FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Exercise 14-2 (Algo) Net Present Value Analysis [LO14-2]

The management of Kunkel Company is considering the purchase of a $22,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 16%.

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table.

Required:

1. Determine the net present value of the investment in the machine.

2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?

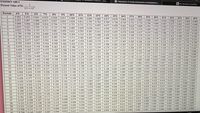

Transcribed Image Text:EXHIBIT 14B-1

Cnapter 14 Homework Problems - Con.

M https://ezto-cf-media.mheducation.com/Media/Con.

b My Questions | bartleby

Present Value of $1;

1

(1+r))"

Periods

4%

5%

6%

7%

8%

10%

9%

11%

12%

15%

0.962 0.952

13%

14%

16%

17%

1

18%

19%

0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800

0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731

0.816 | 0.794 0.772 | 0.751 0.731 0.712 | 0.693 0.675 0.658 0.641 0.624 0.6090.593 0.5790.564 0.551 0,537 0,524 0,512

21%

0.943

0.925 0.907 0.890

0.864 0.840

20%

22%

23%

24%

25%

2

0.889

0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640

0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410

0.822 | 0.784 0.747

0.790 0.746 0.705 0.666

0.760 0.711 0.665 0.623

4

5

0.747 0.713

0.713 0.681

0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341

0.630 0.596 0.564 0.5350.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262

0.583 0.547 | 0.513| 0.482 0.452 | 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 | 0.263 0.249 0.235 0.222 0.210

6.

0.328

8

0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191

0.731

0.677

| 0.179 0.168

0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134

0.508 0.463 0.422 | 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 | 0.149 0.137 0.126 0.116 0.107

0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 | 0.135 0.123 0.112 0.103 0.094 0.086

0.703

0.645 0.592 0.544

10

0.676 0.614 0.558

11

12

0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 | 0.092

0.076

0.326 0.290 0.258 0.229 0.204 0.182 | 0.163 0,145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061

