FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

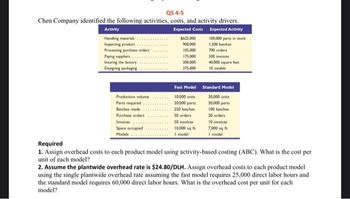

Transcribed Image Text:QS 4-5

Chen Company identified the following activities, costs, and activity drivers.

Activity

Expected Costs

Handling materials

Inspecting product

Processing purchase orders

Paying suppliers.

Insuring the factory

Designing packaging

Production volume

Parts required

Batches made

Purchase orders

Invoices

Space occupied

Models

$625,000

900,000

105,000

175,000

300,000

375.000

Fast Model

10,000 units

20,000 parts

250 batches

50 orders

50 invoices

10,000 sq.ft.

I model

Expected Activity

100,000 parts in stock

1,500 batches

700 orders

500 invoices

40,000 square feet

10 models

Standard Model

30,000 units

30,000 parts

100 batches

20 orders

10 invoices

7,000 sq.ft.

I model

Required

1. Assign overhead costs to each product model using activity-based costing (ABC). What is the cost per

unit of each model?

2. Assume the plantwide overhead rate is $24.80/DLH. Assign overhead costs to each product model

using the single plantwide overhead rate assuming the fast model requires 25,000 direct labor hours and

the standard model requires 60,000 direct labor hours. What is the overhead cost per unit for each

model?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardQuestion 8 Cranston Corporation makes four products in a single facility. Data concerning these products appear below: Products A C D B $42.30 Selling price per unit $50.00 $37.60 $ 33.50 $30.70 $ 21.00 $ 19.90 Variable manufacturing cost per unit $ 20.80 Variable selling cost per unit $2.10 $1.00 $2.40 $2.70 3.30 Milling machine minutes per unit 4.10 2.60 1.30 Monthly demand in units 1,000 4,000 3,000 3,000 The milling machines are potentially the constraint in the production facility. A total of 28,200 minutes are available per month on these machines. How many minutes of milling machine time would be required to satisfy demand for all four products? 23,500 28,200 O 11,000 O 31,400arrow_forward5 part 1arrow_forward

- Assignment 4 – Managerial Accounting Focused: Answer questions 1 through 10 below using Microsoft Excel (input formulas where necessary) and show your work. Shingle Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Shingle produces and sells 25,000 units, its unit costs are as follows: Amount Per Unit Direct Materials $8.00 Direct Labor $5.00 Variable manufacturing overhead $1.00 Fixed manufacturing overhead $6.00 Fixed selling expense $3.50 Fixed administrative expense $2.50 Sales commissions $4.00 Variable administrative expense $1.00 Required: For financial accounting purposes, what is the total amount of product costs incurred to make 25,000 units? What is the total amount of period costs incurred to sell 25,000 units? If 24,000 units are produced, what is the variable…arrow_forwardPlease do not give solution in image format thankuarrow_forward5 part 2arrow_forward

- Please do not give solution in image format thankuarrow_forwardExercise 5-11A Allocating facility-level costs and a product elimination decision Blevins Boards produces two kinds of skateboards. Selected unit data for the two boards for the last quarter follow. Production costs Direct materials Direct labor Allocated overhead Total units produced and sold Total sales revenue Basco Boards Shimano Boards Required a. Compute the per-unit cost for each product. b. Compute the profit for each product. $25 $32 $15 5,000 $ 500,000 $38 $54 $18 10,000 $1,400,000 Blevins allocates production overhead using activity-based costing. It allocates delivery expense and sales commissions, which amount to $54,000 per quarter, to the two products equally.arrow_forwardQuestion 9.3 Burnaby traders makes four products in a single facility. Following information regarding products is given: Product A B C D Selling Price per Unit $35.30 $30.20 $20.80 $26.00 Variable Manufacturing Cost per Unit $16.50 $15.80 $7.90 $8.50 Variable Selling Cost per Unit $3.80 $1.60 $1.90 $3.30 Milling Machine Minutes per Unit 3.20 1.80 2.20 2.50 Monthly Deman in Units 4,000 1,000 3,000 1,000 Maximum minutes on all machines (22,600) Required: 1) How many minutes of milling machine time would be required to satisfy demand for all four products? 2) Which product makes the LEAST profitable use of the milling machines? 3) Which product makes the MOST profitable use of the milling machines?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education