FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

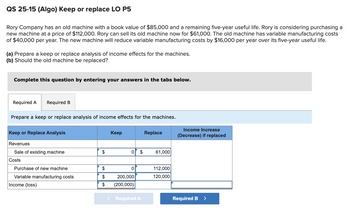

Transcribed Image Text:QS 25-15 (Algo) Keep or replace LO P5

Rory Company has an old machine with a book value of $85,000 and a remaining five-year useful life. Rory is considering purchasing a

new machine at a price of $112,000. Rory can sell its old machine now for $61,000. The old machine has variable manufacturing costs

of $40,000 per year. The new machine will reduce variable manufacturing costs by $16,000 per year over its five-year useful life.

(a) Prepare a keep or replace analysis of income effects for the machines.

(b) Should the old machine be replaced?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a keep or replace analysis of income effects for the machines.

Replace

Income Increase

(Decrease) if replaced

Keep or Replace Analysis

Keep

Revenues

Sale of existing machine

$

0 $

61,000

Costs

Purchase of new machine

$

0

Variable manufacturing costs

$

200,000

112,000

120,000

Income (loss)

$

(200,000)

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 14-2 (Algo) Net Present Value Analysis [LO14-2] The management of Kunkel Company is considering the purchase of a $20,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return is 13%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the investment in the machine. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount. Use the appropriate table to determine the discount factor(s).) Net present value…arrow_forwardProblem 8-38 Replacement Decision (LO4) A forklift will last for only 2 more years. It costs $5,000 a year to maintain. For $20,000 you can buy a new lift that can last for 10 years and should require maintenance costs of only $2,000 a year. a. If the discount rate is 5% per year, should you replace the forklift? Equivalent annual cost of the new machine= Equivalent cost of owning and operating the new machine= b. If the discount rate is 10% per year, should you replace the forklift? Equivalent annual cost of the new machine= Equivalent cost of owning and operating the new machine=arrow_forward55arrow_forward

- CH5 #10 A company is considering two alternative marketing strategies for a new product. Introducing the product will require an outlay of $15,000. With a low price, the product will generate cash proceeds of $10,000 per year and will have a life of two years. With a high price, the product will generate cash proceeds of $18,000 but will have a life of only one year. The hurdle rate for this project is 0.05. Which marketing strategy should be accepted?arrow_forwardPage 266 MINICASE Flowton Products enjoys a steady demand for stainless steel infiltrators used in a number of chemical processes. Revenues from the infiltrator division are $50 million a year, and production costs are $47.5 million. However, the 10 high-precision Munster stamping machines that are used in the production process are coming to the end of their useful life. One possibility is simply to replace each existing machine with a new Munster. These machines would cost $800,000 each and would not involve any additional operating costs. The alternative is to buy 10 centrally controlled Skilboro stampers. Skilboros cost $1.25 million each, but compared with the Munster, they would produce a total saving in operator and material costs of $500,000 a year. Moreover, the Skilboro is sturdily built and would last 10 years, compared with an estimated seven-year life for the Munster. Analysts in the infiltrator division have produced the accompanying summary table, which shows the…arrow_forwardExercise 10-12A (Algo) Determining the payback period LO 10-4 Fanning Airline Company is considering expanding its territory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $14,800,000; It will enable the company to Increase its annual cash Inflow by $3,700,000 per year. The plane is expected to have a useful life of five years and no salvage value. The second plane costs $34,800,000; It will enable the company to increase annual cash flow by $5,800,000 per year. This plane has an eight-year useful life and a zero salvage value. Required *1. Determine the payback period for each Investment alternative. a2. Identify the alternative Fanning should accept if the decision is based on the payback approach. Note: Round your answers to 1 decimal place. a-1. Alternative 1 (First plane) a-1. Alternative 2 (Second plane) a-2. Fanning should accept Payback Period years yearsarrow_forward

- Q30arrow_forwardQd 06.arrow_forwardExercise 14-3 (Algo) Internal Rate of Return [LO14-3] Wendell’s Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,500 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,500 dozen more donuts each year. The company realizes a contribution margin of $1.60 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine’s internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine’s internal rate of return? (Round your final answer…arrow_forward

- Exercise 16-34 Profitability Index; Taxes (Section 2) (LO 16-7) The owner of Atlantic City Confectionary is considering the purchase of a new semiautomatic candy machine. The machine will cost $23,000 and last 9 years. The machine is expected to have no salvage value at the end of its useful life. The owner projects that the new candy machine will generate $3,500 in after-tax savings each year during its life (including the depreciation tax shield). Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the profitability index on the proposed candy machine, assuming an after-tax hurdle rate of (a) 8 percent, (b) 1O percent, and (c) 12 percent. (Round your final answers to 2 decimal places.) Profitability Index (a) 8 percent (b) 10 percent (c) 12 percentarrow_forward2:38 d ces The following information applies to the questions displayed below.] Cardinal Company is considering a five-year project that would require a $2,955,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 18%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed. out-of-pocket costs $750,000 591,000 $ 2,865,000 1,015,000 1,850,000 Depreciation Total fixed expenses Net operating income Click here to view Exhibit 128-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Profitability index 1,341,000 $ 509,000 Foundational 12-5 (Algo) 5. What is the profitability index for this project? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education