FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

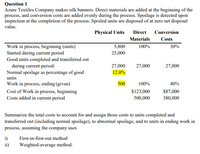

Transcribed Image Text:Question 1

Azure Textiles Company makes silk banners. Direct materials are added at the beginning of the

process, and conversion costs are added evenly during the process. Spoilage is detected upon

inspection at the completion of the process. Spoiled units are disposed of at zero net disposal

value.

Physical Units

Direct

Conversion

Materials

Costs

5,800

100%

Work in process, beginning (units)

Started during current period

Good units completed and transferred out

during current period:

Normal spoilage as percentage of good

30%

25,000

27,000

27,000

27,000

12.0%

units

Work in process, ending (given)

500

100%

40%

$123,000

Cost of Work in process, beginning

Costs added in current period

$87,000

380,000

500,000

Summarize the total costs to account for and assign those costs to units completed and

transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in

process, assuming the company uses

i)

ii)

First-in-first-out method

Weighted-average method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 10 Manama Company manufactures car seats. Each car seat passes through the assembly department and the testing department. This problem focuses on the assembly department. The process-costing system at Manama Company has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). Direct materials are added at the beginning of the process. Conversion costs are added evenly during the process. When the assembly department finishes work on each car seat, it is immediately transferred to testing. Manama Company uses the weighted-average method of process costing. Data for the assembly department for October 2021 are as follows: Physical (Car Seats) Units Direct Conversion Materials Costs 5,000 $1,250,000 $402,750 Work in process, October 1" Started during October 2021 20,000 Completed during October 2021 22,500 Work in process, October 31 2,500 Total costs added during October $4,500,000 $2,337,500 2021 "Degree of completion: direct…arrow_forward1arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Exercise 6.17 FIFO Method, Valuation of Goods Transferred Out and Ending Work in Process K-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the first processing department, the following equivalent units schedule has been prepared: Direct Materials Conversion Costs 28,000 Units started and completed Units, beginning work in process: 28,000 10,000 x 0% 10,000 x 40% 4,000 Units, ending work in process: 6,000 x 100% 6,000 x 75% 6,000 4,500 Equivalent units of output 34,000 38,500 The cost per equivalent unit for the period was as follows: Direct materials $2.00 Conversion costs 6.00 Total $8.00 The cost of beginning work in process was direct materials, $40,000; conversion costs, $30,000. Required: 1. Determine the cost of ending work in process and the cost of goods transferred out. 2. Prepare a physical flow schedule.arrow_forwardSaved Help Save & Exis A company has two manufacturing departments, Forming and Painting. The company uses the weighted-average method and it reports the following data. Units completed in the Forming department are transferred to the Painting department. Units 52 Units completed and transferred out Ending work in process inventory 120,000 40,000 Direct materials Percent Complete 100% Conversion Percent Complete 100% 20% 60% Determine the equivalent units of production for the Forming department for direct materials and conversion costs assuming the weighted average method. Multiple Choice 120,000 direct materials; 120,000 conversion 120,000 direct materials; 160,000 conversion 128,000 direct materials; 120,000 conversion 128,000 direct materials; 144,000 conversion 128,000 direct materials; 184,000 conversionarrow_forwardBackflush Costing: Variation 2 Potter Company has installed a JIT purchasing and manufacturing system and is using backflush accounting for its cost flows. It currently uses a two-trigger approach with the purchase of materials as the first trigger point and the completion of goods as the second trigger point. During the month of June, Potter had the following transactions: Raw materials purchased $245,000 Direct labor cost 41,500 Overhead cost 207,500 Conversion cost applied 269,750* *$41,500 labor plus $228,250 overhead. There were no beginning or ending inventories. All goods produced were sold with a 60 percent markup. Any variance is closed to Cost of Goods Sold. (Variances are recognized monthly.) Required: Prepare the journal entries for the month of June using backflush costing, assuming that Potter uses the sale of goods as the second trigger point instead of the completion of goods. For a compound transaction, if an amount box does not require an entry, leave…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education