0.083

0.069

0.601 0.530 0.469 0.415 0.368

0.505 0.442 0.388 0.340

0.481 0.417 0.362 0.315

0.534 0.458 0.394 0.339 0.292

0.270 |

0.416 0.350 0.296 0.250

13

0.055

0.049 0.044

0.577

0.299 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 | 0.055

0.275 0.239 | 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035

0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036

0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060

0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 | 0.028

14

15

16

0.032 0.028

0.513 0.436 0.371 0.317

0.494

17

0.052 | 0.045

0.039 | 0.034 0.030

0.026

0.023

18

0.024 | 0.021 0.018

0.037 0.031 0.027 0.023

0.232 | 0.194 0.164 0.138 0.116 0.098 0.083 0.070 | 0.060 0.051

0.043

0.014

0.475 0.396 0.331

0.4560.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061

0.439 0.359

0.422 | 0.342

0.406 0.326 0.262 0.211

0.390 0.310

0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024

19

0.277

0.043

0.020 | 0.017

0.016 | 0.014 0.012

0.009

0.037 0.031

|

0.026 | 0.022 0.018

0.032 0.026 0.022 0.018 0.015 0.013

20

0.051

0.026 0.022 0.019

0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031

0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038

| 0.011

0.009

| 0.007 0.006

0.006 0.005

0.004

0.015 0.013

0.294 0.242 0.199

0.226 0.184

21

0.007

22

0.012 0.010 0.009

0.170 0.138 0.112 0.091

0.197 | 0.158 0.126 0.102 | 0.082| 0.066 0.053

0.074 0.060 0.049 0.040 0.033 | 0.027 0.022 | 0.018 0.015

0.023 0.019 0.015 0.013

0.020 0.016 0.013 0.010

23

0.010 | 0.008 0.007

0.009 0.007 |

0.007 | 0.006

0.043 0.035 0.028

24

0.247

0.006 | 0.005

0.005 | 0.004 0.003

0.004

25

0.011

0.066 0.053 0.042 0.033

0.060 0.047 0.037

0.042 0.033

0.029

0.026 0.021 0.017

0.014

0.009

0.220 0.172 0.135 0.106

0.207 0.161

0,281

0.084

0.361

0.347

26

0.003

0.002

0.029 0.023

0.026 0.020

0.022 0.017

0.009 0.007

0.018 0.014 0.011

0.010

0.006 0.005

0.125 0.098 0.076

0.150 0.116 0.090 0.069 0.054

0.082

0.268

0.002 | 0.002

0.002 | 0.002

0.002 0.002 0.001

0.000 | 0.000 0.000

27

0.016 | 0.012 | 0.008

0.006 | 0.005

0.004

0.003

0.255 0.196

0.243 0.185

0.231| 0.174

0.208 0.142 0.097

0.333

0.321

0.003

0.003

0.000

28

0.004

0.002

0.008 | 0.006

0.009 0.007 0.005

0.037

0.014 0.011

0.005

0.063 | 0.048

0.057 0.044 0.033 0.026

0.022 0.015 | 0.011 | 0.008 0.005 0.004 0.003

29

0.141

0.107

0.004

0.003

0.020

0.015

0.012

30

0.308

0.131

0.099

0.075

0.002 | 0.001 | 0.001

0.001

0.000

0.067

0.046 0.032

40

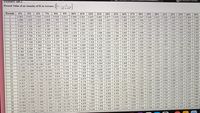

Transcribed Image Text:EXHIBIT 14B-2

D My Questions | bartleby

Present Value of an Annuity of $1 in Arrears;

((1 +r))"

Periods

4%

5%

6%

7%

8%

13%

11%

0.926 0.917 0.909 0.901

1.759 | 1.736 1.713

2.531 2.487 2.444

9%

10%

12%

14%

15%

16%

17%

18%

19%

20%

21%

25%

0.893 0.885 0.877 0.870 0.862 | 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800

1.492 1.474 1.457 1.440

22%

23%

24%

0.962 0.952 0.943

1.886

2.775 2.723

3.630 3.546

1

2

1.859

1.833 1.808

1.690 1.668 1.647 1.626 1.605 1.585

2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 | 2.074 2.042 2.011

1.783

1.566 1.547

1.528

1.509

3

2.673

2.624 2.577

1.981

1.952

3.312 3.240

3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991

4

3.465

3.387

3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494

2.448

2,404 2.362

2.926 2.864 2.803 2.745 2.689

3.167 3.092 3.020 2.951

5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161

3.329

3.566 3.463

4.054 3.923 3.799 3.682 3.571

4.452

5.242 5.076 4.917

5

4.329

4.212

4.100

6.

4.767

4.623

4.486 4.355 4.231

4.111 3.998 3.889 3.784 3.685 3.589 3.498 | 3.410 | 3.326 3.245

5.786 5.582 5.389 5.206

6.463 6.210 5.971

6.002

4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619

3,518

3,421

5.535 5.335 5.146 4.968 4.799

5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673

6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339

8.

6.733

5.747

6.247

7.024 6.710

7.139

9

7.435 7.108

6.802

6.515

10

8.111

7.722

7.360

4.192

6.805 6.495 6.207 5.938 5.687 5.453 5.234. 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656

7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725

5.842 5.583 5.342 5.118 4.910 | 4.715 4.533 4.362 4.203 4.053 3.912 3.780

7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824

8.306 7.887

8.760 |

9.385 8.863

11

7.499

12

8.384

7.943

8.358 7.904 7.487 7.103 6.750 6.424

8.745

13

9.986 9.394 8,853

6.122

10.563 9.899 9.295

11.118 10.380 9.712

14

8.244

7.606 7.191

6.811

6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153

4.001| 3.859

15

9.108

8.559

8.061

8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887

3.910

11.652 10.838 10.106 9.447 8.851

12.166 11.274 10.477 9.763

12.659 11.690 10,828 10.059 9.372

16

8.544 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391

8.756 8.201 7.702 7.250 6.840| 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080

4.219 4.059

17

9.122

3.928

18

3.942

8.365 7.839 7.366 6.938 6.550

9.129 8.514 7.963 7.469 7.025 6.623

6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097

13.134 12.085 11.158 10.336 9.604 8.950

13.590 12.462 11.470 10.594 9.818

14.029 12.821 | 11.764 | 10.836 | 10.017 9.292 |

14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 7.170 6.743 6.359

14.857 13.489 12.303 11.272 10.371 9.580

15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 4.318 4.143

15.622 14.094 12.783 11.654 10.675 9.823

15.983 14.375 13.003 11.826 10.810 9.929 9.161

16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 7.409 6.935 | 6.514 6.136 5.798 5.492 5.215 4.964 4.734 | 4.524 4.332 4.154 3.990

