FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please provide me with answers for 1-3 ...

This is the 3rd time I'm submitting this ... I'm only seeing a blank message

Transcribed Image Text:June 21.

Received $8000 cash from June 06 transaction

June 30.

Paid utilities expense of $600 and salary expense $2,500

Requirements:

1. State the effect each transaction from June 1st 30th will have on the accounting

equation. For example, the transaction increased asset and increased capital the

transaction increased expenses and decreased cash, the transaction increased

asset and decreased asset, etc.

2. Prepare the journal entries with narrations to record the transactions for "June"

3. Post the transactions recorded in your journal to their respective "T" accounts and

balance off each account at June 30th 2020.

4. Having determined the account balances, represent this information using the

accounting equation.

Transcribed Image Text:ting. Avoid interruption and keep your files safe with genuine Office today,

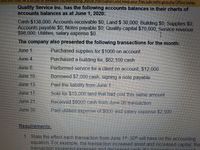

Quality Service Inc. has the following accounts balances in their charts of

accounts balances as at June 1, 2020:

Cash $138,000, Accounts receivable $0, Land $ 30,000, Building $0, Supplies $0,

Accounts payable $0, Notes payable $0, Quality-capital $70,000, Service revenue

$98,000, Utilities, salary expense $0.

The company also presented the following transactions for the month:

June 1.

Purchased supplies for $1000 on account

June 4.

Purchased a building for, $62,100 cash

June 6.

Performed service for a client on account, $12,000

June 10.

Borrowed $7,000 cash, signing a note payable

June 13.

Paid the liability from June 1

June 17.

Sold for $15,000 land that had cost this same amount

June 21.

Received $8000 cash from June 06 transaction

June 30,

Paid utilities expense of $600 and salary expense $2,500

Requirements:

1. State the effect each transaction from June 1s-30th will have on the accounting

equation. For example, the transaction increased asset and increased capital; the

transaction increased exnenses and decreased cash: the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPlease rank the websites in order of total number of click-throughs from lowest to highest.arrow_forwardYour answers are incorrect, there are at least 4 blanks to fill in and you only provided 2 or 3. Also please do not use Excel, please use another way to show your work.arrow_forward

- M Inbox (909) - camillejeunei @gm i General (BSA 1-1: FAR 2) | Micro O FAR 2 LONG QUIZ /Pages/ResponsePage.aspx?id3DcYWpTercOUiPsQvdXclp-WXyu19p0dpLjDbGCXgjKqpURFVGNzZDSzZDWUhSWkRNTUoxTjBXNzhF The net income from January 1 to September 30, 2019 is P44,000. Also, on this date, cash and liabilities are P40,000 and P90,000, respectively. For Romans to receive P55,200 in full settlement of his interest in the firm, how much must be realized from the sale of the firm's non-cash assets? * Corinthians and Galatians decide to dissolve the partnership on September 30, 2021. neir capital balances and profit ratio on this date, follow: Capital Balances Profit Ratio Romans P50,000 40% Corinthians 60,000 Galatians 20,000 30% P196,000 P177,000 P193,000 国 INarrow_forwardPlease help me. Thankyou.arrow_forwardAnswered: The fo x b Details | bartleby x b My Questions |b x Post Altendee -2 x FA Midterm Exan X -> File | C:/Users/Wendy/Downloads/FA%20Midterm%20Exam.pdf ME6 Which of the following entries records the payment of an account payable? a) Debit Accounts Payable, credit Cash b) Debit Cash, credit Accounts Payable c) Debit Expense, credit Cash d) Debit Cash, credit Expense ME7 The process of initially recording a business transaction is called: a) Sliding b) Posting c) Journalizing d) Transposing ME8 Which of the following entries for goods sold by cash is correct? a) Cash Dr, AR Cr b) AR Dr, Revenue Cr c) Fees Earned, debit; Cash credit d) Cash, debit; Bank Cr ME9 The verification that the sum of the debits and the sum of the credits in the ledger are equal is called: a) A journal b) A ledger c) Posting Type here to searcharrow_forward

- ITS-The Political S A M7: Assignment No.1 10201Ox/aMzlzNzk 1NTQxNDg2/details ВА.. e Home | Edmodo O Spoliarium by Juan.. w You searched for Re.. W Operating Performa... 1 Otn.docxlo. Open with Activity No.: Topic : The Worksheet Problems The following are all the steps in the accounting cycle. List them they should be done. 1. the order in which Closing entries are journalized and posted to the ledger. - An unadjusted trial balance is prepared. - An optional end-of-period spreadsheet (worksheet) is prepared. -A post-closing trial balance is prepared. - Adjusting entries are journalized and posted to the ledger. - Transactions are analyzed and recorded in the journal. Adjustment data are assembled and analyzed. -Financial statements are prepared An adjusted trial balance is prepared Transactions are posted to the ledger 2. 7. 8. 6. 10 The balances for the accounts listed below appeared in the Adjusted Tral Balance columns of the work the Income Statement columns or iobtndicato ther cach…arrow_forward2. The date 8/9/2024 is stored in cell C5, and =WEEKDAY (C5) is stored in cell D5. What is the default function result if cell D5 has not been formatted? a. 6 b. 9 c. Friday, August 9, 2024 d. Fridayarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education