ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

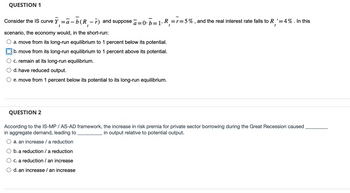

Transcribed Image Text:QUESTION 1

Consider the IS curve Ỹ₁=ā-b(R₁-r) and suppose ā=0¹ b=1, R₁ =r=5%, and the real interest rate falls to R₁' = 4%. In this

t

scenario, the economy would, in the short-run:

a. move from its long-run equilibrium to 1 percent below its potential.

b. move from its long-run equilibrium to 1 percent above its potential.

c. remain at its long-run equilibrium.

d. have reduced output.

e. move from 1 percent below its potential to its long-run equilibrium.

QUESTION 2

According to the IS-MP / AS-AD framework, the increase in risk premia for private sector borrowing during the Great Recession caused

in aggregate demand, leading to

in output relative to potential output.

a. an increase / a reduction

O b. a reduction / a reduction

O c. a reduction / an increase

d. an increase / an increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 2arrow_forwardThe AS curve shifts to the left when O All listed options are correct. the cost of production rises the government does expansionary fiscal policy O net exports rises O we lower interest ratesarrow_forwardThe demand for Peet's Coffee over a week should be more elastic than the demand for Peet's Coffee over a year. True Falsearrow_forward

- 1. A change in autonomous spending results to a shift of the LM curve either to the left or right. O a. False; movement along the IS curve O b. False; movement along the LM curve O c. True O d. False; shift of the IS curve 2. Which of the following statements is true? 3. O a. The goods and money markets can never be in equilibrium. O b. The goods and money markets are in equilibrium at the points where the money market is in equilibrium. O c. The goods and money markets are in equilibrium at their point of intersection only. O d. The goods and money markets are in equilibrium at the points where the goods market is in equilibrium. Which of the following describes the steepest investment schedule? O a. 1-450-8(3) O b. 1=450-2(3) O c. 1=450-9(3) O d. 1=450-5(3)arrow_forward28. Assuming Aggregate Demand and Aggregate Supply are initially at ADo and ASo, and AD1 and AS1 represent changes, which of the above graphs depict the economy's self-correcting mechanism at work? a) Figures A & B b) Figures A & C c) Figures C & D d) Figures B & Darrow_forwardPrice Level 8 7 6 X 50 4 3 2 1 0 2 4 AS AD 6 8 10 12 14 16 18 20 Real GDP (in billions of dollars per year) billion. QE Instructions: Enter your responses as a whole number. a. Identify the macro equilibrium. Instructions: Use the tool provided 'QE' to identify the current macro equilibrium on the graph. The current macro equilibrium is when real GDP is $ Suppose that full-employment GDP is $13 billion. b. The real GDP gap is $ c. Aggregate demand must shift (left or right) by $ billion. billion to achieve the full-employment equilibrium.arrow_forward

- What do you expect will happen to the price level and real GDP in the short run when the bank of Canada buys domestic government bonds given a positively sloped SRAS curve? Select one: O a. Both the price level and real GDP will cross out increase. O b. Both the price level and real GDP will decrease. cross out O c. The price level will increase while real GDP cross out will decrease. O d. The price level will decrease while real GDP cross out will increase. O e. There is no change either to the price level or cross out the real GDParrow_forward2. Suppose that a representative household is part of a two-period economy, with a commodity and a credit market. He holds no initial assets (bonds or money) and no final assets, by the end of the second period. Assume that, for some exogenous reason, the price level decreases at the beginning of period one, before consumption and labor effort decisions are made. This drop is expected to last forever. a) Do you expect this change to yield any real effect? More exactly, are real aggregate output demand (through consumption) or supply (through labor effort) affected? Explain why or why not. b) Imagine now that this household leaves a bequest to the next generation. As a result, a decision is made to hold a fixed real value of bonds (b2/P) by the end of the second period. These will be paid to the children of the household. Under these conditions, will there be any impact from the price level change over the individual consumption and labor effort choices of the representative household…arrow_forwardConsider the basic AD/AS macro model. A rise in an input price like the price of oil would be expected to cause a new macroeconomic equilibrium in which the price level Select one: O a. is lower and real GDP higher than in the initial equilibrium. O b. and real GDP are higher than in the initial equilibrium. O c. is higher and real GDP remained the same as in the initial equilibrium. O d. is higher and real GDP lower than in the initial equilibrium. O e. and real GDP are lower than in the initial equilibrium.arrow_forward

- A decline in the interest rate, other things constant, shifts the investment schedule downward. O True O Falsearrow_forward1. Refer to the figure below. An increase in interest rate would cause: Price level, P AD₂ B AD ADO Aggregate output, Y A) the aggregate demand curve to shift from AD₁ to AD2 B) the economy to move from Point A to Point B C) the aggregate demand curve to shift from AD₁ to ADo D) neither a shift of the aggregate demand curve nor a change in real GD³arrow_forward4. Apply the classical theory. Consider a hypothetical economy described below: Y=C+I+G C = 50+CY - T I = 300 - 20r Y = 2,000 T = 900 G = 1,500 c = 0.6 where Y is output, C is consumption, I is investment, G is government purchases, T' is taxes, and r is real interest rate in percent. b) Find the equilibrium interest rate. (...) c) Suppose taxes are reduced by 80. First, calculate private saving, public saving, and national saving. Second, find the new equilibrium interest rate. Third, draw a graph that shows the change in the equilibrium. (5) d) Instead of reducing taxes by 80, suppose government purchases are increased by 80. First, calculate private saving, public saving, and national saving. Second, find the new equilibrium interest rate. Third, draw a graph that shows the change in the equilibrium. (. e) Why is the change in national saving larger in (d) than in (c) even if the magnitude of the change in fiscal policy in (c) and (d) are the same?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education