16.663 14.898 13.406 12.137 11.051 10.116 9.307

16.984 15.141 13.591 12.278 11.158 10.198 9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 | 4.975 4.743 4.531

17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160

19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244

6.259 5.929 5.628 5.3535.101 4.870 4.657 4.460 4.279 4.110 3.954

4.121 | 3.963

4.130 | 3.970

4.137 | 3.976

19

8.649 8.075 7.562 7.102 6.687 6.312 5.973 5.665 5.384 5.127 4.891 4.675 4.476 4.292

6.011 5.696 5.410 5.149 4.909 4.690 4.488 4.302

20

21

22

23

8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311

3.981

4.514 4.323 4.147

4.151

3.985

24

9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721

3.988

25

6.118 5.783 5.480 5.206 4.956 4.728 4.520 4.328

8.488 7.896 7.372 6.906 6.491

26

4.335 4.157 3.992

4.337 4.159 3.994

3.995

27

8.602 7.984 7.441 6.961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.528

28

29

30

7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999

40

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Show work Ursus, Incorporated, is considering a project that would have a ten-year life and would require a $2,552,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.): Sales Variable expenses. Contribution margin Fixed expenses: Fixed out-of-pocket cash expenses Depreciation Net operating income. b. Compute the project's internal rate of return. Note: Round your final answer to the nearest whole percent. c. Compute the project's payback period. Note: Round your answer to 2 decimal place. d. Compute the project's simple rate of return. Note: Round your final answer to the nearest whole percent. a. Net present value b. Internal rate of return c. Payback period d. Simple rate of return All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 14%. Required: a. Compute…arrow_forwardReplacement Analysis Although the Chen Company's milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $100,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $18,200 per year. It would have zero salvage value at the end of its life. The project cost of capital is 9%, and its marginal tax rate is 25%. Should Chen buy the new machine? Do not round intermediate calculations. Round your answer to the nearest cent. Negative value, if any, should be indicated by a minus sign. NPV: $ Chen -Select- purchase the new machine.arrow_forwardSh7 Please help me. Fast solution please.arrow_forward

- QUESTION 7 Massey Enterprises is planning to buy a new machine to decrease the overall cost of production. This machine will cost $50000 and will help to save the company $22000 in operating costs annually. The machine will be fully depreciated using a straight-line depreciation method to a useful life of 4 years. The actual market value of the machine is expected to be zero at the termination of the project. The marginal tax rate for the company is 21 and the discount rate for this project is 11 percent. What is the net present value of this 4-year project?arrow_forward36arrow_forwardplease aswer fast i give upvotearrow_forward

- Ac [The following information applies to the questions displayed below.] Beacon Company is considering automating its production facility. The initial investment in automation would be $10.76 million, and the equipment has a useful life of 8 years with a residual value of $1,160,000. The company will use straight-line depreciation. Beacon could expect a production increase of 33,000 units per year and a reduction of 20 percent in the labor cost per unit. Production and sales volume Sales revenue Variable costs Direct materials Direct labor Variable manufacturing overhead i Total variable manufacturing costs Contribution margin Fixed manufacturing costs Net operating income Current (no automation) Proposed (automation) 89,000 units 122,000 units Per Per Unit Total Unit $100 $7 $100 Total $ 7 $ 20 $ 20 25 2 9 9 54 $ 46 2 ? $ 51 $ 1,180,000 $ 2,190,000 2 7 Required: 1-a. Complete the following table showing the totals. (Enter your answers in whole dollars, not in millions.) Current (no…arrow_forwardanswer number 2 onlyarrow_forwardNonearrow_forward

- Nonearrow_forwardFinancearrow_forwardReplacement Analysis Although the Chen Company's milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $106,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $18,100 per year. It would have zero salvage value at the end of its life. The project cost of capital is 12%, and its marginal tax rate is 25%. Should Chen buy the new machine? Do not round intermediate calculations. Round your answer to the nearest cent. Negative value, if any, should be indicated by a minus sign. NPV: $ Chen -Select- purchase the new machine.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education