FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:de bne

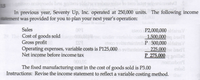

In previous year, Seventy Up, Inc. operated at 250,000 units. The following income

ement was provided for you to plan your next year's operation:

Sales

Cost of goods sold

Gross profit

Operating expenses, variable costs is P125,000

Net income before income tax

eleo P2,000,000d

1,500,000 it

P 500,000 ns

mh 225,000

P 275,000

29

adeo

baud

The fixed manufacturing cost in the cost of goods sold is P3.00

Instructions: Revise the income statement to reflect a variable costing method.

lad

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- XYZ, Inc. reports the following information for November: Sales Revenue $800,000 Variable Cost of Goods Sold 110,000 Fixed Cost of Goods Sold 45,000 Variable Selling and Administrative Costs 100,000 Fixed Selling and Administrative Costs 70,000 Calculate the gross profit for November using absorption (traditional) costing. Question 18Select one: A. $ 730,000 B. $690,000 C. $700,000 D. $645,000arrow_forwardLattimer Company had the following results of operations for the past year: Contribution margin income statement Sales (18,000 units) Variable costs Direct materials Direct labor Overhead Contribution margin Fixed costs Fixed overhead Fixed selling and administrative expenses Income Multiple Choice O $6,000 profit. Per Unit $ 12.00 $4,000 loss. 1.50 4.00 1.00 5.50 1.00 1.40 $ 3.10 A foreign company offers to buy 6,000 units at $7.50 per unit. In addition to variable costs, selling these units would add a $0.25 selling expense for export fees. Lattimer's annual production capacity is 28,000 units. If Lattimer accepts this additional business, the special order will yield a: Annual Total $ 216,000 27,000 72,000 18,000 99,000 18,000 25, 200 $ 55,800arrow_forwarded Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. Income Statements (Absorption Costing) Sales ($60 per unit) Year 1 $ Year 2 $ 1,920,000 3,960,000 Cost of goods sold ($45 per unit) 1,440,000 2,970,000 Gross profit 480,000 990,000 Selling and administrative expenses ok Income t 338,000 474,000 $ 142,000 $ 516,000 Additional Information a. Sales and production data for these first two years follow. Year 1 Year 2 nces Units Units produced 49,000 49,000 Units sold 32,000 66,000 b. Variable costs per unit and fixed costs per year are unchanged during these years. The company's $45 per unit product cost using absorption costing consists of the following. Direct materials Direct labor $ 12 19 Variable overhead Fixed overhead ($539,000/49,000 units) 3 11 Total product cost per unit $ 45 c. Selling and administrative expenses consist of the following. Selling and Administrative Expenses Variable selling and…arrow_forward

- Please do not give solution in image format thankuarrow_forwardDetermine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 83,700 units at a price of $48 per unit during the current year. Its income statement for the current year is as follows: Sales $4,017,600 Cost of goods sold 1,984,000 Gross profit $2,033,600 Expenses: Selling expenses $992,000 Administrative expenses 992,000 Total expenses 1,984,000 Income from operations $49,600 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $336,000 in yearly sales. The expansion will increase fixed costs by $33,600, but…arrow_forwardDuring Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows: Year 1 Year 2 Sales (@ $60 per unit) $ 1,200,000 $ 1,800,000 Cost of goods sold (@ $34 per unit) 680,000 1,020,000 Gross margin 520,000 780,000 Selling and administrative expenses* 308,000 338,000 Net operating income $ 212,000 $ 442,000 * $3 per unit variable; $248,000 fixed each year. The company’s $34 unit product cost is computed as follows: Direct materials $ 7 Direct labor 9 Variable manufacturing overhead 2 Fixed manufacturing overhead ($400,000 ÷ 25,000 units) 16 Absorption costing unit product cost $ 34 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced 25,000 25,000 Units sold 20,000 30,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net…arrow_forward

- During Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows: Year 1 Year 2 Sales (@ $62 per unit) $ 1,178,000 $ 1,798,000 Cost of goods sold (@ $42 per unit) 798,000 1,218,000 Gross margin 380,000 580,000 Selling and administrative expenses* 306,000 336,000 Net operating income $ 74,000 $ 244,000 * $3 per unit variable; $249,000 fixed each year. The company’s $42 unit product cost is computed as follows: Direct materials $ 8 Direct labor 11 Variable manufacturing overhead 5 Fixed manufacturing overhead ($432,000 -: 24,000 units) 18 Absorption costing unit product cost $ 42 Production and cost data for the first two years of operations are: Year 1 Year 2 Units produced 24,000 24,000 Units sold 19,000 29,000 Required: Using variable costing, what is the unit product cost for both years? What is the variable costing net operating income in Year 1 and in Year 2? Reconcile the absorption costing and the variable costing net operating…arrow_forwardCashan Corporation makes and sells a product called a Miniwarp. One Miniwarp requires 1.5 kilograms of the direct raw material Jurislon. Budgeted production of Miniwarps for the next five months is as follows: August . .. 24,500 units September . 24,700 units . 24,600 units 26,400 units December . 24,500 units October November The company wants to maintain monthly ending inventories of Jurislon (direct raw material) equal to 30% of the following month's raw material needs for production. What should be the desired ending inventory ( in units) of Jurislon for the month of September? SHOW CALCULATIONS CLEARLY.arrow_forwardThe GAAP income statement for Carla Vista Company for the year ended December 31, 2022,s shows sale $930,000, cost of good sold $555,000, and operating expenses $235,000. Assuming all costs and expenses are 70% variable and 30% fixed, prepare a CVP income statement through contribution margin.arrow_forward

- The following monthly data are available for the Phelps Company: Product A Product B $150,000 $130,000 Variable expenses $91,000 $104,000 Contribution margin $59,000 $26,000 Fixed expenses Operating income The break-even sales for the month for the company are: Sales Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a $203,000 Product C $90,000 $27,000 $63,000 foonnnn. Total $370,000 $222,000 $148,000 $55,000arrow_forwardDetermine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 83,700 units at a price of $48 per unit during the current year. Its income statement for the current year is as follows: Sales $4,017,600 Cost of goods sold 1,984,000 Gross profit $2,033,600 Expenses: Selling expenses $992,000 Administrative expenses 992,000 Total expenses 1,984,000 Income from operations $49,600 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $336,000 in yearly sales. The expansion will increase fixed costs by $33,600, but…arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education