we record this in MYOB. Please help me Transactions from early January 2021 2 Obtained a loan of $14,000 from Uncle Oliver (a family relative of Beatrice Reed) at a simple interest rate of 10% per year, Cheque No. 145, ID #CR000001. The principal and interest on the loan are payable in six months time. 3 Received Cheque No. 227 from Pikea for the full amount outstanding on their account, ID #CR000002. 4 Issued Cheque No. 4098 for $10,065 to Mega Tech in payment of Purchase #303 (Supplier Inv#230). 4 Purchased 9 units MePod multimedia players from Pony at $979 each (includes 10% GST), Purchase #306, Supplier Inv#328. Issued Cheque No. 4099 for $3,900 to this supplier for this particular invoice at the time of the purchase. 4 Issued Cheque No. 4100 for $1,320 (includes 10% GST) to Discount Office Supplies for the cash purchase of office supplies. 6 Sold the following items on credit to Jerry Technology, Invoice #3284: 3 units BG90 plasma televisions for…arrow_forwardPart A: Journalize the following transactions for June.Dean Winchester opened Ghost Cleaners on June 1, 2021. He is the sole owner of the corporation.During June, the following transactions were completed by Dean.1-Jun Invested $65,000 in exchange for common stock in Ghost Cleaners, Inc.1-Jun Purchased a used van for $12,000, paying $3,000 cash and the taking out a note payable for the rest.He plans to pay off the remaining balance on the van by June 1, 2022. The note has a 10% APRwith interest being payable at the end of every month. No principle payments are due until August 1, 2021.1-Jun Paid $1,800 cash on a 12-month insurance policy effective June 1, 2021.1-Jun Hired his brother, Sam, to help with the corporation. He will be paid $1,000 per month for now.5-Jun Purchased cleaning supplies for $1,500 on account.7-Jun Billed a client, F. Crowley, for services performed on June 7 in the amount of $3,000.8-Jun Paid $100 for gasoline for the van.12-Jun Paid $200 for maintenance on the…arrow_forward

- Transactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: Opened a business bank account with a deposit of $25,000 from personal funds. Purchased office supplies on account, $2,540. Paid creditor on account, $1,610. Earned sales commissions, receiving cash, $25,920. Paid rent on office and equipment for the month, $5,080. Withdrew cash for personal use, $8,000. Paid automobile expenses (including rental charge) for the month, $2,440, and miscellaneous expenses, $1,170. Paid office salaries, $3,060. Determined that the cost of supplies on hand was $860; therefore, the cost of supplies used was $1,680. Required: 1. Indicate the effect of each transaction and the balances after each transaction. For those boxes in which no entry is required, leave the box blank. If required, enter negative values as negative numbers. Assets = Liabilities + Owner's Equity Cash +…arrow_forwardTransactions; Financial Statements On July 1, 2019, Pat Glenn established Half Moon Realty. Pat completed the following transactions during the month of July: Opened a business bank account with a deposit of $34,000 from personal funds. Purchased office supplies on account, $3,470. Paid creditor on account, $2,190. Earned sales commissions, receiving cash, $35,390. Paid rent on office and equipment for the month, $6,940. Withdrew cash for personal use, $11,000. Paid automobile expenses (including rental charge) for the month, $3,330, and miscellaneous expenses, $1,590. Paid office salaries, $4,180. Determined that the cost of supplies on hand was $1,170; therefore, the cost of supplies used was $2,300. Required: 1. Indicate the effect of each transaction and the balances after each transaction. For those boxes in which no entry is required, leave the box blank. If required, enter negative values as negative numbers. Assets = Liabilities + Owner's Equity Cash +…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education