FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

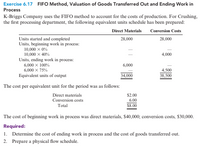

Transcribed Image Text:Exercise 6.17 FIFO Method, Valuation of Goods Transferred Out and Ending Work in

Process

K-Briggs Company uses the FIFO method to account for the costs of production. For Crushing,

the first processing department, the following equivalent units schedule has been prepared:

Direct Materials Conversion Costs

28,000

Units started and completed

Units, beginning work in process:

28,000

10,000 x 0%

10,000 x 40%

4,000

Units, ending work in process:

6,000 x 100%

6,000 x 75%

6,000

4,500

Equivalent units of output

34,000

38,500

The cost per equivalent unit for the period was as follows:

Direct materials

$2.00

Conversion costs

6.00

Total

$8.00

The cost of beginning work in process was direct materials, $40,000; conversion costs, $30,000.

Required:

1. Determine the cost of ending work in process and the cost of goods transferred out.

2. Prepare a physical flow schedule.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Equivalent Units Calculations—Weighted Average Method Ferris Corporation makes a powdered rug shampoo in two sequential departments, Compounding and Drying. Materials are added at the beginning of the process in the Compounding Department. Conversion costs are added evenly throughout each process. Ferris uses the weighted average method of process costing. In the Compounding Department, beginning work in process was 2,000 pounds (70% processed), 18,500 pounds were started in process, 18,000 pounds transferred out, and ending work in process was 30% processed. Calculate equivalent units for March 2016 for the Compounding Department. Ferris CorporationFlow of Units and Equivalent Units Calculation, March 2016 Equivalent Units % Workdone DirectMaterials % WorkDone ConversionCosts Complete/Transferred Answer Answer Answer Answer Answer Ending Inventory Answer Answer Answer Answer Answer Total Answer Answer Answerarrow_forwardProblem 1 Brabensky Company produces a product in two departments: (1) Assembly and (2) Painting. The company uses a process cost accounting system. Purchased raw materials for $90,000 on account. Raw materials requisitioned for production were: Direct materials Assembly department $77,000 Factory labor used: Assembly department $34,000 Painting department 18,000 Manufacturing overhead is applied to the product based on machine hours used in each department: Assembly department—320 machine hours at $40 per machine hour. Painting department—120 machine hours at $15 per machine hour. Units costing $86,000 were completed in the Painting Department and were transferred to the Finished Good. Finished goods costing $70,000 were sold on cash for $102,000. Instructions Prepare the journal…arrow_forwardUnits to be Assigned Costs Question 11 Eve Cosmetics Company consists of two departments, Blending and Filling. The Filling Department received 51,800 ounces from the Blending Department. During the period, the Filling Department completed 53,200 ounces, including 3,500 ounces of work in process at the beginning of the period. The ending work in process inventory was 2,100 ounces. How many ounces were started and completed during the period?fill in the blank 1 ouncesarrow_forward

- Saved Help Save & Exis A company has two manufacturing departments, Forming and Painting. The company uses the weighted-average method and it reports the following data. Units completed in the Forming department are transferred to the Painting department. Units 52 Units completed and transferred out Ending work in process inventory 120,000 40,000 Direct materials Percent Complete 100% Conversion Percent Complete 100% 20% 60% Determine the equivalent units of production for the Forming department for direct materials and conversion costs assuming the weighted average method. Multiple Choice 120,000 direct materials; 120,000 conversion 120,000 direct materials; 160,000 conversion 128,000 direct materials; 120,000 conversion 128,000 direct materials; 144,000 conversion 128,000 direct materials; 184,000 conversionarrow_forwardExercise 6.21 FIFO Method, Unit Cost, Valuation of Goods Transferred Out, and Ending Work in Process Dama Company produces women's blouses and uses the FIFO method to account for its manu- facturing costs. The product Dama makes passes through two processes: Cutting and Sewing. During April, Dama's controller prepared the following equivalent units schedule for the Cutting Department: Direct Materials Conversion Costs Units started and completed Units, beginning work in process: 10,000 x 0% 10,000 x 50% Units, ending work in process: 40,000 40,000 5,000 20,000 x 100% 20,000 x 25% 20,000 5,000 Equivalent units of output 60,000 50,000 Costs in beginning work in process were direct materials, $20,000; conversion costs, $80,000. Manufacturing costs incurred during April were direct materials, $240,000; conversion costs, $320,000. Required: 1. Prepare a physical flow schedule for April. 2. Compute the cost per equivalent unit for April. 3. Determine the cost of ending work in process and…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Process Costing Drill #3 Zerorez Corporation has a three phase manufacturing process to make its bestselling product. The company uses a weighted average process costing model to track product cost. The following partial data was obtained from Phase 1 of the August production process: Cost of units completed and transferred to Phase 2: • Materials = $275,000 • Labor = $134,400 • Overhead = $201,600 Number of units completed and transferred to Phase 2 = 20,000 What is the total cost per equivalent unit for Phase 1 of the production process during August? 244arrow_forwardPROBLEM 4- South River Chemical manufactures a product called Zbek. Direct materials are added at the beginning of the process, and conversion activity occurs uniformly throughout production. The beginning work-in-process inventory is 100% complete for DM and 60% complete for conversion; the ending work-in-process inventory is 100% complete for DM and 20% complete for conversion. The following data pertain to May: Work in process, Máy 1 Units started during May Units completed and transferred out Work in process, May 31 Costs: Work in process, May 1 Costs incurred during May Totals Units 15,000 60,000 68,000 7,000 Total $ 41,250 234,630 $275,880 Direct Materials $16,500 72,000 $88.500 Conversion Costs $ 24,750 162.630 $187.380 Use the WEIGHTED AVERAGE method. Show computations a. Compute the equivalent units of production for DM and conversion. b. Compute the cost per equivalent unit for DM and conversion.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education