ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

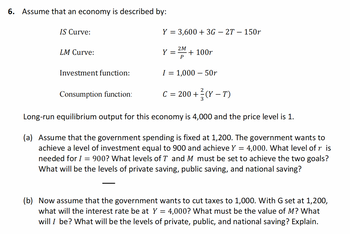

Transcribed Image Text:6. Assume that an economy is described by:

IS Curve:

LM Curve:

Investment function:

Consumption function:

Y = 3,600 + 3G − 2T - 150r

2M

Y = + 100r

P

I = 1,000 - 50r

C = 200+ (Y-T)

3

Long-run equilibrium output for this economy is 4,000 and the price level is 1.

(a) Assume that the government spending is fixed at 1,200. The government wants to

achieve a level of investment equal to 900 and achieve Y = 4,000. What level of r is

needed for I 900? What levels of T and M must be set to achieve the two goals?

What will be the levels of private saving, public saving, and national saving?

=

(b) Now assume that the government wants to cut taxes to 1,000. With G set at 1,200,

what will the interest rate be at Y = 4,000? What must be the value of M? What

will I be? What will be the levels of private, public, and national saving? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- . You are given the following data concerning Freedonia, a new republic. 1) Consumption is 200 when income is zero and the marginal propensity to consume is 0.6 out of every dollar increase in income 2) Investment function: I = 200 3) AE ≡ C + I 4) AE = Y A. Derive the savings function? B. Suppose equation 2) is changed to I = 150. What is the new equilibrium level of income (Y)? By how much does the $50 decrease in planned investment change equilibrium income? What is the value of the tax multiplier? C. Plot the savings function from a. on a graph with equation 2).arrow_forwardProblem 1 Suppose the system of aggregate expenditures can be described by the following relationships and parameter values. C(Y – T) = 1200 + 0.8 (Y – T) I(r) = 100 – 3r G = 200 ;T = 200; r = 5; Ex = Im = 0 %3D 1. Find the equilibrium value ofY (output/income) in this model. Let this level of production be the economy's potential GDP (Y;).arrow_forwardAssume consumption is represented by the following function: C=400+0.75Y. Also assume that planned investment (I) equals 100 and there are no government or taxes.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward(a) Suppose in a simple Keynesian economy, planned consumption function is given by C=250+0.65(Y-T). Planned investment, government purchases, taxes are $100 million, $100 million and $150 million respectively. What is MPC, MPS and autonomous consumption Derive the saving function. What is the equilibrium level of income? Y= AD=C+I+G If government purchases increase to $150 million, what is the new equilibrium level of income? What level of government purchases is needed to achieve an income of $2000 million? From question e) you get the newly government purchase. Now find out the multiplier value What is the amount of shift in AD curve? [Use the multiplier value from e)] (b) In a self-regulating economy “X”, labor supply is 40 million but labor demand is 10 million. What will happen in goods and service market simultaneously? Explain this situation with relevant graph. Based on your findings in a) is it denoting long run equilibrium? If not, will the economy be able to restore…arrow_forwardAssume that specific functional forms are assumed for the consumption function and the investment demand function: C = c1(Y; – G;) + c2(Y;+1- G++1) – C3ri I = -dır: + d2At+1+ d3Kt Where c1, C2, c3, di, dzand d3are fixed parameters governing the sensitivity of consumption and investment to different relevant decision factors. a) Find an algebraic expression of the IS (Investment-Savings) curve. b) Use the above expression to find the slope of the IS curve. C) Assume that the parameter values are: C1 = 0.6, c2 = 0.5, c3 = 10, dı = 20, d2 = 1 and d3 = 0.5. Assume that Yt+1 = 15, Gt = 10, Gt+1 = 10, At+1 = 5 and Kt = 15. Assume that rt = 0.1. Find the product in the current period. d) Now suppose ri = 0.15. Find the product Y in the current period. (e) Create a range of values of r, between 0.01 to 0.2, with 0.001 intervals between values. Find Y for each r:using an Excel sheet and draw the IS curve. Does it have the expected slope? Comment f) Find another version of the IS curve with A…arrow_forward

- Question 2 Refer to the information provided in Figure 23.9 below to answer the question(s) that follow. Aggregate expenditures ($ millions) 225 200 175 150 45° AE 100 200 300 Aggregate output ($ millions) Figure 23.9 a) Refer to Figure 23.9. Write the equation for the aggregate expenditure function (AE). Show your work. b) Refer to Figure 23.9. What is the equilibrium level of output in this economy? State the equilibrium condition used to determine this. c) Explain the forces that maintain/drive the economy to this equilibrium by considering what will happen at the following two levels of output, $300 million and $100 million. You will need to discuss changes in investment through unplanned inventories and the response of output. d) Refer to Figure 23.9. How will equilibrium aggregate expenditure and equilibrium aggregate output change as a result of a decrease in investment by $20 million? e)The interest rate is an exogenous factor that effects the level of investment in an economy.…arrow_forwardSuppose that country Y is identical to country Z, with the exception that country Y's population has a lower marginal propensity to consume than country Z. Initially, both countries have the same level of real GDP. The diagram shows the expenditure curve for country Y. Using the line drawing tool, draw the expenditure curve of country Z in Figure 1. Label your curve 'Ez'. Carefully follow the instructions above and only draw the required object. Figure 1 Planned Expenditure ($, trillions) Real GDP, Y ($, trillions) Ex Select ✓ Linearrow_forwardConsider an economy that is characterized by the following equations: C= 400 + 0.5 Yd I = 700 - 4000i + 0.1Y G= 200 T= 200 (MP)d = 0.75Y - 7500; (M/P)S = 600 What is the equilibrium investment (I)?arrow_forward

- n an effort to make sales projections, M/s K, B and A, the three B-school executives of Vengaboys Inc., were discussing about the national income and its growth in Ibiza. K had estimated a linear consumption function for Ibiza to be C = 100 + 0.6 Y, and investment to be I = 100 per ear. In Ibiza, there was no income tax and government spending was minimal (assume 0). Ibiza was a closed economy, and hence no exports and imports. (i)K immediately knew what the investment Multiplier was. Can you find out? (ii)What is the level of income in Ibiza? (iii)K estimated that with Government spending 100 on a new road to be constructed, the income levels are sure to go up. K quickly calculated the change in income and the new income level to be:arrow_forwardAssume that an economy is based on three industrial sectors: agriculture (A), building (B), and energy (E). The technology matrix M is: A BE uarruarruarr (4 [0.6 0.2 0.1 0.4 0.1 0.1 0.4] 0.1 0.1 B 0.1 M How much input from A, B, and E are required to produce a dollar's worth of output for B? How much input from A is required to produce a dollar's worth of output for B? How much input from B is required to produce a dollar's worth of output for B? How much input from E is required to produce a dollar's worth of output for B ? Assume that an economy is based on three industrial sectors: agriculture (A), building (B), and energy (E). The technology matrix M is: A BE ↑ ↑ ↑ A-> 0.6 0.2 0.1 B-> =M 0.1 0.4 0.1 E-> 0.1 0.1 0.4 How much input from A, B, and E are required to produce a dollar's worth of output for B? How much input from A is required to produce a dollar's worth of output for B? How much input from B is required to produce a dollar's worth of output for B? How much input from E…arrow_forwardSuppose a closed economy with no government spending or taxing is capable of producing an output of $1600 at full employment. Suppose also that autonomous consumption is $120, intended investment is $160, and the mpc is 0.50. What is the value of output (Y) in equilibrium?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education